US and Asian Market - 27.03.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, March 26, 2023

US and Asian Market - 27.03.2023

Motisons Jewellers files DRHP for IPO - 27.03.2023

Motisons Jewellers files DRHP for IPO - 27.03.2023

STT on sale of options to be hiked by 25%, Finance Ministry clarifies - 27.03.2023

STT on sale of options to be hiked by 25%, Finance Ministry clarifies - 27.03.2023

NSE to roll back 6% transaction charges on equity and F&O trading from April 1 - 27.03.2023

NSE to roll back 6% transaction charges on equity and F&O trading from April 1 - 27.03.2023

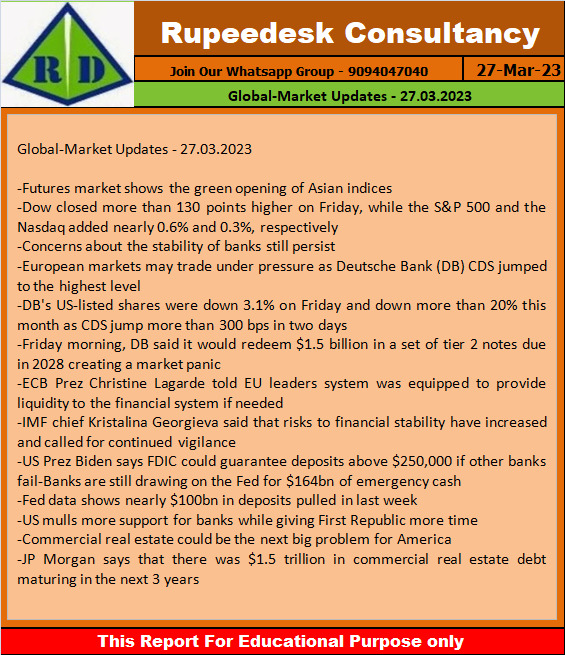

Global-Market Updates - 27.03.2023

Global-Market Updates - 27.03.2023

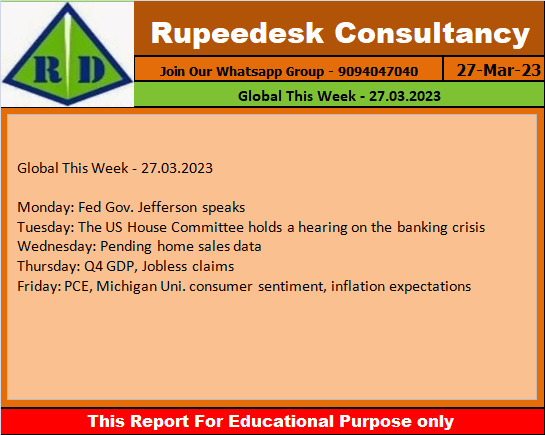

Global This Week - 27.03.2023

Global This Week - 27.03.2023

Stock to Watch Today - Rupeedesk Reports - 27.03.2023

Stock to Watch Today - Rupeedesk Reports - 27.03.2023

Buzzing Stocks: L&T Finance, NBCC, Sun Pharma, BEL and others in news today.

TTK Healthcare: Ace investor Sunil Singhania-owned Abakkus picked 1.74% equity stake or 2.47 lakh shares in TTK Healthcare via open market transactions. Asset management firm Abakkus Asset Manager LLP itself has bought 1.31 lakh equity shares at an average price of Rs 911.08 per share, and its Abakkus Diversified Alpha Fund has purchased 1.15 lakh shares at an average price of Rs 910 per share. However, investor MCap India Fund, managed by Gurgaon-based private equity firm MCap Fund advisors, was the seller in a bulk deal, offloading 2.45 lakh equity shares in TTK at an average price of Rs 910 per share.

Campus Activewear: Foreign investors Fidelity Investments, and Societe Generale have picked 2.98% stake in the footwear manufacturing company via open market transactions, whereas TPG Growth exited Campus. Investment Trust Fidelity Series Emerging Markets Opportunities Fund has bought 33.39 lakh shares, Societe Generale bought 40.56 lakh shares, and Fidelity Investment Trust Fidelity International Discovery Fund acquired 17.1 lakh shares at an average price of Rs 347 per share. However, TPG Growth III SF Pte Limited sold entire 2.32 crore shares in Campus at an average price of Rs 347.24 per share.

Sun Pharmaceutical Industries: The pharma major has entered into an agreement to acquire 60% shareholding in Vivaldis Health and Foods, from its existing shareholders, for Rs 143.3 crore. The remaining 40% shareholding will be acquired in future as per certain terms & conditions. Vivaldis is engaged in the business of manufacturing and marketing of drugs, food supplements and over the counter products in the companion animal segment of animal healthcare industry.

