Global Market Updates - 27.04.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Wednesday, April 26, 2023

Global Market Updates - 27.04.2023

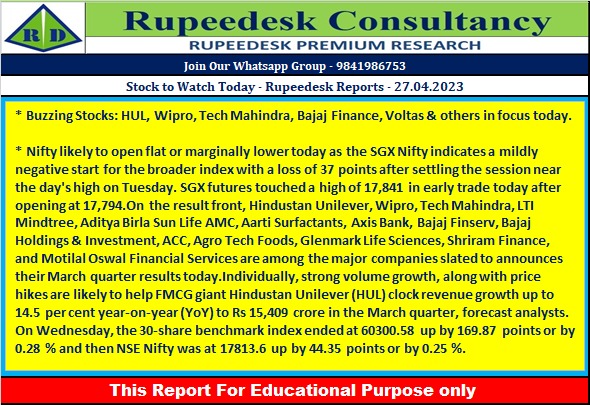

Stock to Watch Today - Rupeedesk Reports - 27.04.2023

Stock to Watch Today - Rupeedesk Reports - 27.04.2023

Buzzing Stocks: HUL, Wipro, Tech Mahindra, Bajaj Finance, Voltas & others in focus today.

Hindustan Unilever is expected to see a 13% year-on-year jump in both top line and bottom line for the quarter ended March 2023. The company will announce its Q4 FY23 results on April 27. According to a poll of brokerages, HUL’s standalone Q4 revenue is seen at Rs 15,277 crore and net profit at Rs 2,584 crore.

Results on April 27: Axis Bank, Wipro, Tech Mahindra, ACC, Bajaj Finserv, Aarti Surfactants, Aditya Birla Sun Life AMC, Chennai Petroleum Corporation, Coforge, Dwarikesh Sugar Industries, Gateway Distriparks, Glenmark Life Sciences, Indian Hotels, Laurus Labs, LTIMindtree, Motilal Oswal Financial Services, Mphasis, Shriram Finance, Tinplate Company of India, Trent, and Welspun India are expected to declare their March quarter and full year earnings on April 27.

Bajaj Finance: The non-banking finance company recorded a 30% year-on-year growth in profit at Rs 3,158 crore for quarter ended March FY23 despite 22.4% increase in loan losses and provisions in the same period. Net interest income for the quarter grew by 28% to Rs 7,771 crore compared to year-ago period, with number of new loans booked during Q4FY23 increasing by 20% to 7.56 million YoY.

HDFC Life Insurance Company: The life insurance company has reported a 0.3% year-on-year growth in standalone profit at Rs 358.66 crore for March FY23 quarter. Net premium income for the quarter at Rs 19,426.6 crore increased by 36% over a year-ago period, and net commission jumped 79% to Rs 1,111.4 crore during the same period.

L&T Technology Services: The L&T Group company has recorded 2% sequential growth in profit at Rs 309.6 crore for March FY23 quarter. Revenue grew by 2.3% QoQ to Rs 2,096.2 crore, while revenue in dollar terms increased by 2.8% and 2.2% in constant currency terms for Q4FY23 QoQ. The deal wins for the quarter were $70 million. The board recommended final dividend of Rs 30 per share for FY23.

Voltas: The home appliances company has posted a 21.2% year-on-year decline in consolidated profit at Rs 143.92 crore for quarter ended March FY23 dented by weak operating performance. Revenue grew by 10.88% YoY to Rs 2,957 crore in Q4FY23 YoY, while EBITDA fell 16.4% YoY to Rs 218.2 crore with margin declining 240 bps at 7.4% for the quarter. The board recommended dividend of Rs 4.25 per share for FY23.

HCL Technologies: Global pigment manufacturer Heubach Group has selected HCL Tech to drive its digital transformation agenda. HCL Tech will deliver an IT system for Heubach Group across 11 countries to include deployment of hybrid cloud, cybersecurity solutions, end-user services and secure networks.

Rail Vikas Nigam: Finance Minister has approved the upgradation of Rail Vikas Nigam to Navratna CPSE. RVNL will be the 13th Navratna amongst the CPSEs. RVNL is a Ministry of Railways CPSE with an annual turnover of Rs 19,381 crore and net profit of Rs 1,087 crore for FY22.

IDFC First Bank: The bank said its Board of Directors will be meeting on April 29 to consider an enabling proposal of borrowing via issuance of debt securities, on private placement basis, in one or more tranches.

City Union Bank: The Reserve Bank of India has given its approval for the re-appointment of N Kamakodi as the Managing Director & CEO of the bank. He will remain MD & CEO of the bank for three years with effect from May 1.

Central Bank of India: The public sector lender said the Board of Directors will meet on April 29 to consider the capital raising plan for FY24 via follow-on public offer, or Rights issue, or qualified institutional placement, or preferential issue, and/or issue of BASEL III compliant AT1/Tier II bonds.

Supreme Petrochem: The polystyrene polymer producer has recorded a massive 78.4% quarter-on-quarter growth in profit at Rs 159.8 crore for Q4FY23 driven by strong operating performance. Revenue from operations grew by 17.5% sequentially to Rs 1,387 crore, while EBITDA jumped 75.7% QoQ to Rs 208.9 crore with margin expansion of 500 bps to 15.06% for the quarter.

GI Engineering Solutions: The board members have approved appointment of Alka Jain as Whole-time Director of GI Engineering for five years, with effect from May 1.

Goldiam International: The company has received export orders worth of Rs 50 crore from its international clients for manufacturing of diamond studded gold jewellery, which includes orders of lab-grown diamonds jewellery to the tune of 35%.

Infosys: The country's second largest IT services company has announced collaboration with Walmart Commerce Technologies to deliver scalable omni-channel solutions to retailers. Infosys will help retailers implement and use Store Assist, which enables them to provide seamless omnichannel experiences such as pickup, delivery and ship from store for both employees and customers.

CG Power and Industrial Solutions: The company has completed the voluntary winding up of its step down subsidiary CG Middle East FZE, Dubai UAE. In August 2021, the board had approved the proposal for voluntary winding up of step down subsidiary.

UTI Asset Management Company: The asset management company has recorded a 58.7% year-on-year growth in consolidated profit at Rs 85.7 crore for March FY23 quarter driven by lower tax cost. Consolidated revenue for the quarter fell 0.1% to Rs 300.7 crore compared to same period last year. The final dividend of Rs 22 per share has been announced by the company.

IIFL Finance: The company has reported a 16.7% year-on-year growth in profit at Rs 269.15 crore for quarter ended March FY23. Total revenue from operations for the quarter largely remained flat at Rs 1,070.2 crore on year-on-year basis in Q4FY23. The board has given its approval for enabling annual resolution for raising funds through issue of non-convertible debentures, on a private placement basis, up to Rs 10,000 crore, subject to approval of shareholders.

Hardwyn India: The company has received board approval for sub-division of equity shares of 1 share of face value of Rs 10 each into 10 equity shares of face value of Re 1 each, and issue of bonus shares in the proportion of one share of Re 1 each for every 3 shares of Re 1 each held by shareholder.

HG Infra Engineering: The company has incorporated a wholly-owned subsidiary HG Varanasi-Kolkata PKG-13 Private Limited as a special purpose vehicle to undertake NHAI's highway project in Jharkhand.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc