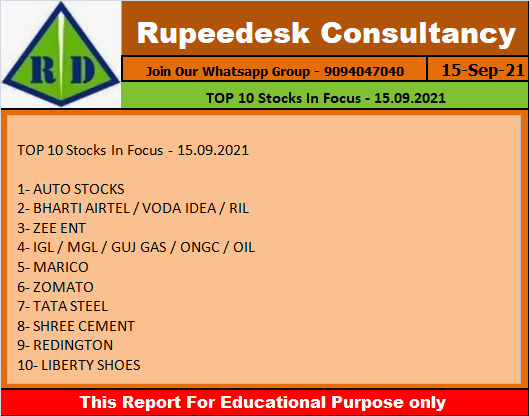

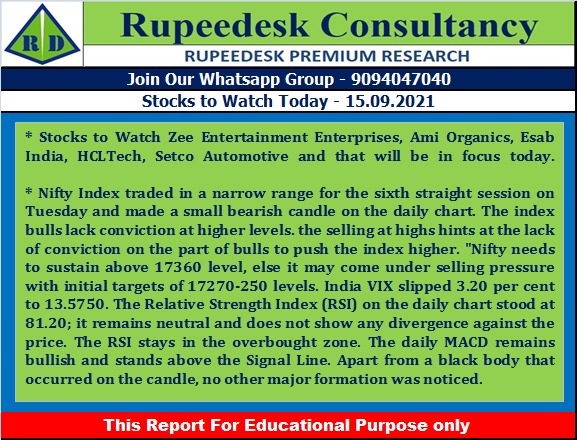

Buzzing Stocks: Zee Entertainment Enterprises, Ami Organics, Esab India, and other stocks in news today

Zee Entertainment Enterprises | Rare Enterprises, a stock trading firm owned by ace investor Rakesh Jhunjhunwala, bought 50 lakh equity shares of the company, representing 0.52 percent of total paid up equity, at a price of Rs 220.44 per share on the NSE, the bulk deals data showed. The stake is valued at Rs 110.22 crore. BofA Securities Europe SA also acquired 48,65,513 equity shares in Zee today at Rs 236.2 per share.

Ami Organics | Vanaja Sundar acquired 5 lakh shares of the specialty chemical company at Rs 910 per equity share and Vanaja Sundar Iyer bought 4 lakh shares at Rs 909.97 per share on the NSE, the bulk deals data showed.

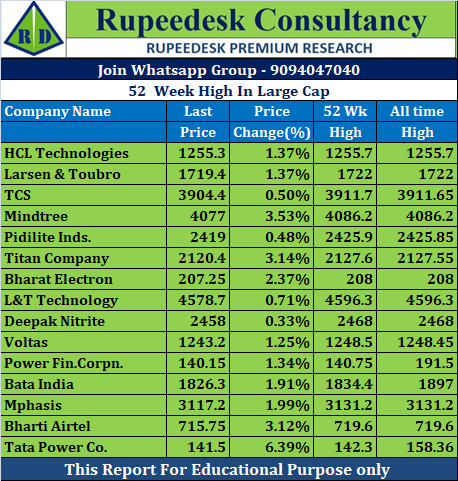

HCL Tech: The company has expanded partnership with Finastra for tech solutions in South Korea, Taiwan.

Esab India | Acacia Conservation Fund LP sold 3.61 lakh equity shares of the welding and cutting equipment manufacturer at Rs 2,235.28 per share. Pramerica Mutual Fund acquired 2.7 lakh equity shares at Rs 2,235 per share on the NSE, the bulk deals data showed.

Setco Automotive | 16.25 percent stake pledged by promoter entity Setco Engineering against loan taken has been released.

Wardwizard Innovations & Mobility | The company on September 20 will consider fund raising for various business purposes and to explore avenues for the same including by way of rights issue of equity shares.

Liberty Shoes | Investor Seetha Kumari sold 2.57 percent stake in the company via open market transactions, reducing shareholding to 2.73 percent from 5.3 percent earlier.

Dynacons Systems & Solutions | The company won e-Governance contract worth Rs 7.46 crore for development & management of GMDMA Website, disaster management app and command & control system along with comprehensive maintenance of automatic weather stations, flow level sensor from Municipal Corporation of Greater Mumbai.

Power Finance Corporation | UBS Group AG increased stake in the company to 5.67 percent from 3.4 percent earler, through rights issue.

LIC Housing Finance | Life Insurance Corporation of India's stake in the company increased to 45.239 percent from 40.313 percent post preferential allotment.

Jindal Steel & Power | CRISIL has upgraded its rating from 'A' with 'stable' outlook to 'A+' with 'Positive' outlook on the long term bank facilities and from "A2+" to "Al+" for short term bank facilities of the company.

Linde India | Nippon Life India Trustee through various schemes of Nippon India Mutual Fund sold 91,066 equity shares in the company, reducing shareholding to 6.7115 percent from 6.8183 percent earlier.

Intrasoft Technologies | University of Notre Dame du Lac sold 2.36 percent stake in the company via open market transaction, reducing shareholding to 4.4 percent from 6.76 percent earlier.