Bharat Electronics: The Ministry of Defence has signed a contract worth Rs 3,000 crore with Bharat Electronics for supply of integrated electronic warfare systems for the Indian Army. Further, BEL has also received several contracts totaling to Rs 1,300 crore during last fortnight from the Indian Navy for supply of indigenously developed fire control, gun fire control, surveillance, tracking, ESM, sonar systems etc.

Alembic Pharmaceuticals: The United States Food and Drug Administration (USFDA) has conducted an inspection at Alembic Pharmaceuticals' injectable and ophthalmic facility (F-3) at Karkhadi during March 16-24. The USFDA has issued a Form 483 with 2 minor procedural observations. None of the observations are related to data integrity and management.

Eris Lifesciences: The pharma company has completed acquisition of 9 dermatology brands from Dr Reddy's Labs for Rs 275 crore. The transaction helps Eris augment and expand the cosmetic dermatology business by way of expansion in the product offerings.

L&T Finance Holdings: The Reserve Bank of India has given its approval for merger of L&T Finance, L&T Infra Credit & L&T Mutual Fund Trustee with L&T Finance Holdings. The board in January 2023 had already approved the amalgamation of subsidiaries L&T Finance, L&T Infra Credit, and L&T Mutual Fund Trustee with L&T Finance Holdings via merger.

IndusInd Bank: The private sector lender has announced appointment of Vikas Muttoo as COO & Head Member Services of its subsidiary Bharat Financial Inclusion. Vikas is a veteran banker with over 27 years of experience across the banking & financial spectrum and earlier he was the MD & CEO of microfinance business at RBL Bank.

Suryoday Small Finance Bank: The small finance bank says its board of directors approved appointment of Yogesh Dixit, as Chief Risk Officer of the bank for three years effective from April 1, 2023.

NBCC India: Subsidiary HSCC (India) has received work order worth Rs 81.19 crore from All India Institute of Medical Sciences (AIIMS), New Delhi. HSCC will construct vertical expansion of service block (1st Floor to 9th Floor), at AIIMS Campus. The project period is 18 months from the date of commencement work.

Khadim India: The retail footwear company has appointed Rittick Roy Burman, Whole-time Director, to manage the regular affairs & overall operations effective from March 24. Rittick is a member of the promoter group and key managerial personnel of the company. The change in leadership is announced after the resignation of former CEO, Namrata Ashok Chotrani.

Adani Total Gas, Adani Transmission: Exchanges on Friday said Adani Total Gas and Adani Transmission will move to the first stage of the long term additional surveillance measure framework from March 27. On March 10, both exchanges had put the two companies under the second stage of the long-term Additional Surveillance Measure (ASM) framework.

Dalmia Bharat: Subsidiary Dalmia Cement (Bharat) (DCBL) has entered into a binding agreement to sell its entire investment of 1.87 crore equity Shares (42.36% stake) of Dalmia Bharat Refractories (DBRL) for Rs 800 crore to Sarvapriya Healthcare Solutions, a promoter group company. The transaction will be consummated within 30 days. This transaction is in line with company's strategy to exit non-core business/investment.

JSW Energy: After the approval by the National Company Law Tribunal (NCLT)filings, the proposed amalgamation of JSW Future Energy with JSW Neo Energy and their respective shareholders has been made effective and JSW Future Energy stands amalgamated with JSW Neo Energy with effect from the appointed date of April 1, 2022.

One 97 Communications: The Reserve Bank of India said that Paytm Payments Services can continue with the online Payment Aggregation business, while it awaits approval from Government of India for past investment from One 97 Communications into Paytm Payments Services as per FDI Guidelines. RBI has provided 15 days’ time to Paytm Payments Services to file application to operate as an online Payment Aggregator after getting government approval.

TCI Finance: The company has defaulted in payment of EMI of the term loan of HDFC for March 25, 2023 for Rs 17.13 lakh.

Zydus Lifesciences: The US Food and Drug Administration (USFDA) conducted an inspection at the manufacturing facility SEZ-1 of Zydus Lifesciences at Pharmez, Ahmedabad during March 20-24. The inspection was a pre-approval inspection (PAI) as well as a GMP Audit and concluded with three observations. There were no data integrity related observations.

Karur Vysya Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 30 lakh on Karur Vysya Bank for non-compliance with certain provisions.

Tata Steel: The company has acquired 4.65 lakh equity shares of subsidiary Tata Steel Utilities and Infrastructure Services (TSUISL) at a price of Rs 215 per share, on Rights basis, for Rs 10 crore. Consequent to the completion of the transaction, TSUISL continues to be a wholly owned subsidiary of the company.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc