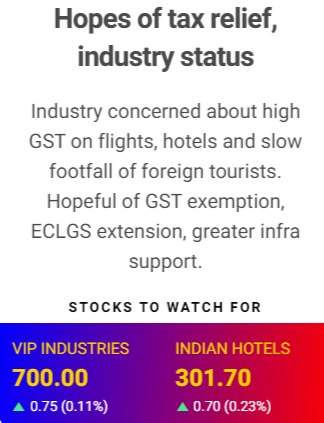

Hopes of tax rellief industry status - 01.02.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Tuesday, January 31, 2023

Hopes of tax rellief industry status - 01.02.2023

Extension of PLI schemes - 01.02.2023

Extension of PLI schemes - 01.02.2023

Relief for home buyers - 01.02.2023

Relief for home buyers - 01.02.2023

Stock to Watch Today - Rupeedesk Reports - 01.02.2023

Stock to Watch Today - Rupeedesk Reports - 01.02.2023

Buzzing Stocks: Britannia, Coal India, GE Shipping, others in news on Budget day.

Results on February 1: Britannia Industries to be in focus ahead of quarterly earnings on February 1. Among others, Ashok Leyland, Ajanta Pharma, Alembic Pharmaceuticals, Gillette India, IDFC, Jubilant FoodWorks, Kaya, Mahindra Logistics, Ramco Systems, Raymond, Redington, RPG Life Sciences, Sundram Fasteners, Tata Chemicals, Timken India, UTI Asset Management Company, Whirlpool of India, and Zuari Agro Chemicals will declare their quarterly earnings on Wednesday.

Auto stocks to be in focus: Auto stocks to be in focus ahead of monthly sales volume numbers. Auto companies, including Tata Motors, Ashok Leyland, Bajaj Auto, Hero MotoCorp, Maruti Suzuki India, TVS Motor Company, Escorts, and Eicher Motors, will drive attention before declaring their monthly sales volume for January 2023.

Britannia Industries: The FMCG major’s consolidated net profit is expected to grow 32 percent year-on-year on the back of an 18 percent rise in revenue. According to an average of estimates by five brokerages polled by Moneycontrol, the Good Day biscuit maker’s revenue is pegged at Rs 4,220 crore and net profit at Rs 492 crore for Q3 FY23.

Coal India: The country's largest coal mining company recorded profit at Rs 7,719 crore for the quarter ended in December FY23, rising 69% YoY on the back of higher add-on over the notified price in e-auction sale of 14.65 million tonnes (MTs) coal during the quarter. Consolidated revenue grew by 24% YoY to Rs 35,169 crore for the quarter with strong realisation. The realisation per tonne of coal of was Rs 5,046 under auction segment, in Q3FY23 against Rs 1,947 per tonne for comparable quarter in FY22. The jump was Rs 3,099 per tonne or 159%.

KPIT Technologies: The IT services company has registered a 20.4% sequential growth in profit at Rs 100.5 crore with revenue rising.

Great Eastern Shipping: The company reported a 205% on-year growth in consolidated profit at Rs 627.2 crore for quarter ended December FY23 led by healthy topline and operating performance. Revenue from operations at Rs 1,421 crore increased by 51.4% compared to year-ago period.

Procter & Gamble Hygiene & Health Care: The FMCG company recorded a 2.2% year-on-year decline in profit at Rs 207.5 crore for quarter ended December FY23 hit by weak operating margin and muted topline growth. Revenue grew by 4% to Rs 1,137.4 crore compared to year-ago period. At the operating level, EBITDA declined 2% YoY to Rs 290.5 crore and margin dropped 158 bps YoY to 25.54% for the quarter. Company declared an interim dividend of Rs 80 per share.

Lemon Tree Hotels: The hotel chain operator has signed a license agreement for a 75 rooms property in Jabalpur, Madhya Pradesh. The hotel is expected to be operational by June, 2024. Carnation Hotels, a wholly owned subsidiary and the hotel management arm of the company will be operating this hotel.

RailTel Corporation of India: The company recorded a 52% year-on-year decline in consolidated profit at Rs 31.95 crore for quarter ended December FY23 on high base. The year-ago period included higher other income, which fell from Rs 56.46 crore in Q3FY22 to Rs 7.85 crore in Q3FY23. Revenue from operations grew by 9% YoY to Rs 454.32 crore for the quarter.

