Global Market Updates - 06.03.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, March 5, 2023

Global Market Updates - 06.03.2023

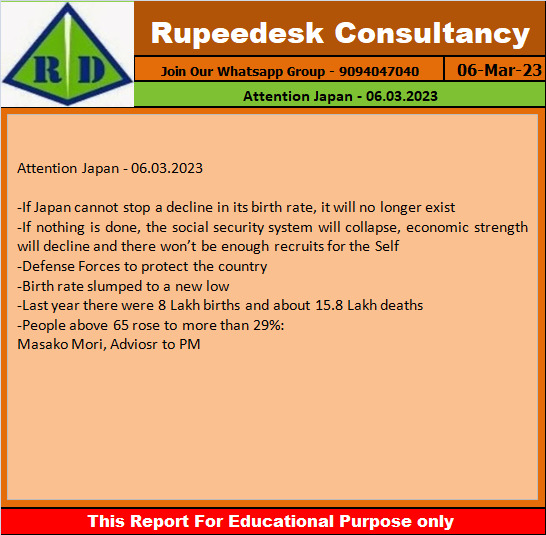

Attention Japan - 06.03.2023

Attention Japan - 06.03.2023

Centre slashes windfall tax on diesel, removes it on ATF - 06.03.2023

Centre slashes windfall tax on diesel, removes it on ATF - 06.03.2023

US and Asian Market - 06.03.2023

US and Asian Market - 06.03.2023

Stock to Watch Today - Rupeedesk Reports - 06.03.2023

Stock to Watch Today - Rupeedesk Reports - 06.03.2023

Buzzing Stocks: HDFC, Hindustan Aeronautics, Power Grid, others in news today.

Housing Development Finance Corporation: The National Company Law Tribunal (NCLT) has given approval for the amalgamation of HDFC Property Ventures and HDFC Venture Capital with HDFC Capital Advisors, a subsidiary of HDFC.

Hindustan Aeronautics: The state-owned aerospace company has received Income Tax refund order from Office of Joint Commissioner of IT for Assessment Year 2012-13, pursuant to the direction of ITAT, Bangalore. ITAT allows R&D expenditure of Rs 725.98 crore as capital expenditure, resulting in refund of Rs 570.05 crore. This refund includes interest of Rs 163.68 crore.

Kansai Nerolac Paints: The paint company has acquired 40% stake in Nerofix from Polygel, for Rs 37 crore. Now Nerofix will become a wholly owned subsidiary of Kansai. The acquisition is expected to be completed by March 31, 2023. Nerofix was a joint venture between Polygel Industries and Kansai Nerolac Paints. Kansai Nerolac acquired 60% stake of Nerofix in January 2020.

Power Grid Corporation of India: The state-owned power transmission utility is declared as successful bidder to establish inter-state transmission system for two projects on build, own operate and transfer (BOOT) basis, in Chhattisgarh. The company has received letters of intent for two projects on March 2.

Satin Creditcare Network: The microfinance company has announced the merger of its wholly owned subsidiaries, Taraashna Financial Services (TFSL, a business correspondent subsidiary), with Satin Finserv (SFL, a MSME arm). The decision to merge the two businesses was made to capitalize on underlying synergies and to develop capabilities that would make the combined entity stronger.

Mahanagar Gas: The company is going to acquire a 100% stake in Unison Enviro, a city gas distribution company and a subsidiary of Ashoka Buildcon, for Rs 531 crore. The acquisition of shareholding in Unison is subject to PNGRB approval. Unison is authorised by PNGRB to implement the city gas distribution network in the geographical areas of Ratnagiri, Latur & Osmanabad in Maharashtra and Chitradurga & Devengere in Karnataka.

Force Motors: The company has announced the production of 2,259 vehicles for February 2023, down 6.4% compared to 2,413 vehicles in previous month. Domestic sales grew by 9% MoM to 2,236 vehicles, but exports fell 45% to 221 vehicles in the same period. Company manufactures commercial vehicles, utility vehicles and tractors.

Texmaco Infrastructure & Holdings: Raniya Flariharan has resigned as independent director of company due to her professional commitments. Company confirmed that there is no other material reason for resignation of Hariharan.

Info Edge India: Redstart Labs (India), a wholly-owned subsidiary of the company, has agreed to invest about Rs 5.2 crore in Sploot, a community and content-led platform for pet parenting. Redstart will acquire 1,822-compulsorily convertible preference shares as primary acquisition of shares. The aggregate shareholding of the company through Redstart, post this investment, in Sploot would be 24.13% on fully converted & diluted basis.

Cressanda Solutions: The company is interested in acquiring 20.1% stake in Cadcon Education, and its subsidiaries free from all encumbrances. This investment is in line with company's strategy to build a global business with software and technology services at its core.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc