Price Increase & Vol Increase In Large Cap - 14.11.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, November 13, 2022

Price Increase & Vol Increase In Large Cap - 14.11.2022

Price Increase & Vol Increase In Mid Cap - 14.11.2022

Price Increase & Vol Increase In Mid Cap - 14.11.2022

Price Increase & Vol Increase In Small Cap - 14.11.2022

Price Increase & Vol Increase In Small Cap - 14.11.2022

Results Earning Corner - 14.11.2022

Results Earning Corner - 14.11.2022

US and Asian Market - 14.11.2022

US and Asian Market - 14.11.2022

Global-Market Updates - 14.11.2022

Global-Market Updates - 14.11.2022

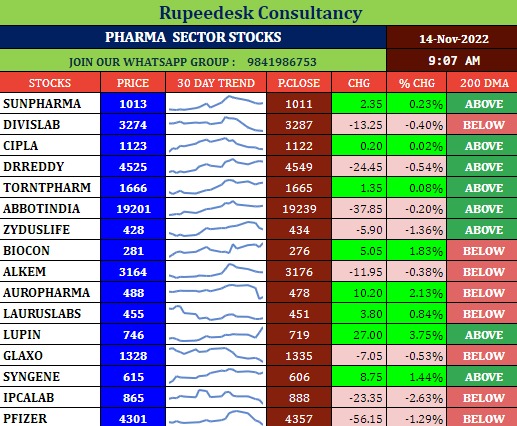

Pharma Stocks in Focus - 14.11.2022

Pharma Stocks in Focus - 14.11.2022

Stock to Watch Today - Rupeedesk Reports - 14.11.2022

Stock to Watch Today - Rupeedesk Reports - 14.11.2022

Buzzing Stocks | ONGC, Zee Entertainment, LIC, and others in news today.

Results on November 14: ONGC will be in focus ahead of its September FY23 quarter earnings today. Others to declare their financials for the quarter today include Grasim Industries, Biocon, Bharat Forge, Apollo Tyres, IRCTC, Aarti Industries, Abbott India, Ahluwalia Contracts, Aarey Drugs & Pharmaceuticals, Balkrishna Industries, BGR Energy Systems, Birla Tyres, CESC, Dilip Buildcon, Godrej Industries, Greaves Cotton, HUDCO, Indiabulls Housing Finance, Jyothy Labs, Linde India, Lux Industries, Mindspace Business Parks REIT, NBCC (India), Radico Khaitan, Sobha, and SpiceJet.

LIC: The life insurance company clocked a 27 percent year-on-year growth in net premium at Rs 1.32 lakh crore for the quarter ended September FY23. The net profit for the quarter at Rs 15,952 crore jumped 11-fold over Rs 1,434 crore last year, partly driven by incomes. The company's other income stood at Rs 6,795 crore as against Rs 46 crore a year back for the quarter, including refund of income tax.

Glenmark Pharmaceuticals: The pharma company reported a 1.1 percent year-on-year growth in profit at Rs 260.4 crore for the quarter ended September FY23, with revenue rising 7.2% YoY to Rs 3,375.2 crore for the quarter impacted by North America business that fell 0.1% YoY but India business grew by 12.7% and Europe 11.9% YoY. EBITDA increased by 5.3% to Rs 621.6 crore in Q2FY23 and margin declined by 40 bps to 18.4% compared to year-ago period. Numbers were ahead of analysts' estimates.

ABB India: The company clocked a massive 68.6% year-on-year growth in profit at Rs 202.5 crore for the quarter ended September FY23 with revenue rising 19.2% YoY to Rs 2,119.7 crore. The strong performance for the quarter can be attributed to its expanding customer base and industry-leading product portfolio. On the operating front, EBITDA increased by 16.4% YoY to Rs 211 crore and margin expanded by 50 bps YoY to 10% for the quarter.

Zee Entertainment Enterprises: The media and entertainment company reported a 58% year-on-year decline in profit at Rs 112.8 crore for the September FY23 quarter, dented by weak operating performance and muted topline growth. Revenue for the quarter at Rs 2,028.4 crore grew by 2.5% as domestic advertising revenues were lower by 7.7% due to FTA withdrawal (Zee Anmol) and challenging macroeconomic environment. EBITDA fell 26.3% YoY to Rs 297.3 crore for the quarter.

Thermax: The energy and environment solutions company recorded a 24.1% year-on-year growth in profit at Rs 109.2 crore for the quarter ended September FY23 on strong top line and operating performance. Revenue grew by 41.3% to Rs 2,075.3 crore and EBITDA surged 28.4% to Rs 140.8 crore for the quarter compared to same period last year. As on September 2022, Thermax Group had an order balance of Rs 9,485 crore, up 46% YoY.

Sun TV Network: The television broadcaster clocked a 3% year-on-year growth in consolidated profit at Rs 407.4 crore on better margin performance but impacted by tepid top line growth. Consolidated revenue from operations for the quarter fell 2.7% YoY to Rs 825.7 crore and EBITDA increased by 1.7% to Rs 537.5 crore. EBITDA margin expanded to 65.1% from 62.3% on year-on-year basis.

Info Edge India: The internet company has registered 42.4% quarter-on-quarter decline in profit at Rs 103 crore for the quarter ended September FY23 impacted by lower other income and lower operating margin. Revenue grew by 10.4% QoQ to Rs 604.1 crore.

Bharat Dynamics: The state-owned company reported a massive 75.3% year-on-year growth in profit at Rs 75.8 crore for the quarter ended September FY23 supported by healthy operating performance and higher other income. Revenue grew by 6.1% to Rs 534.8 crore compared to year-ago period. EBITDA increased by 41.9% YoY to Rs 93.8 crore and margin expanded by 450 bps YoY to 17.6% for the quarter.

Astral: The CPVC pipes and fitting manufacturer has recorded a 48% year-on-year decline in consolidated profit at Rs 74.6 crore for the quarter ended September FY23 impacted by lower top line and weak operating performance. Revenue for the quarter declined 2.4% to Rs 1,171.6 crore and EBITDA fell 35.6% to Rs 144 crore compared to year-ago period.

BHEL: The power equipment manufacturer has recorded standalone profit of Rs 10.3 crore for the quarter ended September FY23 against loss of Rs 67.5 crore in same period last year, largely due to tax write-back and higher other income. Standalone revenue grew by 1.8% YoY to Rs 5,202.6 crore for the quarter, and standalone EBITDA loss widened to Rs 243.9 crore from Rs 29 crore on-year basis.

Ircon International: The state-owned turnkey construction company has clocked a strong 38.4% year-on-year growth in consolidated profit at Rs 174.2 crore led by healthy top line and operating performance though margin contracted a bit. Revenue from operations for the quarter grew by 47% to Rs 2,238.9 crore and EBITDA increased by 43% to Rs 199.7 crore compared to year-ago period. The total order book as of September FY23 stood at Rs 40,020 crore.

Fortis Healthcare: The healthcare services provider has registered a massive 67% year-on-year increase in consolidated profit at Rs 218.24 crore for the quarter ended September FY23, driven by exceptional gain, higher other income and lower tax cost. Consolidated revenue rose by 9.9% to Rs 1,607 crore and EBITDA increased 6.5% to Rs 302.9 crore compared to same period last year.

Fortis Healthcare: The healthcare services provider has registered a massive 67% year-on-year increase in consolidated profit at Rs 218.24 crore for the quarter ended September FY23, driven by exceptional gain, higher other income and lower tax cost. Consolidated revenue rose by 9.9% to Rs 1,607 crore and EBITDA increased 6.5% to Rs 302.9 crore compared to same period last year.

