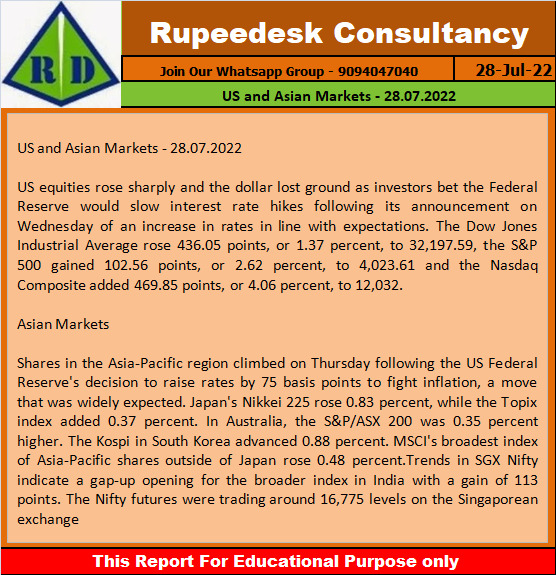

US and Asian Markets - 28.07.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Wednesday, July 27, 2022

US and Asian Markets - 28.07.2022

Earning Results on 28.07.2022

Earning Results on 28.07.2022

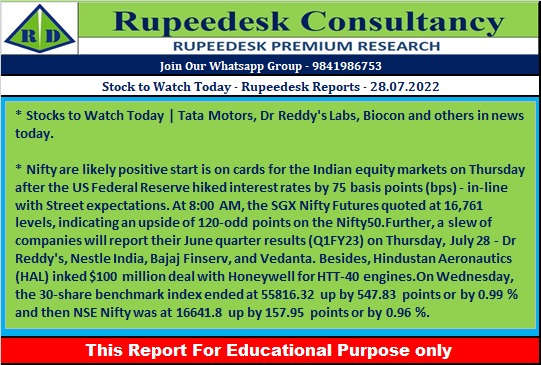

Stock to Watch Today - Rupeedesk Reports - 28.07.2022

Stock to Watch Today - Rupeedesk Reports - 28.07.2022

Stocks to Watch Today | Tata Motors, Dr Reddy's Labs, Biocon and others in news today.

Results on July 28: Dr Reddy's Labs to be in focus ahead of the June quarter earnings on July 28. Besides Dr Reddy's Laboratories, Nestle India, SBI Life Insurance Company, Shree Cement, Jubilant FoodWorks, Vedanta, Bajaj Finserv, Punjab National Bank, Mahindra & Mahindra Financial Services, PNB Housing Finance, SBI Cards and Payment Services, TVS Motor Company, Shriram Transport Finance, Chalet Hotels, Equitas Small Finance Bank, CMS Info Systems, GHCL, AAVAS Financiers, Intellect Design Arena, Dr Lal PathLabs, Motilal Oswal Financial Services, Nippon Life India Asset Management, NIIT, NOCIL, RITES, Sona BLW Precision Forgings, TTK Prestige, and Westlife Development will declare their June quarter earnings today.

Tata Motors: The company posted a consolidated loss of Rs 5,006.6 crore for the quarter ended June 2022, widening from Rs 4,450.92 crore a year back on account of weak JLR performance. Consolidated revenue from operations grew by 8.3 percent YoY to Rs 71,934.66 crore during the same period, driven by domestic business. Jaguar Land Rover revenue declined 7.6 percent QoQ and 11.3 percent YoY to 4.4 billion pound impacted by semiconductor shortages and China lockdowns, but customer order book grew further to 2 lakh vehicles.

Welspun India: The company has reported a 11.6 percent year-on-year decline in consolidated revenue at Rs 1,957.3 crore for the quarter ended June 2022, impacted by home textile business but flooring business fared better. Profit fell sharply by 90.4 percent to Rs 21.36 crore on weak operating performance at home textile business.

Biocon: The pharma company recorded a 54.4 percent YoY growth in consolidated profit at Rs 167.40 crore for the quarter ended June 2022, partly aided by higher revenue & other income and lower tax cost. Revenue grew by 21.5 percent to Rs 2,139.50 crore during the same period.

Exide Industries: Subsidiary Exide Energy Solutions (EESL) has executed the lease cum sale agreement for procuring land parcel admeasuring 80 acres in Bengaluru with Karnataka Industrial Areas Development Board (KIADB). The land will be used to set up state-of-the-art green field multi-gigawatt Li-ion battery cell manufacturing facility for the new-age electric mobility and stationary application businesses in India.

Hindustan Aeronautics: HAL has signed contract worth over $100 million with Honeywell for HTT-40 Engines. The company will supply and manufacture 88 TPE331-12B engines/kits along with maintenance and support services to power the Hindustan Trainer Aircraft (HTT-40).

Poonawalla Fincorp: The company reported a 118.3 percent YoY growth in consolidated profit at Rs 140.92 crore for the quarter ended June 2022 on write-back of impairment on financial instruments at Rs 13.96 crore (against impairment on financial instruments of Rs 49.38 crore in Q1FY22). Total income grew by 18.3 percent to Rs 571.67 crore with assets under management for Q1FY23 rising 22.4 percent YoY to Rs 17,660 crore, while disbursements stood at Rs 3,436 crore, growing by 98.3 percent YoY.

Dhampur Sugar Mills: The company clocked a 26.2 percent year-on-year growth in consolidated profit at Rs 39.30 crore for the quarter ended June 2022, driven by higher topline. Revenue grew by 52.3 percent to Rs 828.86 crore during the same period.

Home First Finance Company: The company recorded a 46 percent year-on-year growth in profit at Rs 51 crore for the quarter ended June 2022. Total income increased by 19.4 percent to Rs 169 crore and pre-provision operating profit grew by 15.2% to Rs 70 crore during the same period, with assets under management rising 35.8 percent YoY to Rs 5,832 crore.

EIH: The company clocked consolidated profit of Rs 65.86 crore for the quarter ended June 2022 on normalisation of business, against loss of Rs 114.25 crore in same period last year. In Q1FY22, numbers were affected by second Covid wave. Revenue grew by 314% YoY to Rs 394.3 crore in Q1FY23.

Schaeffler India: Schaeffler India Q2 profit jumps 76.2 percent YoY to Rs 225.75 crore driven by healthy topline, higher operating income. Revenue grows 42 percent. The company recorded a 76.2 percent year-on-year growth in profit at Rs 225.75 crore in Q2CY22 driven by healthy topline and higher operating income. Gain on sale of chain drive business also supported bottom line. Revenue grew by 41.8 percent YoY to Rs 1,748.83 crore during the June 2022 quarter.

VIP Industries: The company registered a healthy growth in consolidated profit at Rs 69.10 crore in Q1FY23, on a low base in profit at Rs 2.53 crore in Q1FY22 that affected by second Covid wave. Revenue grew by 186.4 percent YoY to Rs 590.61 crore during the same period.

Filatex India: The company clocked a 16.8 percent year-on-year decline in profit at Rs 43.39 crore for the quarter ended June 2022, impacted by higher input cost and weak operating performance. Revenue surged 46.4 percent YoY to Rs 1,023.3 crore during the same period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 27.07.2022

Mcx Commodity Intraday Trend Rupeedesk Reports - 27.07.2022

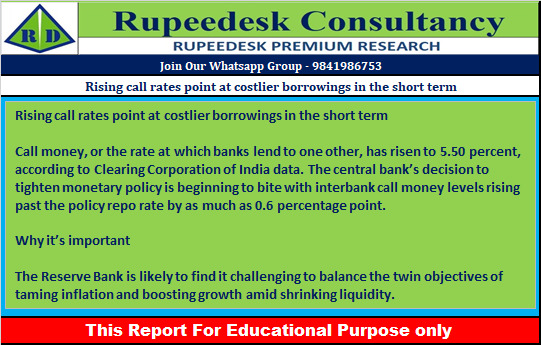

Rising call rates point at costlier borrowings in the short term - Rupeedesk Reports - 27.07.2022

Rising call rates point at costlier borrowings in the short term - Rupeedesk Reports - 27.07.2022

L&T beats estimates as profit soars 45 percent in fiscal first quarter - Rupeedesk Reports - 27.07.2022

L&T beats estimates as profit soars 45 percent in fiscal first quarter - Rupeedesk Reports - 27.07.2022

Mergers and acquisitions rise as startups diversify into new areas - Rupeedesk Reports - 27.07.2022

Mergers and acquisitions rise as startups diversify into new areas - Rupeedesk Reports - 27.07.2022

Market Highlights - 27.07.2022

Market Highlights - 27.07.2022

Bharti’s OneWeb and Eutelsat to merge to rival Elon Musk’s SpaceX - Rupeedesk Reports - 27.07.2022

Bharti’s OneWeb and Eutelsat to merge to rival Elon Musk’s SpaceX - Rupeedesk Reports - 27.07.2022