Cholamandalam Investment and Finance Company: The company recorded 31% year-on-year growth in profit at Rs 684 crore for December FY23 quarter. Net income jumped 22% YoY to Rs 1,832 crore, disbursements rising 68% to Rs 17,559 crore for the quarter. Total AUM crossed the milestone of Rs 1 lakh crore at Rs 1.03 lakh crore, up 31% YoY. Despite high inflation and high interest rates, strong festive season sales and workforce returning to metro cities has helped drive growth.

Sterlite Technologies: The company has signed an agreement to sell its telecom product software business via business transfer agreement by way of slump sale as a going concern to Skyvera through its Indian subsidiary. The company will receive $15 million from the sale of telecom product software business. Skyvera LLC is an affiliate of TelcoDR, which is a US headquartered global acquirer of telecommunication software businesses.

Ind-Swift Laboratories: The company has completed a sale of its subsidiary in Dubai - Ind-Swift Middle East FZ-LLC. The full sale proceeds has been received by the company.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Nifty Outlook - Rupeedesk Shares - 31.01.2023

Nifty Outlook - Rupeedesk Shares - K Karthik Raja - 31.01.2023

Indian Crudeoil outlook - 31.01.2023

Indian Crudeoil outlook - 31.01.2023

Gold Outlook - 31.01.2023

Gold Outlook - 31.01.2023

EURINR OUTLOOK - 31.01.2023

EURINR OUTLOOK - 31.01.2023

USDINR OUTLOOK - 31.01.2023

USDINR OUTLOOK - 31.01.2023

Defence sector in focus - 31.01.2023

Defence sector in focus - 31.01.2023

SENSEX OUTLOOK - 31.01.2023

SENSEX OUTLOOK - 31.01.2023

Dowjones Outlook - 31.01.2023

Dowjones Outlook - 31.01.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.01.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 31.01.2023

Top Weightage Stocks Trend Rupeedesk Reports - 31.01.2023

Top Weightage Stocks Trend Rupeedesk Reports - 31.01.2023

Currency Market Intraday Trend Rupeedesk Reports - 31.01.2023

Currency Market Intraday Trend Rupeedesk Reports - 31.01.2023

Top corporate executives go gaga over AI after success of ChatGPT - Rupeedesk Reports - 31.01.2023

Top corporate executives go gaga over AI after success of ChatGPT - Rupeedesk Reports - 31.01.2023

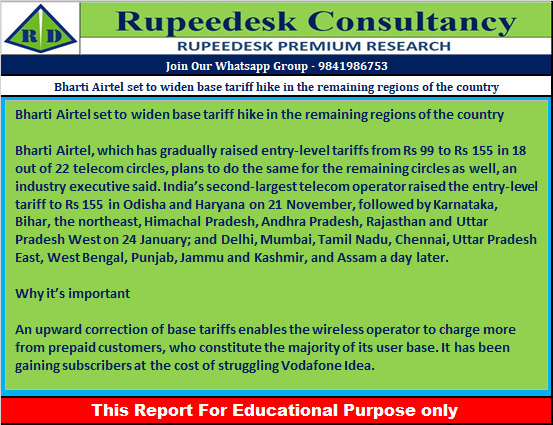

Bharti Airtel set to widen base tariff hike in the remaining regions of the country - Rupeedesk Reports - 31.01.2023

Bharti Airtel set to widen base tariff hike in the remaining regions of the country - Rupeedesk Reports - 31.01.2023

Fifth-gen Ananya and Aryaman inducted as directors on Aditya Birla Fashion’s board - Rupeedesk Reports - 31.01.2023

Fifth-gen Ananya and Aryaman inducted as directors on Aditya Birla Fashion’s board - Rupeedesk Reports - 31.01.2023

Government’s market borrowing seen a new high at Rs 15.5 lakh crore in 2023-24 - Rupeedesk Reports - 31.01.2023

Government’s market borrowing seen a new high at Rs 15.5 lakh crore in 2023-24 - Rupeedesk Reports - 31.01.2023

IMF retains India’s GDP growth forecast at 6.1 percent for 2023-24 - Rupeedesk Reports - 31.01.2023

IMF retains India’s GDP growth forecast at 6.1 percent for 2023-24 - Rupeedesk Reports - 31.01.2023