Buzzing Stocks | Bharti Airtel, Reliance Industries, Hindalco others in news today

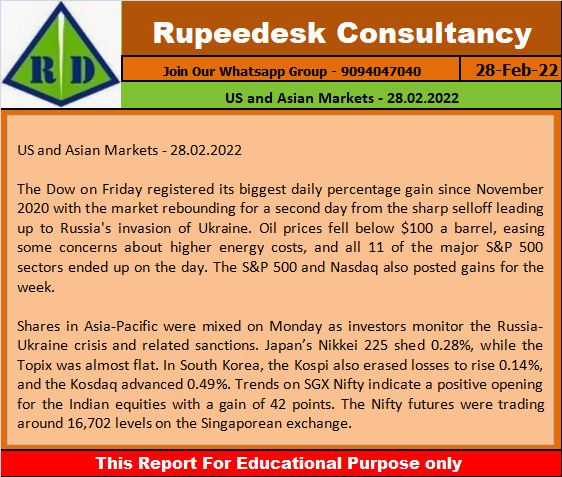

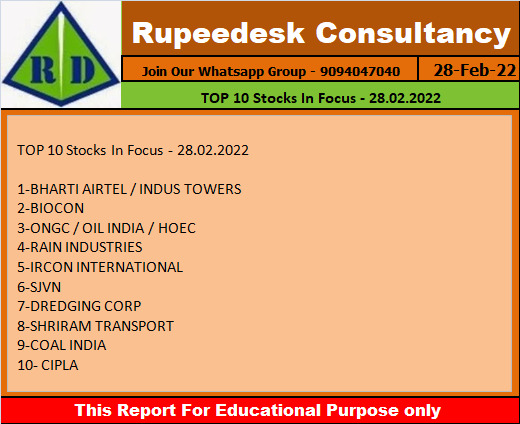

Bharti Airtel: Bharti Airtel agrees to buy stake in Indus Tower. The company will buy a 4.7 percent stake in Indus Towers from Vodafone. It has entered into an agreement with Euro Pacific Securities Ltd, an affiliate of Vodafone Group Plc, for the acquisition of a stake in the tower infrastructure company.

Reliance Industries: The company has effectively taken over the operations of Future Retail stores and has offered jobs to its employees. Reliance Retail has started to take possession of the premises in which Future Retail is operating its stores such as Big Bazaar and replaced them with its brand stores, said sources close to the development. Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Hindalco Industries: Hindalco in pact with Brazilian firm. The aluminium major has entered into a share-purchase agreement with Brazilian firm Terrabel Empreedimentos Ltda to divest its entire equity shareholding in Hindalco Do Brazil Industria Comercia de Alumina LTDA (HDB), the wholly-owned step down subsidiary.

Patel Engineering: Patel Engineering arm sells Nepal arm. Patel Energy Resources, the wholly owned subsidiary of the company, has divested its entire stake in Naulo Nepal Hydroelectric based in Nepal. With this, Naulo Nepal Hydroelectric ceased to be a subsidiary of the company.

Fortis Healthcare: Crisil upgrades Fortis Healthcare rating. Rating agency CRISIL has upgraded the long-term rating to 'AA- from 'A+' for the private hospital chain and placed the rating on watch with developing implications. Further, the short-term rating has been upgraded to A1+ from 'A1' and placed rating on watch with developing implications.

Rain Industries: Rain Industries reports consolidated loss in December quarter. The company posted a consolidated net loss of Rs 72.3 crore for the quarter ended December 2021 against a profit of Rs 322 crore in the year-ago period following an abnormal fall in net realisable value of inventories after a change in the macro-economic conditions like the effect of COVID-19 and fall in crude oil prices. However, revenue grew by 52 percent year-on-year to Rs 4,026 crore in Q4CY21.

SJVN: Government nod to Kinnaur Solar plant. The government has granted in-principle approval for the development of a 400MW solar park in Kinnaur by SJVN. The projects will help SJVN achieve its ambitious shared vision of 5,000 MW by 2023, 25,000 MW by 2030 and 50,000 MW by 2040.

Mahindra Lifespace Developers: Mahindra Lifespace Developers sees block deal. Kotak Mahindra Mutual Fund bought additional 2.19 lakh equity shares via open market transactions on February 23. With this, its shareholding in the company stands at 5.13 percent, up from 4.98 percent. The stock gained 3 percent on February 25 to close at Rs 292.

Biocon: The company's arm to acquire Viatris’ biosimilars for $3.3 billion

Motilal Oswal Financial Services: Crisil upgrades credit rating of Motilal Oswal material subsidiaries. Rating agency Crisil has upgraded the credit rating of long-term debt instruments of the company's material subsidiaries. The rating agency has upgraded the credit rating of Motilal Oswal Home Finance and Motilal Oswal Finvest 'AA' from 'AA-' and revised the outlook to stable from positive. The rating takes into account Motilal Oswal Home Finance's healthy capitalisation profile, strong growth in disbursements and the improvement in its profitability, and Motilal Oswal Finvest's ability to scale up the business along with the group's strong market position in the equity broking business.

Shriram Transport Finance Company: Shriram Transport Fin board to consider dividend on March 5. The firm said the board on March 5 will consider the second interim dividend for the financial year 2021-22.

Beardsell: Company sees huge block deal. Promoter Anumolu Bharat sold 1.09 million shares in the company via open market transactions at an average price of Rs 12.56 per share on the NSE. As of December quarter, Bharat had a 5.4 percent stake, of which he has offloaded 4.8 percent in this quarter so far.

Steel Exchange India: Steel Exchange India sees block deal. France-based financial services company Societe Generale acquired 5.3 lakh equity shares, or 0.6 percent stake, in the company via open market transactions at an average price of Rs 214.48 a share.

Metro Brands: Metro Brands board meets on March 7. Rakesh Jhunjhunwala-backed firm said its board will meet on March 7 to consider an interim dividend for the financial year 2021-22. The record date for the payment of the dividend will be March 19.

Nuvoco Vistas Corporation: Nuvoco Vistas Corp sees block deal. An institutional broker BofA Securities Europe SA sold 3.06 million shares, or a 0.85 percent stake, in the company via open market transactions. These shares were sold at an average price of Rs 303 a share. BofA Securities had a 1.52 percent shareholding in the cement company as of December 2021.

Ducon Infratechnologies: Ducon Infratechnologies announces bonus issue. The firm said the board declared the bonus issue of equity shares in the proportion of one equity share for every ten shares each held by shareholders. It has received fine notice of more than Rs 3 lakh from NSE and BSE for violation of regulations.