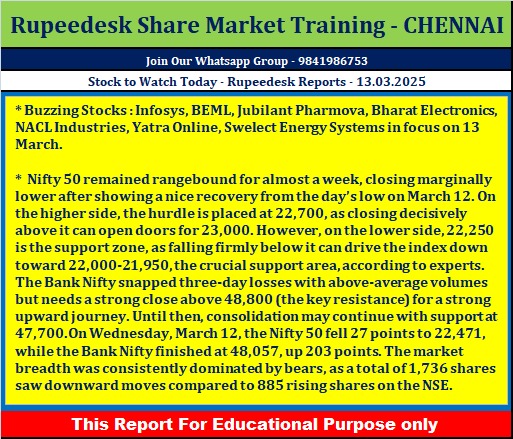

Buzzing Stocks : Infosys, BEML, Jubilant Pharmova, Bharat Electronics, NACL Industries, Yatra Online, Swelect Energy Systems in focus on 13 March.

Infosys : The digital services and consulting company announced the expansion of its long-standing strategic collaboration with NYSE-listed Citizens (one of the oldest and largest financial institutions in the US). Citizens will leverage Infosys’ deep domain expertise in financial services and its innovative technologies, including AI, cloud, and automation, to develop cloud-native domain platforms and achieve a data center exit.

BEML : The company has signed a non-binding Memorandum of Understanding (MoU) with Siemens India to jointly explore opportunities in the semi-high-speed and suburban passenger train segments, as well as in the metro and commuter rail markets. Additionally, the company has signed an MoU with Dragflow S.R.L., Italy Forge, to strengthen indigenous dredging solutions.

Jubilant Pharmova : The company’s US-based subsidiary, Jubilant Cadista Pharmaceuticals Inc., has received the Establishment Inspection Report (EIR) with Voluntary Action Indicated (VAI) status from the US Food and Drug Administration (USFDA) for its solid oral formulations facility at Salisbury. The regulator had inspected the facility in January 2025. With the receipt of the EIR from the USFDA, the inspection is now successfully closed. Going forward, the facility is not expected to manufacture any products as it has ceased manufacturing operations, effective April 18, 2024.

Bharat Electronics : The company has signed a contract with the Ministry of Defence valued at Rs 2,463 crore for the supply and services of Ashwini radars to the Indian Air Force. With this, the company has accumulated orders totaling Rs 17,030 crore in the current financial year.

Tata Steel : Rajiv Kumar has resigned as Vice President - Operations of Tata Steel Kalinganagar, effective March 12.

NHPC : The Board will meet on March 19 to consider the borrowing plan for raising debt for the financial year 2025-26.

NTPC Green Energy : The company has successfully commissioned the second and final part of the capacity (50 MW) out of the 105 MW Shajapur solar project (Unit-1) of its subsidiary, NTPC Renewable Energy. The first part capacity of 55 MW was already declared to be in commercial operation, effective November 29, 2024.

Firstsource Solutions : The company's subsidiary, Firstsource Group USA Inc., has incorporated a new wholly owned subsidiary, Firstsource Solutions Limited Colombia S.A.S.

Coromandel International : Coromandel is set to acquire a 53% shareholding in NACL Industries for Rs 820 crore at a price of Rs 76.7 per share from the current promoter, KLR Products. Coromandel also proposes to make an open offer to the public to acquire up to 26% of the equity share capital of NACL.

Yatra Online : Rohan Purshottamdas Mittal has resigned as Group Chief Financial Officer of the company to pursue new opportunities.

SP Apparels : The Board has re-appointed Sundararajan Shantha and Sundararajan Chenduran as Joint Managing Directors of the company, for a period of three years, effective August 11, 2025.

Zydus Lifesciences : Zynext Ventures USA LLC, the venture capital arm of Zydus, announced its investment in biopharmaceutical company Illexcor Therapeutics. Illexcor is developing next-generation oral therapies for sickle cell disease (SCD). This investment underscores Zynext Ventures' commitment to supporting disruptive healthcare innovations that address significant unmet medical needs.

Jaiprakash Associates : The consortium of lenders has assigned/transferred their outstanding debt/financial assets charged for financial assistance granted by them to Jaiprakash Associates in favour of the National Asset Reconstruction Company (NARCL).

Swelect Energy Systems : The company has secured orders for over 150 MW for its TOPCon Bi-facial solar PV modules. Additionally, the Swelect Group has successfully raised Rs 290 crore in funding through non-convertible debentures (NCDs) via a private placement with India Infradebt.

Rollatainers : The Board has approved the withdrawal and cancellation of the preferential issue of 11.76 crore warrants convertible into equity shares of the company. This preferential issue was approved by the Board on April 20, 2024.

Satin Creditcare Network : For the purpose of raising funds from various lenders, the company, as the holding company, will issue a Letter of Comfort or a Side Letter to any third party in respect of credit facilities availed or to be availed by its subsidiary, Satin Housing Finance, up to Rs 300 crore, from the existing limit of Rs 200 crore, outstanding at any point in time. This will not be a guarantee on the part of the company to make payment on behalf of the subsidiary in case of default.

Ola Electric Mobility : The pure-play electric vehicle company announced Holi flash sale offers for its S1 range of electric scooters. It will provide discounts of up to Rs 26,750 on the S1 Air and Rs 22,000 on the S1 X+ (Gen 2). It is also offering discounts of up to Rs 25,000 on the rest of its S1 range, including the S1 Gen 3 range, and additional benefits worth up to Rs 10,500.

%20Major%20Market%20Breakdown%20or%20Bounce%20Back%20Key%20Levels%20to%20Watch!.jpeg)