MOIL: The state-run manganese ore mining company has recorded a 54.7% year-on-year fall in profit at Rs 27.3 crore for the quarter ended September FY23 impacted by lower topline as well as weak operating performance. Revenue for the quarter declined by 34.3% to Rs 236 crore and EBITDA tanked 59% to Rs 33 crore with margin falling by 12 percentage points compared to year-ago period.

GlaxoSmithKline Pharmaceuticals: The company has reported a 2.2% year-on-year increase in consolidated profit at Rs 193.4 crore for quarter ended September FY23 on good operating performance, but revenue fell 1.8% to Rs 917 crore compared to corresponding period last fiscal. EBITDA increased 0.3% YoY to Rs 256.9 crore and margin expanded 60 bps to 28% for the quarter.

Mahanagar Gas: The natural gas distribution company has reported a 11.5% quarter-on-quarter decline in profit at Rs 164 crore for quarter ended September FY23, dented by weak operating performance. Revenue from operations at Rs 1,717.5 crore for the quarter grew by 7.8% QoQ. EBITDA fell by 11.5% to Rs 252.8 crore and margin declined 340 bps to 16.2% compared to previous quarter.

Krishna Institute of Medical Sciences: The Telangana and Andhra Pradesh-based medical and healthcare services provider reported a 26% year-on-year growth in consolidated profit at Rs 106 crore for quarter ended September FY23 led by healthy top line. Revenue from operations at Rs 564 crore increased by 37% compared to year-ago period. EBITDA grew by 18.4% to Rs 152.5 crore and margin declined 430 bps to 27% compared to corresponding period last fiscal.

Krishna Institute of Medical Sciences: The Telangana and Andhra Pradesh-based medical and healthcare services provider reported a 26% year-on-year growth in consolidated profit at Rs 106 crore for quarter ended September FY23 led by healthy top line. Revenue from operations at Rs 564 crore increased by 37% compared to year-ago period. EBITDA grew by 18.4% to Rs 152.5 crore and margin declined 430 bps to 27% compared to corresponding period last fiscal.

Gujarat Ambuja Exports: The agro processing company has recorded a 38% year-on-year decline in profit at Rs 64.1 crore for quarter ended September FY23, impacted by weak operating performance as well as lower top line. Revenue from operations fell 6.4% to Rs 1,077.8 crore compared to year-ago period. EBITDA at Rs 93.6 crore for the quarter declined 36% and margin dropped 4 percentage points.

Indiabulls Real Estate: The real estate firm has reported a 10-fold year-on-year increase in profit at Rs 56.5 crore for quarter ended September FY23 largely driven by operating performance, but revenue from operations fell 44.4% YoY to Rs 194 crore for the quarter. EBITDA at Rs 91 crore for the quarter increased by 306% YoY, and margin jumped 40 percentage points as cost of land, plots, constructed properties and others dropped significantly.

Procter & Gamble Health: The company has recorded a 15% year-on-year growth in profit at Rs 63.66 crore for Q1FY23 backed by improved product mix and productivity initiatives. Revenue from operations at Rs 297.55 crore for the quarter grew by 9% as strong off-take on key brands supported by extensive consumer awareness and HCP engagement efforts. EBITDA grew by 16.3% to Rs 90.8 crore and margin increased by nearly 2 percentage points to 30.5% for the quarter YoY.

Shilpa Medicare: The pharmaceutical company posted consolidated loss of Rs 18.7 crore for quarter ended September FY23 against profit of Rs 20 crore in corresponding period last fiscal impacted by lower top line, and sharp fall in operating margin. Consolidated revenue from operations fell 11% YoY to Rs 262.9 crore with EBITDA declining 11% to Rs 12.2 crore and margin down more than 13 percentage points compared to year-ago period.

EID Parry India: The sugar company clocked a 20% year-on-year growth in consolidated profit at Rs 565 crore for quarter ended September FY23 on healthy top line. Consolidated revenue from operations grew by 62% to Rs 11,327.6 crore compared to year-ago period, and EBITDA increased by 27.3% to Rs 950 crore but margin fell by 230 bps YoY due to higher input cost.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc