ANURAS Stock Report - 03.05.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Tuesday, May 2, 2023

ANURAS Stock Report - 03.05.2023

CUMMINSIND Stock Report - 03.05.2023

CUMMINSIND Stock Report - 03.05.2023

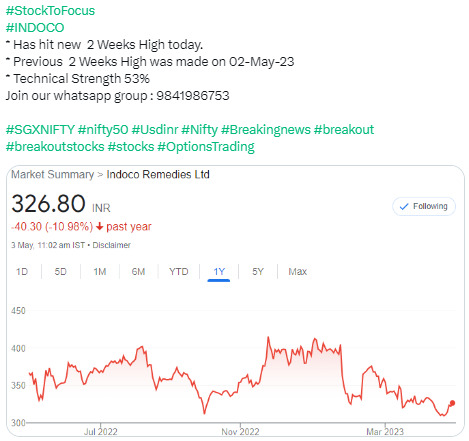

Stock to Focus INDOCO - 03.05.2023

Stock to Focus INDOCO - 03.05.2023

Stock to Watch Adanient - 03.05.2023

Stock to Watch Adanient - 03.05.2023

Stock to Watch Today - Rupeedesk Reports - 03.05.2023

Stock to Watch Today - Rupeedesk Reports - 03.05.2023

Buzzing stocks: Tata Steel, Ambuja Cement, Bharti Airtel, and others in news.

Results on May 3: Titan Company, ABB India, Tata Chemicals, Petronet LNG, AAVAS Financiers, Anupam Rasayan India, Adani Wilmar, Bajaj Consumer Care, Cholamandalam Investment and Finance Company, Godrej Properties, Havells India, Jyothy Labs, KEC International, Mold-Tek Packaging, MRF, R Systems International, SIS, Sona BLW Precision Forgings, and Sula Vineyards will be in focus ahead of declaring their quarterly and full-year earnings today.

Tata Steel: The Tata Group steel company has recorded an 84% year-on-year decline in consolidated profit at Rs 1,566.2 crore for quarter ended March FY23, impacted by weak operating performance and lower topline. Revenue from operations declined 9.2% to Rs 62,961.5 crore compared to year-ago period. On the operating front, EBITDA plunged 52% YoY to Rs 7,219.2 crore with margin falling 1,022 bps to 11.46% for the quarter, but overall numbers above analysts' estimates. The board announced a dividend of Rs 3.6 per share for FY23.

Ambuja Cements: The cement maker has reported standalone profit of Rs 502.4 crore for March FY23 quarter, a 1.6% growth YoY, supported by topline and other income. However, the profitability was impacted by weak operating performance and restructuring cost (Rs 80.71 crore). Revenue grew by 8.4% year-on-year to Rs 4,256.3 crore, with sales volumes increasing by 8% YoY to 8.1 million tonnes. At operating level, EBITDA at Rs 788.3 crore for Q4FY23 declined 0.6% YoY, with margin falling 170 bps to 18.5%.

Bharti Airtel: The telecom operator, Dialog Axiata Plc, and Axiata Group Berhad have entered into a binding term sheet to combine operations of Bharti Airtel Lanka (Airtel's wholly-owned subsidiary with Dialog, a subsidiary of Axiata Group Berhad). Discussions with respect to the proposed transaction are ongoing between the parties and also with the relevant regulatory authorities

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 238 crore, from Embassy Construction. The said contract is expected to be executed within 28 months. The total order book as on date stands at Rs 2,518 crore.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc