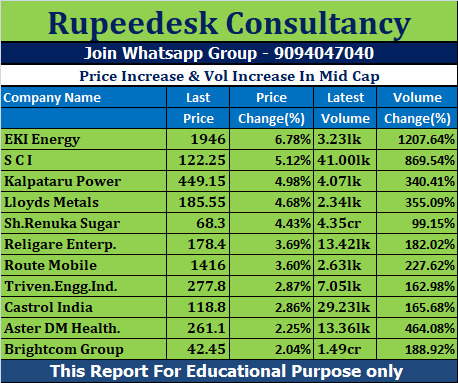

Price Increase & Vol Increase In Mid Cap - 11.10.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, October 10, 2022

Price Increase & Vol Increase In Mid Cap - 11.10.2022

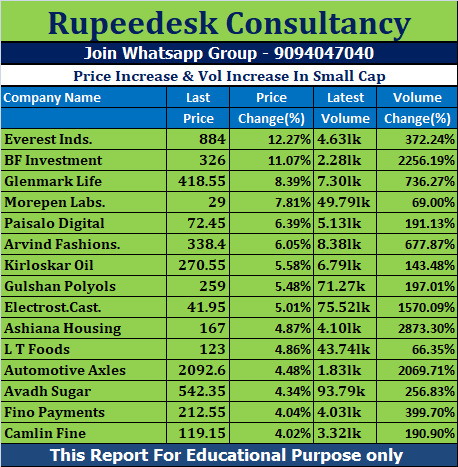

Price Increase & Vol Increase In Small Cap - 11.10.2022

Price Increase & Vol Increase In Small Cap - 11.10.2022

US and Asian Market - 11.10.2022

US and Asian Market - 11.10.2022

Earning Results Corner - 11.10.2022

Earning Results Corner - 11.10.2022

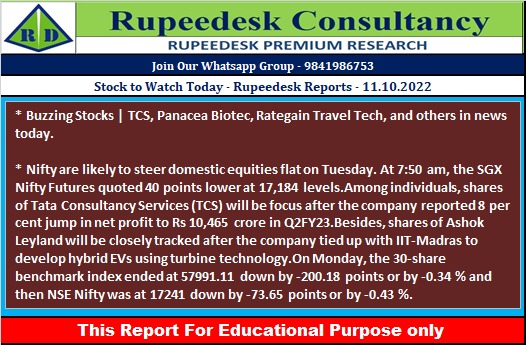

Stock to Watch Today - Rupeedesk Reports - 11.10.2022

Stock to Watch Today - Rupeedesk Reports - 11.10.2022

Buzzing Stocks | TCS, Panacea Biotec, Rategain Travel Tech, and others in news today.

Results on October 11: Delta Corp, GM Breweries, Gujarat Hotels, Supreme Infrastructure India, and Trident Texofab will be in focus ahead of quarterly earnings on October 11.

Tata Consultancy Services: The IT services company reported a 10% sequential growth in consolidated profit at Rs Rs 10,431 crore for Q2FY23, with profitable growth across all industry verticals and in all major markets. Consolidated revenue grew by 4.8% sequentially (up 18% YoY) to Rs 55,309 crore, driven by strong execution, with dollar revenue rising 1.4% and constant currency revenue growth at 4% for the quarter. The orderbook remained quite strong at $8.1 billion for Q2FY23, though slightly down compared to $8.2 billion in previous quarter.

JTL Infra: The stock will be in focus as the company clocked a 56.5% growth year-on-year in consolidated profit at Rs 20.27 crore for the September FY23 quarter, backed by strong operating performance. Consolidated revenue for the quarter grew by 14% YoY to Rs 299.9 crore.

Rategain Travel Technologies: Investor Wagner exited the company by selling entire 57.04 lakh equity shares or 5.28% shareholding in the company via open market transactions on October 6. However, Nippon Life India Trustee acquired additional 4.89% equity in Rategain during December 9, 2021 and October 6, 2022, taking total shareholding to 8.75%.

Panacea Biotec: The company has received long-term supply orders worth $127.30 million (around Rs 1,040 crore) from UNICEF and Pan American Health Organization (PAHO). It will supply WHO pre-qualified fully liquid Pentavalent vaccine, Easyfive-TT (DTwP-HepB-Hib). UNICEF order is worth $98.755 million (Rs 813 crore) for supply of 99.70 million doses during calendar years 2023-2027 and PAHO award is worth $28.55 million (Rs 235 crore) for supply 24.83 million doses during calendar years 2023-2025.

India Cements: The cement company has sold its entire shareholding in Springway Mining to JSW Cement. It has entered into a Share Purchase Agreement with JSW Cement and divested the entire shareholdings for Rs 476.87 crore. With this, Springway Mining is ceased to be the wholly owned subsidiary of the company.

Triveni Turbine: Nippon Life India Trustee sold 2.92 lakh equity shares or 0.09% stake in the company via open market transactions. With this, its shareholding in the company reduced to 2.98%, from 3.07% earlier.

JMC Projects (India): Kotak Mahindra Mutual Fund picked additional 0.02% stake in the company through open market transactions on October 6. With this, its shareholding in the company rose to 5%, up from 4.98% earlier.

Inox Wind: The company said its subsidiary Inox Green Energy Services sold entire equity shareholding held in Wind One Renergy, Wind Three Renergy and Wind Five Renergy, to Adani Green Energy. All three special purpose vehicles successfully commissioned 50 MW each of SECI Tranche 1 in 2019. Inox Wind had won 250 MW under the Tranche 1 of Solar Energy Corporation of India's (SECI -1) bids for wind power projects at Dayapar, Gujarat connected on the central grid, at a fixed tariff of Rs 3.46 per unit for 25 years for sale to PTC India.

PG Electroplast: Avestha Fund Management LLP acquired 1.42 lakh equity shares in the company via open market transactions. These shares were bought at an average price of Rs 1,046.79 per share.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 10.10.2022

Mcx Commodity Intraday Trend Rupeedesk Reports - 10.10.2022

Currency Market Intraday Trend Rupeedesk Reports - 10.10.2022

Currency Market Intraday Trend Rupeedesk Reports - 10.10.2022

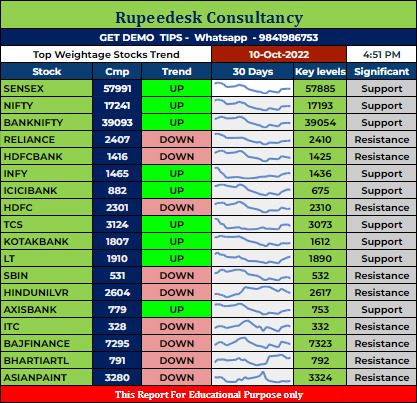

Top Weightage Stocks Trend Rupeedesk Reports - 10.10.2022

Top Weightage Stocks Trend Rupeedesk Reports - 10.10.2022

Market Highlights - 10.10.2022

Market Highlights - 10.10.2022

US Dollar Trend Update - Rupeedesk Reports - 10.10.2022

US Dollar Trend Update - Rupeedesk Reports - 10.10.2022

Coal inventories accumulate at ports as buyers back out - Rupeedesk Reports - 10.10.2022

Coal inventories accumulate at ports as buyers back out - Rupeedesk Reports - 10.10.2022

Coal inventories accumulate at ports as buyers back out - Rupeedesk Reports - 10.10.2022

Government may change duty on steel exports in next year’s budget - Rupeedesk Reports - 10.10.2022

Government may change duty on steel exports in next year’s budget - Rupeedesk Reports - 10.10.2022

Government may change duty on steel exports in next year’s budget - Rupeedesk Reports - 10.10.2022

VINDHYATEL Stock Analysis - Rupeedesk Reports - 10.10.2022

VINDHYATEL Stock Analysis - Rupeedesk Reports - 10.10.2022

5G push likely to raise digital and telecom’s share in capex in the next five years - Rupeedesk Reports - 10.10.2022

5G push likely to raise digital and telecom’s share in capex in the next five years - Rupeedesk Reports - 10.10.2022

5G push likely to raise digital and telecom’s share in capex in the next five years - Rupeedesk Reports - 10.10.2022

Regulatory action forces return worth Rs 510 crore in profiteering by domestic firms - Rupeedesk Reports - 10.10.2022

Regulatory action forces return worth Rs 510 crore in profiteering by domestic firms - Rupeedesk Reports - 10.10.2022

Regulatory action forces return worth Rs 510 crore in profiteering by domestic firms - Rupeedesk Reports - 10.10.2022

Rakesh Jhunjhunwala group approaches Barclays to prepay loans worth Rs 500 crore - Rupeedesk Reports - 10.10.2022

Rakesh Jhunjhunwala group approaches Barclays to prepay loans worth Rs 500 crore - Rupeedesk Reports - 10.10.2022

Rakesh Jhunjhunwala group approaches Barclays to prepay loans worth Rs 500 crore - Rupeedesk Reports - 10.10.2022

Corporate earnings may shrink in fiscal second quarter on slower sales growth - Rupeedesk Reports - 10.10.2022

Corporate earnings may shrink in fiscal second quarter on slower sales growth - Rupeedesk Reports - 10.10.2022

Corporate earnings may shrink in fiscal second quarter on slower sales growth - Rupeedesk Reports - 10.10.2022

Adani group looking to raise $10 billion from global investors - Rupeedesk Reports - 10.10.2022

Adani group looking to raise $10 billion from global investors - Rupeedesk Reports - 10.10.2022

Adani group looking to raise $10 billion from global investors - Rupeedesk Reports - 10.10.2022

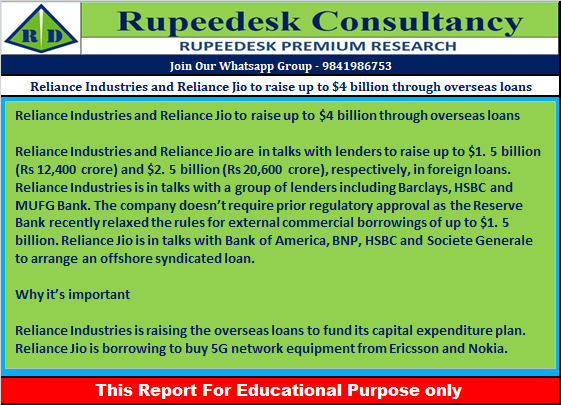

Reliance Industries and Reliance Jio to raise up to $4 billion through overseas loans - Rupeedesk Reports - 10.10.2022

Reliance Industries and Reliance Jio to raise up to $4 billion through overseas loans - Rupeedesk Reports - 10.10.2022

Reliance Industries and Reliance Jio to raise up to $4 billion through overseas loans - Rupeedesk Reports - 10.10.2022

Government to look to slashing non-priority expenditure in next year’s budget - Rupeedesk Reports - 10.10.2022

Government to look to slashing non-priority expenditure in next year’s budget - Rupeedesk Reports - 10.10.2022

Government to look to slashing non-priority expenditure in next year’s budget - Rupeedesk Reports - 10.10.2022