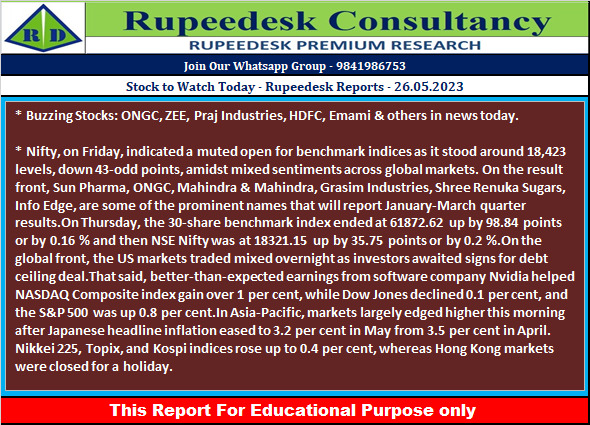

Stock to Watch Today - Rupeedesk Reports - 26.05.2023

Buzzing Stocks: ONGC, ZEE, Praj Industries, HDFC, Emami & others in news today.

Results on May 26: Oil and Natural Gas Corporation, Mahindra & Mahindra, Sun Pharmaceutical Industries, Grasim Industries, Engineers India, Astra Microwave Products, Avalon Technologies, BEML, BHEL, BL Kashyap and Sons, Chambal Fertilisers & Chemicals, City Union Bank, Easy Trip Planners, Edelweiss Financial Services, Finolex Cables, HUDCO, Indigo Paints, Inox Wind, Karnataka Bank, MOIL, Samvardhana Motherson International, Info Edge (India), NCC, PNC Infratech, Shree Renuka Sugars, Sunteck Realty, and Wockhardt will be in focus ahead of quarterly earnings on May 26.

Results on May 27: Aurobindo Pharma, Power Finance Corporation, Ahluwalia Contracts, Balkrishna Industries, Barbeque-Nation Hospitality, GMR Airports Infrastructure, Godfrey Phillips India, Greenlam Industries, IFB Industries, JK Cement, Jaiprakash Associates, Krsnaa Diagnostics, PTC India, Reliance Communications, Reliance Home Finance, Sadbhav Engineering, and Shalimar Paints will be in focus ahead of quarterly earnings on May 27.

Zee Entertainment Enterprises: The media & entertainment company has posted consolidated loss of Rs 196 crore for quarter ended March FY23, against profit of Rs 181.9 crore in corresponding period last fiscal. The weak operating numbers, lower topline & other income, and exceptional loss impacted profitability. Revenue fell by 9% to Rs 2,112.1 crore compared to year-ago period, with domestic advertising revenues falling 10.2% YoY due to FTA withdrawal (Zee Anmol) and slowdown in advertising spending, and subscription revenue declining 1%.

Reliance Industries: Reliance Consumer Products, the FMCG arm and a wholly-owned subsidiary of Reliance Retail Ventures (a subsidiary of Reliance Industries) has completed the acquisition of 51% controlling stake in LOTUS for Rs 74 crore, and subscribed to non-cumulative redeemable preference shares of LOTUS for Rs 25 crore. Reliance Consumer Products has also completed the acquisition of equity shares pursuant to the open offer, and has taken sole control of LOTUS with effect from May 24

Housing Development Finance Corporation: The Corporation has further sold 1.86 crore shares or 2.14% stake in Siti Networks. In May, the Corporation had sold 1.87 crore shares or 2.15% stake in Siti Networks.

Emami: The FMCG company has registered a 56.4% year-on-year growth in consolidated profit at Rs 144.43 crore for March FY23 quarter despite healthy operating numbers, as the base in Q4FY22 was higher due to tax write-back. Revenue from operations for the quarter at Rs 836 crore increased by 8.8% over a year-ago period, with domestic sales growing 5% and international business rising 19%.

Page Industries: The exclusive licensee of JOCKEY International Inc (USA) has appointed Deepanjan Bandyopadhyay as Chief Financial Officer (CFO) with effect from June 1, 2023, after current CFO Chandrasekar K retiring due to his superannuation with effect from May 31. The company has also reappointed Shamir Genomal as Deputy Managing Director for another 5 years with effect from September 1, 2023. The company has reported a 59% year-on-year growth in profit at Rs 78.4 crore for quarter ended March FY23, impacted by weak operating as well as topline numbers. Revenue fell 12.8% to Rs 969.1 crore for the quarter YoY.

Max India: The stock will be in focus as the board has given approval for infusion of Rs 294 crore in its wholly owned subsidiary companies, i.e. Rs 177 crore for Antara Senior Living, and Rs 117 crore for Antara Assisted Care Services, to meet their funding / business expansion requirements. The company posted consolidated loss of Rs 4.18 crore for March FY23 quarter, widening from Rs 1.08 crore in same period last year. Revenue from operations for the quarter grew by 12.6% year-on-year to Rs 56.35 crore.

Religare Enterprises: Subsidiary Religare Finvest has received the no-dues certificates (NDC) from all 16 secured OTS (one-time settlement) lenders against their total outstanding dues including dues toward their unsecured exposure. In March, Religare Finvest completed the entire OTS payment of Rs 2,178 crore to all 16 secured OTS lenders. Accordingly, the OTS stands completed.

eClerx Services: The business process management, automation and analytics services provider has clocked a 11.6% year-on-year growth in consolidated profit at Rs 132.5 crore for quarter ended March FY23, driven by healthy revenue and operating numbers. Revenue from operations at Rs 693.1 crore for the quarter increased by 17.1% over a year-ago period.

Vodafone Idea: The telecom operator has narrowed its consolidated loss to Rs 6,418.9 crore for quarter ended March FY23, from Rs 7,990 crore in previous quarter, with improvement in operating performance. Revenue from operations fell by 0.8% sequentially to Rs 10,531.9 crore in Q4FY23, with ARPU coming in flat at Rs 135 compared to previous quarter.

Voltas: The cooling products maker has laid the groundwork at Thiruvallur district in Tamil Nadu, for its new air conditioner factory. The construction of the new manufacturing facility is spread over 150 acres. The company has planned to invest over Rs 500 crore in this factory, for RAC (room air conditioners) manufacturing, over the next couple of years. This facility will initially manufacture room air conditioners and is an extension to the existing RAC facility in Pantnagar.

Aster DM Healthcare: The healthcare service provider has registered a 24% year-on-year decline in profit at Rs 171 crore for quarter ended March FY23, impacted by weak operating margin performance. However, revenue from operations grew by 20% to Rs 3,262 crore compared to year-ago period.

Shilpa Medicare: The pharma company has posted loss of Rs 8.04 crore for March FY23 quarter, against profit of Rs 29.5 crore in same period last year, impacted by dismal topline and operating numbers. Revenue for the quarter at Rs 263.6 crore dropped by 22.6% compared to year-ago period.

Prince Pipes & Fittings: The piping solutions & multi polymer manufacturer has recorded profit at Rs 94 crore for the quarter ended March FY23, growing 7% over a year-ago period despite lower topline numbers, supported by strong operating margin. Revenue fell by 15% year-on-year to Rs 764 crore for March FY23 quarter.

GMM Pfaudler: The glass-lined equipment company has reported a massive 140% year-on-year growth in consolidated profit at Rs 38.5 crore for March FY23 quarter, driven by topline and operating numbers. Revenue for the quarter grew by 23.8% on-year to Rs 866 crore.

General Insurance Corporation of India: The company has recorded consolidated profit at Rs 2,729.2 crore for quarter ended March FY23, growing 41% over a year-ago period. Total income for the quarter at Rs 9,322 crore fell by 14.7% compared to same period last fiscal. The board has recommended dividend at Rs 7.20 per share for FY23.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc