Stocks in the news | Infosys, HFCL, Tata Steel, Goa Carbon, Jubilant FoodWorks, United Spirits

Transport Corporation of India, Likhitha Infrastructure, Den Networks, Tata Elxsi, JTL Infra, Grauer & Weil India, Sunedison Infrastructure, Dalmia Bharat, Avanti Feeds, Subex, Polyplex Corporation, are also among the stocks in focus today.

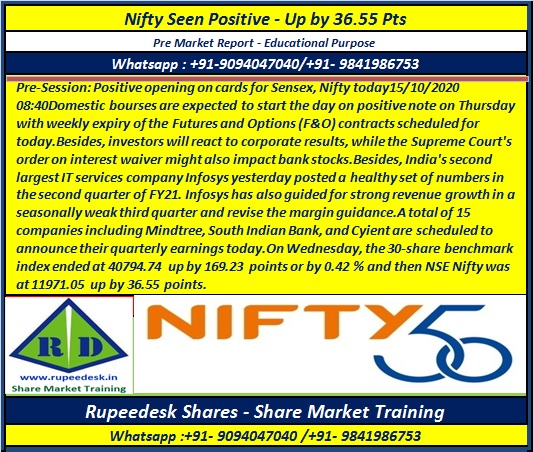

Results today | Mindtree, South Indian Bank, Cyient, Trident, Hathway Cable & Datacom, Rane Brake Lining, Boston Leasing and Finance, Bonlon Industries, Chennai Ferrous Industries, Dolat Investments, Interactive Financial Services, Jupiter Infomedia, Moschip Technologies, RS Software, Systematix Securities and Vimta Labs.

Infosys | Company reported 14.4 percent QoQ growth in Q2FY21 profit at Rs 4,845 crore, 3.8 percent rise in revenue at Rs 24,570 crore. Company raised FY21 revenue and margin guidance.

Transport Corporation of India | HDFC Mutual Fund A/C HDFC Small Cap Fund bought 9,80,000 equity shares in company at Rs 228 per share. However, Canara Robeco Mutual Fund A/C Canara Robeco Emerging Equity sold 9,91,685 shares at same price on the NSE.

Likhitha Infrastructure | Company to list shares on bourses on October 15.

Den Networks | Company reported consolidated profit at Rs 36.7 crore in Q2FY21 against Rs 9.5 crore YoY, revenue increased to Rs 337.7 crore from Rs 332.4 crore YoY.

Tata Elxsi | Company reported higher profit at Rs 78.9 crore in Q2FY21 compared to Rs 49.8 crore YoY, revenue rose to Rs 430.2 crore from Rs 385.8 crore YoY.

JTL Infra | Company reported profit at Rs 2.87 crore in Q2FY21 against Rs 2.19 crore, revenue increased to Rs 79.88 crore from Rs 45 crore YoY.

Jubilant FoodWorks | FPIs raised stake in company to 37.86 percent in September quarter, from 36.19 percent in June quarter.

Grauer & Weil India | CARE reaffirmed credit rating on company's long term bank facilities at AA- with stable outlook.

Goa Carbon | Company reported loss at Rs 5.03 crore in Q2FY21 against loss at Rs 13.7 crore, revenue fell to Rs 87.98 crore from Rs 101.48 crore YoY.

Sunedison Infrastructure | Promoter entity Avyan Pashupathy Capital Advisors proposed to sell 5,31,811 equity shares (representing 11.84 percent of equity capital) via offer for sale on October 15-16. The floor price of the sale is fixed at Rs 22 per share.

Dalmia Bharat | Jayesh Nagindas Doshi resigned from the position of Whole Time Director and Chief Financial Officer of the company.

Avanti Feeds | Andhra Pradesh Industrial Development Corporation (APIDC) has withdrawn its Nominee Director Dr Rajat Bhargava, from the Board of company.

HFCL | Promoter entity MN Ventures acquired further 20 lakh equity shares in company.

Tata Steel Bsl | Company reported profit at Rs 341.7 crore in Q2FY21 against loss of Rs 244 crore YoY, revenue increased to Rs 5,519.4 crore from Rs 4,554.6 crore YoY.

Subex | BSE to remove Subex from Smallcap, MidSmallcap, Information Technology and AllCap indices from October 22.

Polyplex Corporation | The share buyback offer will close on October 15 as per schedule available on the BSE.

Reliance Industries: Reliance Retail receives subscription amount of Rs 5,550 crore from KKR. Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

United Spirits | The company has entered into a definitive agreement to sell its entire shareholding in Tern Distilleries for Rs 30 crore.

Punjab National Bank | India Ratings and Research has upgraded the bank’s long-term issuer ratings to ‘IND AAA’ from ‘IND AA+’ while resolving the rating watch evolving. The outlook is 'Stable'.

Thomas Cook (India) | CRISIL has downgraded its ratings on the long-term bank facilities of the company to CRISIL A+ from CRISIL AA-with outlook remaining negative.

NMDC | The government has approved demerger of the under-construction Nagarnar steel plant from NMDC and its strategic divestment by selling the entire government stake.

Indiabulls Housing Finance | The National Housing Bank has levied a penalty of Rs 3.5 lakh on the company for non-disclosure of related party transactions.