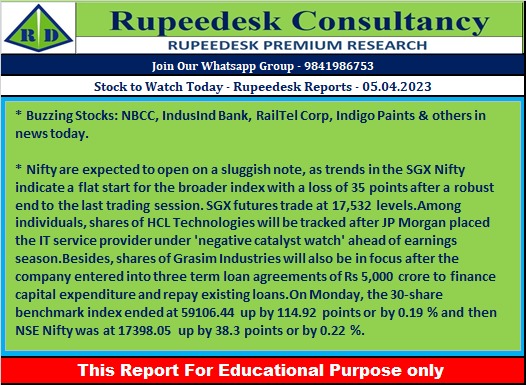

Stock to Watch Today - Rupeedesk Reports - 05.04.2023

Buzzing Stocks: NBCC, IndusInd Bank, RailTel Corp, Indigo Paints & others in news today.

IndusInd Bank: The private sector lender clocked net advances at Rs 2.89 lakh crore for the quarter ended March FY23, up 21% YoY and 6% QoQ, while deposits grew by 12% year-on-year and 3% sequentially to Rs 3.36 lakh crore. The retail deposits and deposits from small banking customers amounted to Rs 1.43 lakh crore as of March 2023, marginally high from Rs 1.37 lakh crore as of December 2022.

South Indian Bank: The bank has reported a 16.65% year-on-year growth in gross advances at Rs 72,107 crore, while total deposits grew by 2.82% YoY to Rs 91,652 crore, with CASA deposits rising 2.07% to Rs 30,215 crore. CASA ratio moved down to 32.97%, from 33.21% on YoY basis.

NBCC (India): The company has received work order worth Rs 448.02 crore, for construction of border and road in Mizoram along Indo Bangladesh Border (IBB), from Government of India.

RailTel Corporation of India: The company has received work order worth Rs 76.10 crore from Bihar State Electronics Development Corporation for implementation and management of electronic knowledge network in academic/administrative buildings of government engineering colleges and polytechnic institutes in Bihar. Another order worth Rs 38.95 crore is from National Informatics Centre Services for installation, testing and commissioning of 4 Mbps lease line connectivity for 19 sites.

Bajaj Finance: Company's core AUM (assets under management) grew by 29% YoY to Rs 2.47 lakh crore as of March 2023 and AUM in Q4FY23 grew by Rs 16,500 crore. New loans booked during Q4 increased by 20% to 7.6 million YoY and booked the highest ever new loans of 29.6 million in FY23. Consolidated net liquidity surplus stood at Rs 11,850 crore as of March 2023. Deposit book stood at Rs 44,650 crore as of March 2023, up 45% over Rs 30,800 crore deposits as of March 2022.

S H Kelkar and Company: Subsidiary Keva Fragrances (KFG) has sold its 50% stake in Purandar Fine Chemicals. With this disinvestment, Purandar Fine Chemicals ceases to be a joint venture of KFG.

SKF India: The company has completed acquisition of 26% stake or 2,600 equity shares in Cleanmax Taiyo, from Clean Max Group.

Engineers India: The state-owned company has received several orders worth Rs 47 crore from Petronet, Nayara Energy, BPCL, and PNGRB.

Marico: The FMCG major said its consolidated revenue in March FY23 quarter grew in low single digits on a year-on-year basis. India business witnessed some improvement in YoY volume growth and stayed in the mid-single digit zone, while the international business maintained its stellar growth trajectory as it posted mid-teen constant currency growth. Parachute Coconut Oil posted a strong high single-digit volume growth, aided by stable consumer pricing while copra prices remained steady through the quarter. Value Added Hair Oils touched double-digit value growth.

M&M Financial Services: In March 2023, the company estimates overall disbursement at Rs 5,600 crore, delivering a 42% YoY growth. The Q4FY2023 disbursements at Rs 13,750 crore registered a growth of 50% YoY. FY2023 disbursement was approximately at Rs 49,500 crore registering a YoY growth of 80%. Healthy disbursement trends during FY23 have led to business assets at Rs 82,300 crore, growth of 7% over December 2022 and 27% over March 2022. The collection efficiency was at 105% for March 2023, and in Q4FY23 it was at 99% against 100% for Q4FY22).

Federal Bank: The private sector ender has announced total deposits at Rs 2.13 lakh crore for March FY23 quarter, rising 17.4% over Q4FY22. Customer deposits (total deposits excluding Interbank deposits and certificates of deposit) jumped 13.3% YoY to Rs 2.01 lakh crore. Gross advances grew by 20.2% YoY to Rs 1.77 lakh crore. Retail credit increased by 18.6% and wholesale credit book rose by 22.2%.

Cyient: Krishna Bodanapu, who is presently the Managing Director and Chief Executive Director, is appointed as Executive Vice-Chairman and Managing Director of the company. Karthikeyan Natarajan, who is presently the Executive Director and Chief Operating Officer, is appointed as Executive Director and Chief Executive Officer of the company. Company appointed Prabhakar Atla as Chief Financial Officer designate as Ajay Aggarwal will retire as Chief Financial Officer on April 20.

Dhampur Sugar Mills: The company has declared an interim dividend of Rs 5 per share (face value Rs 10 each) and special dividend of Re 1 each on successful commissioning of new distillery project, for FY23.

Indigo Paints: The company has entered into a share purchase and share subscription agreement, and a shareholders agreement with Apple Chemie India (ACIPL) to acquire 51% equity shares in ACIPL which manufactures construction chemicals and water proofing products.

Canara Bank: Uday Sankar Majumder, Chief General Manager has been designated as the Group Chief Risk Officer of the bank with immediate effect. Uday will replace the present incumbent Jagdish Chander, General Manager, who has been entrusted with new role in the bank.

MIRC Electronics: The company said the board has appointed Shirish Suvagia, Chief Financial Officer of the company as an Additional Director and Whole-time Director. Lokesh Sikka has resigned as Whole-time Director of the company.

Securekloud Technologies: Subsidiary Healthcare Triangle Inc has announced a multi-year subscription agreement with long-standing customer CalvertHeath for readabl.ai, a medical document automation solution.

Sterlite Technologies: The company has completed the transfer of its digital business undertaking to its wholly-owned subsidiary STL Digital, as a going concern on a slump sale basis. The company has signed business transfer agreement in February this year.

Carysil: Subsidiary Carysil UK has agreed to acquire 70% equity shares of 'The Tap Factory Limited', based at Yorkshire, UK, for 1.16 million pound. It has an option to acquire the balance 30% in 2 tranches of 15% each in next two years. The acquistion will help the company to get access to the Tap's design and marketing capabilities in Kitchen and bath segments, and strengthen its position further in UK Kitchen and bathroom segment.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc