Price Increase & Vol Increase In Large Cap - 02.05.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, May 1, 2022

Price Increase & Vol Increase In Large Cap - 02.05.2022

Price Increase & Vol Increase In Mid Cap - 02.05.2022

Price Increase & Vol Increase In Mid Cap - 02.05.2022

Price Increase & Vol Increase In Small Cap - 02.05.2022

Price Increase & Vol Increase In Small Cap - 02.05.2022

Stock to Watch Today - Rupeedesk Reports - 02.05.2022

Stock to Watch Today - Rupeedesk Reports - 02.05.2022

Buzzing Stocks | HDFC, Wipro, IndusInd Bank, SBI Card and others in news today

Results on May 2: HDFC, Britannia Industries, Adani Wilmar will be in focus. Besides these three, Alembic Pharmaceuticals, Astec Lifesciences, Castrol India, CG Power and Industrial Solutions, Devyani International, Dwarikesh Sugar Industries, EIH Associated Hotels, IDBI Bank, Inox Leisure, JBM Auto, Jindal Stainless, Mahindra & Mahindra Financial Services, Mahindra Holidays & Resorts India, Meghmani Organics, NGL Fine-Chem, Olectra Greentech, Saregama India, Shakti Pumps (India), and Surana Solar will also release their quarterly earnings today.

HDFC: HDFC Limited (HDFC), the biggest mortgage lender of the country is slated to declare its results for the quarter ended March 2022 on May 2. Experts are a divided lot about the growth in the lender’s bottom line as some expect its profit after tax (PAT) to decline ~2-4 percent on year while some expect the PAT to grow 7 percent on year. They expect a PAT of ~Rs 3,000 – 3,400 crore for the quarter. Net interest income (the difference between the interest earned and interest expended) is likely to grow ~7 percent to Rs 4,330 crore.

Britannia Industries: FMCG major Britannia Industries Ltd is expected to report a decline in its on-year net profit for the fourth quarter ended March 2022 when it will declare its results on May 2. Brokerages expect the consolidated profit after tax (PAT) for the home grown confectioner to remain flat or decline in low single digits vis-à-vis the corresponding period last year. On a sequential basis, the decline is sharper due to a slump in volumes. Revenues, however, are expected to increase 8-11 percent on-year due to price hikes and stay flat to lower volume growth compared to last year. On a sequential basis, the revenues are seen declining 2-5 percent due to falling biscuits volumes.

Wipro: The IT services company clocked a 3.1 percent sequential increase in dollar revenue at $2,721.7 million for the quarter ended March 2022 and revenue in constant currency grew at 3.1 percent QoQ. Wipro expects 1-3 percent sequential growth in Q1FY23 revenue at $2,748-2,803 million. Profit during the March 2022 quarter grew by 3.98 percent QoQ to Rs 3,087.3 crore and revenue increased by 2.68 percent QoQ to Rs 20,860 crore in Q4FY22.

Yes Bank: The private sector lender reported a profit of Rs 367 crore in Q4FY22 against a loss of Rs 3,788 crore in the corresponding quarter of previous fiscal, driven by a sharp downtick in provisions, strong net interest income, and pre-provision operating profit (PPoP) with an improvement in asset quality performance. For the full year, it reported a profit for the first time since FY19, at Rs 1,066 crore against a loss of Rs 3,462 crore in FY21 and a loss of Rs 22,715 crore in FY20, but net interest income (NII) declined 12.5 percent to Rs 6,498 crore compared to the previous year.

IndusInd Bank: The private sector lender registered a 55.4 percent year-on-year growth in profit at Rs 1,361.4 crore for the quarter ended March 2022 as provisions declined 21.5 percent with improvement in asset quality performance. Net interest income grew by 12.7 percent YoY to Rs 3,985.16 crore in Q4.

SBI Cards and Payment Services: The company clocked a massive 231 percent year-on-year growth in profit at Rs 581 crore as impairment loss and bad debts declined 44 percent YoY to Rs 393 crore for the quarter ended March 2022. Total revenue from operations grew by 23 percent to Rs 2,850 crore during the same period, led by higher income from fees and services and interest income.

Tata Chemicals: The company recorded strong consolidated profit at Rs 438.2 crore for the quarter ended March 2022, against profit of Rs 11.77 crore in same period last year despite significant increase in input cost, power and fuel, and freight and forwarding charges, driven by healthy topline and other income. Revenue grew by 32 percent to Rs 3,481 crore compared to the year-ago period, with production volumes remaining strong and at historic highs in the US unit.

HFCL: The company reported a 21.2 percent decline in consolidated profit at Rs 68.13 crore for the quarter ended March 2022 on lower topline. Revenue from operations declined 15 percent to Rs 1,183 crore compared to year-ago quarter.

GE Power India: GE Power gets Rs 864 crore order. The company has bagged a contract worth Rs 863.4 crore from GREENKO KA01 IREP Pvt Ltd.

Sonata Software: The IT services company clocked a 21.5 percent year-on-year growth in profit at Rs 100.90 crore for the quarter ended March 2022, led by strong topline and operating performance. Revenue during the quarter at Rs 1,463.6 crore increased by 36 percent compared to corresponding period of previous fiscal.