US Dollar Trend Update - Rupeedesk Reports - 27.07.2022

US Dollar Trend Update - Rupeedesk Reports - 27.07.2022

Adani to invest $70 billion in energy transition and infrastructure projects - Rupeedesk Reports - 27.07.2022

Adani to invest $70 billion in energy transition and infrastructure projects - Rupeedesk Reports - 27.07.2022

LT Stock Analysis - Rupeedesk Reports - 27.07.2022

LT Stock Analysis - Rupeedesk Reports - 27.07.2022

Metropolis Healthcare looking to raise $500 million to fund acquisitions - Rupeedesk Reports - 27.07.2022

Metropolis Healthcare looking to raise $500 million to fund acquisitions - Rupeedesk Reports - 27.07.2022

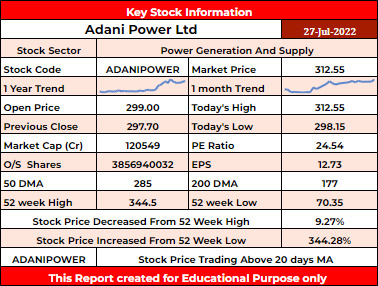

ADANIPOWER Stock Analysis - Rupeedesk Reports - 27.07.2022

ADANIPOWER Stock Analysis - Rupeedesk Reports - 27.07.2022

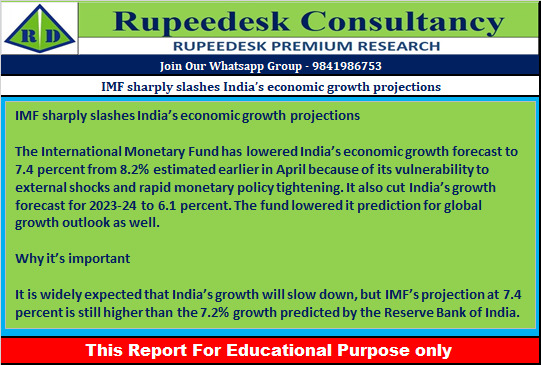

IMF sharply slashes India’s economic growth projections - Rupeedesk Reports - 27.07.2022

IMF sharply slashes India’s economic growth projections - Rupeedesk Reports - 27.07.2022

India becomes largest importer of seaborne Russian crude oil - Rupeedesk Reports - 27.07.2022

India becomes largest importer of seaborne Russian crude oil - Rupeedesk Reports - 27.07.2022

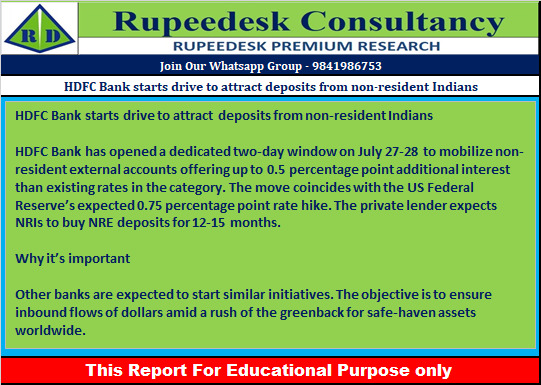

HDFC Bank starts drive to attract deposits from non-resident Indians - Rupeedesk Reports - 27.07.2022

HDFC Bank starts drive to attract deposits from non-resident Indians - Rupeedesk Reports - 27.07.2022

Telcos put in bids worth Rs 1.45 lakh crore on first day of 5G auction - Rupeedesk Reports - 27.07.2022

Telcos put in bids worth Rs 1.45 lakh crore on first day of 5G auction - Rupeedesk Reports - 27.07.2022

52 Week High In Large Cap - 27.07.2022

52 Week High In Large Cap - 27.07.2022

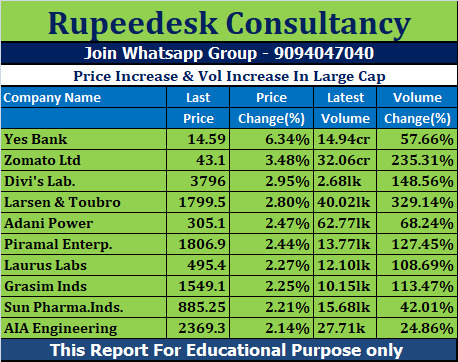

Price Increase & Vol Increase In Large Cap - 27.07.2022

Price Increase & Vol Increase In Large Cap - 27.07.2022