US & Asian Markets - 10.05.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Tuesday, May 9, 2023

US & Asian Markets - 10.05.2023

Crudeoil - Dollar - Gold Updates - 10.05.2023

Crudeoil - Dollar - Gold Updates - 10.05.2023

Global Market Updates - 10.05.2023

Global Market Updates - 10.05.2023

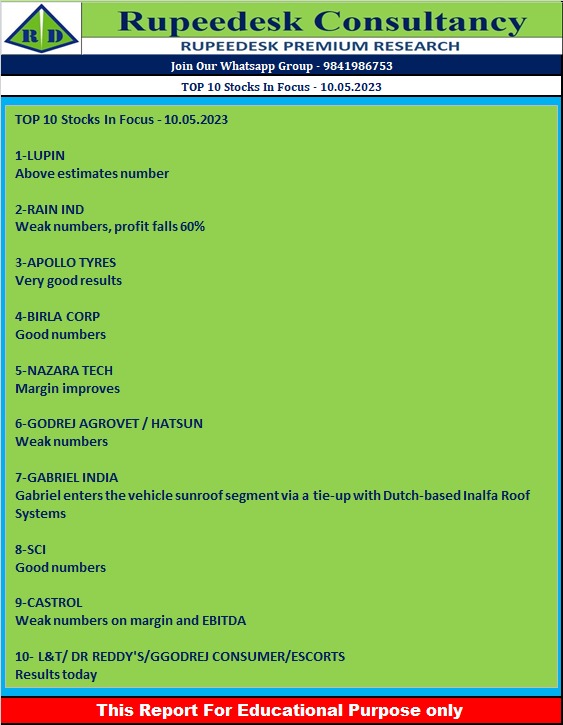

TOP 10 Stocks In Focus - 10.05.2023

TOP 10 Stocks In Focus - 10.05.2023

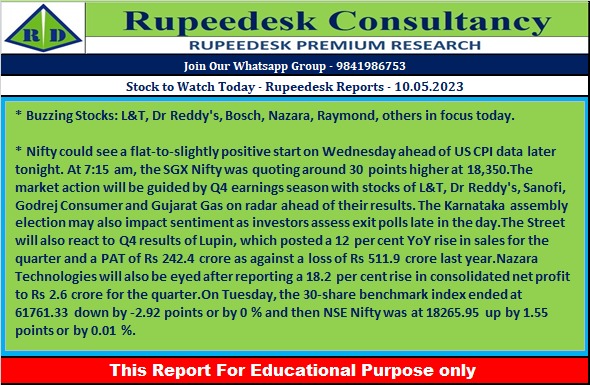

Stock to Watch Today - Rupeedesk Reports - 10.05.2023

Stock to Watch Today - Rupeedesk Reports - 10.05.2023

Buzzing Stocks: L&T, Dr Reddy's, Bosch, Nazara, Raymond, others in focus today.

Results on May 10: Larsen & Toubro, Dr Reddy's Laboratories, Bosch, Escorts Kubota, Godrej Consumer Products, BASF India, Cera Sanitaryware, Chambal Breweries & Distilleries, Gujarat Gas, HG Infra Engineering, JBM Auto, Novartis India, Orchid Pharma, Procter & Gamble Hygiene & Health Care, Pricol, Relaxo Footwears, Sanofi India, and Venky's India will be in focus ahead of declaring their quarterly earnings today.

Dr Reddy's Laboratories: Consolidated net profit for the drugmaker is seen at Rs 1,093.6 crore, a jump of 24 percent from Rs 875 crore in the corresponding quarter last year. The company is also poised to benefit from brand sales of Rs 275 crore, which will incrementally boost its headline numbers for Q4. During the quarter, Dr Reddy's sold nine dermatology brands to Eris Lifesciences.

Nazara Technologies: The diversified gaming and sports media platform has recorded a massive 92% year-on-year growth in consolidated profit at Rs 9.4 crore, driven by healthy topline and operating numbers. Revenue for the quarter grew by 65% to Rs 289.3 crore compared to year-ago period. EBITDA increased by 86% YoY to Rs 27.7 crore in same period.

Apollo Tyres: The tyre manufacturer has registered a 277% year-on-year growth in consolidated profit at Rs 427.4 crore for quarter ended March FY23, supported by strong operating numbers. Revenue from operations at Rs 6,247.33 crore increased by 12% over a corresponding period last fiscal. The company announced a final dividend of Rs 4 per share, and special dividend of Rs 0.50 per share for FY23.

Greaves Cotton: The engineering company has completed first stage acquisition of 60% shareholding in Excel Controlinkage.

Raymond: The company has received board approval for issuance of non-convertible debentures of up to Rs 2,200 crore in two or more tranches on private placement basis to associate Raymond Consumer Care, for repayment of external debt.

SRF: The chemicals company has increased its capex to set up an aluminium foil manufacturing facility to Rs 530 crore from Rs 425 crore earlier. In March, the company incorporated wholly owned subsidiary for setting up the said manufacturing facility. The increase in capex is due to changes being made to the machine configuration to enhance output, product portfolio, and quality along with some increase in civil and preoperative expenses.

KIOCL: The Ministry of Steel has appointed Ganti Venkat Kiran as Director (production & projects) of KIOCL. Ganti Venkat Kiran has assumed the charge of Director on May 9.

Balu Forge Industries: The board has appointed Amit Todkari as Chief Financial Officer of the company with effect from May 10. The company recorded a 43.3% year-on-year increase in consolidated profit at Rs 15.2 crore on healthy topline numbers. Revenue from operations at Rs 123.78 crore in Q4FY23 increased by 50.4% over a year-ago period.

Birla Corporation: The MP Birla Group company has reported a 23.5% year-on-year decline in consolidated profit at Rs 84.95 crore for quarter ended March FY23, impacted by lower operating numbers. Revenue from operations increased 8.8% YoY to Rs 2,462.6 crore in March FY23 quarter.

Castrol India: The automotive and industrial lubricant manufacturing company has registered a 11.3% year-on-year decline in profit at Rs 202.5 crore for quarter ended March FY23, dented by disappointing operating numbers. Revenue from operations at Rs 1,293.9 crore increased by 4.7% compared to corresponding period last fiscal.

Hatsun Agro Product: The dairy product company has recorded a 15.7% year-on-year decline in profit at Rs 24.98 crore in March FY23 quarter, impacted by weak operating margin. Revenue from operations grew by 10% to Rs 1,789.5 crore compared to same period last fiscal.

Rain Industries: The calcined petroleum coke producer has registered a 62% year-on-year decline in consolidated profit at Rs 105.3 crore for quarter ended March FY23, impacted by disappointing operating numbers. Revenue from operations increased 18.4% to Rs 5,253.5 crore compared to same period last year.

KSB: The pumps and industrial valves manufacturer has recorded a 1.2% year-on-year increase in consolidated profit at Rs 40.9 crore in Q1CY23, impacted by fall in operating margin. Revenue from operations for the quarter increased 17.2% to Rs 489.6 crore compared to same period last fiscal.

Latent View Analytics: The digital analytics consulting and solutions firm has reported a 4% year-on-year decline in profit at Rs 34.2 crore in March FY23 quarter, impacted by disappointing operating numbers. Revenue from operations jumped 20% YoY to Rs 141 crore in Q4FY23.

Shipping Corporation Of India: The company has recorded a 156.3% year-on-year growth in consolidated profit at Rs 379.91 crore for March FY23 quarter, backed by robust operating performance. Revenue from operations grew by 8.3% YoY to Rs 1,418.1 crore in quarter ended March FY23.

Eveready Industries India: The battery and lighting products manufacturer has narrowed its loss to Rs 14.4 crore for quarter ended March FY23, from Rs 38.4 crore in same period last year. Revenue from operations for the quarter at Rs 286.2 crore grew by 18.6% over a year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 09.05.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 09.05.2023

Currency Market Intraday Trend Rupeedesk Reports - 09.05.2023

Currency Market Intraday Trend Rupeedesk Reports - 09.05.2023