L&T Finance Holdings: The company registered a 28.3 percent year-on-year growth in profit at Rs 341.35 crore with significant drop in impairment on financial instruments. Total revenue from operations fell by 11.3 percent to Rs 2,946.8 crore compared to corresponding period of previous fiscal.

Astral: To expand product portfolio under the building material segment, the company will acquire 51 percent stake in the operating paint business of Gem Paints. The company will initially invest Rs 194 crore in Gem Paints by subscribing to optionally convertible debentures equivalent to value of 51 percent equity stake of operating paint business of Gem Paints. The balance 49 percent stake will be acquired by Astral over a period of five years in tranches.

Shriram City Union Finance: The company reported a 7.6 percent year-on-year growth in standalone profit at Rs 303.44 crore in Q4FY22 and total revenue from operations grew by 18 percent to Rs 1,750 crore compared to year-ago period.

Star Health and Allied Insurance Company: Star Health net loss narrowed in March quarter. The firm posted a loss of Rs 82.04 crore for the quarter ended March 2022, which narrowed from loss of Rs 578.37 crore recorded in previous quarter. During the same period, premiums earned increased by 3.7 percent sequentially to Rs 2,621.2 crore during the quarter.

Solara Active Pharma Sciences: Solara Active Pharma MD and CEO resigns. The company in a BSE filing said Rajender Rao Juvvadi has resigned as Managing director and CEO and directorship of the company, and the board approved appointment of Jitesh Devendra as Managing Director of the company.

Just Dial: The local search engine company recorded a 34 percent year-on-year decline in profit at Rs 22.1 crore for the quarter ended March 2022 hit by lower topline and operating loss. Revenue from operations stood at Rs 166.7 crore for the quarter, down 5.1 percent compared to year-ago period, but total traffic of unique visitors) for the quarter at 144.8 million grew by 12.2 percent YoY and total active listings at 31.9 million increased by 4.9 percent YoY, while active paid campaigns at the end of quarter stood at 4,61,495, which rose by 0.9 percent YoY.

Thyrocare Technologies: The company reported a 44 percent year-on-year decline in Q4FY22 profit at Rs 21.24 crore on lower topline. Revenue declined 11 percent to Rs 130.56 crore compared to the same period last year.

GHCL: The company clocked a healthy 144 percent year-on-year growth in Q4FY22 profit at Rs 271.3 crore despite rising input cost, led by strong topline and operating income. Revenue during the quarter grew by 77 percent to Rs 1,273.3 crore compared to year-ago period.

Usha Martin: The company clocked a massive 60.1 percent year-on-year growth in consolidated profit at Rs 108.7 crore in Q4FY22 driven by subsidy Rs 31.18 crore from Jharkhand government, and topline. Revenue during the quarter grew by 17.4 percent to Rs 766.56 crore YoY.

IDFC First Bank: IDFC First Bank approves raising funds. The bank in a BSE filing said the board has approved fund raising up to Rs 3,000 crore.

Can Fin Homes: The housing finance company reported a 20 percent year-on-year growth in profit at Rs 122.92 crore for the quarter ended March 2022 despite four times increase in provisions for expected credit loss and write offs to Rs 30.24 crore. Total income from operations grew by 20 percent to Rs 561.30 crore in the same period.

Tanla Platforms: The largest CPaaS provider reported a 37 percent year-on-year growth in profit at Rs 140.6 crore on strong topline and operating performance. Revenue increased by 32 percent year-over-year to Rs 853.1 crore and operating income grew by 37 percent to Rs 184.1 crore compared to year-ago period.

Mitsu Chem Plast: The company reported a 50 percent year-on-year growth in Q4FY22 profit at Rs 3.3 crore led by topline and operating income. Revenue from operations increased by 43 percent to Rs 74.60 crore during the same period.

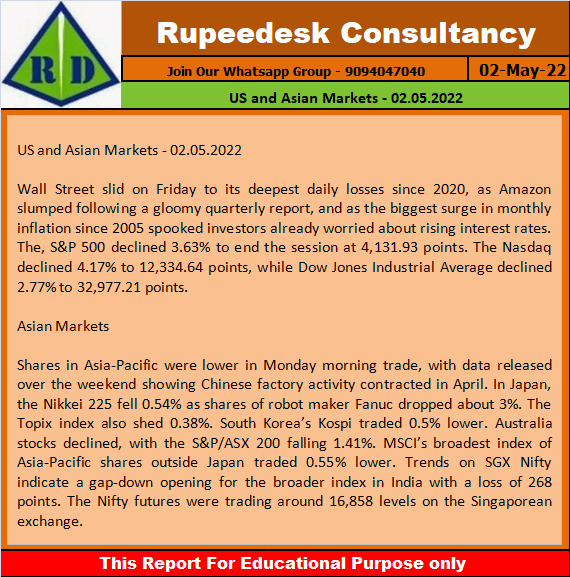

US and Asian Markets - 02.05.2022

US and Asian Markets - 02.05.2022

Earning Result Corner - 02.05.2022

Earning Result Corner - 02.05.2022

Global Market Updates - 02.05.2022

Global Market Updates - 02.05.2022

TOP 10 Stocks In Focus - 02.05.2022

TOP 10 Stocks In Focus - 02.05.2022