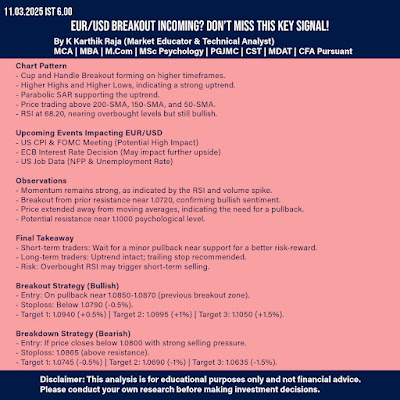

Chart Pattern

- Cup and Handle Breakout forming on higher timeframes.

- Higher Highs and Higher Lows, indicating a strong uptrend.

- Parabolic SAR supporting the uptrend.

- Price trading above 200-SMA, 150-SMA, and 50-SMA.

- RSI at 68.20, nearing overbought levels but still bullish.

Upcoming Events Impacting EUR/USD

- US CPI & FOMC Meeting (Potential High Impact)

- ECB Interest Rate Decision (May impact further upside)

- US Job Data (NFP & Unemployment Rate)

Observations

- Momentum remains strong, as indicated by the RSI and volume spike.

- Breakout from prior resistance near 1.0720, confirming bullish sentiment.

- Price extended away from moving averages, indicating the need for a pullback.

- Potential resistance near 1.1000 psychological level.

Final Takeaway

- Short-term traders: Wait for a minor pullback near support for a better risk-reward.

- Long-term traders: Uptrend intact; trailing stop recommended.

- Risk: Overbought RSI may trigger short-term selling.

Breakout Strategy (Bullish)

- Entry: On pullback near 1.0850-1.0870 (previous breakout zone).

- Stoploss: Below 1.0790 (-0.5%).

- Target 1: 1.0940 (+0.5%) | Target 2: 1.0995 (+1%) | Target 3: 1.1050 (+1.5%).

Breakdown Strategy (Bearish)

- Entry: If price closes below 1.0800 with strong selling pressure.

- Stoploss: 1.0865 (above resistance).

- Target 1: 1.0745 (-0.5%) | Target 2: 1.0690 (-1%) | Target 3: 1.0635 (-1.5%).

No comments:

Post a Comment