Nifty index outlook - 28.04.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Thursday, April 27, 2023

Nifty index outlook - 28.04.2023

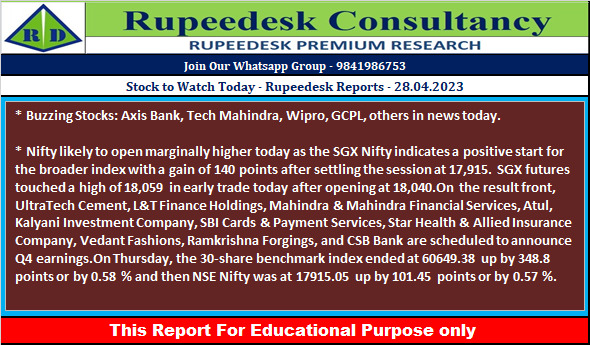

Stock to Watch Today - Rupeedesk Reports - 28.04.2023

Stock to Watch Today - Rupeedesk Reports - 28.04.2023

Buzzing Stocks: Axis Bank, Tech Mahindra, Wipro, GCPL, others in news today

Results on April 28: UltraTech Cement, SBI Cards and Payment Services, CSB Bank, L&T Finance Holdings, Mahindra & Mahindra Financial Services, Vedant Fashions, Atul, CarTrade Tech, eMudhra, Himadri Speciality Chemical, Ramkrishna Forgings, Star Health and Allied Insurance Company, and Tata Metaliks will be in focus ahead of March quarter earnings on April 28.

Results on April 29: Kotak Mahindra Bank, IDBI Bank, RBL Bank, IDFC First Bank, Aarti Drugs, Central Bank of India, GHCL, Meghmani Organics, Parag Milk Foods, Rossari Biotech, and Satin Creditcare Network will be in focus ahead of March quarter earnings on April 29.

Axis Bank: The private sector lender has posted loss of Rs 5,728.4 crore for March FY23 quarter against profit of Rs 4,117.8 crore in same period last year. The loss was due to the buying cost of Citi Bank's India consumer business during the quarter. Profit excluding the impact of exceptional items would have been Rs 6,625.29 crore for the quarter, a 61% growth YoY. Net interest income grew by 33.1% YoY to Rs 11,742.2 crore in Q4FY23.

Tech Mahindra: The IT services provider has reported a 13.8% sequential decline in consolidated profit at Rs 1,117.7 crore on weak operating performance and lower topline growth. Numbers missed analysts' expectations on all fronts. Revenue dropped 0.1% QoQ to Rs 13,718.2 crore during the quarter. The revenue growth in constant currency terms came in at 0.3%, while the deal wins were at $582 million in Q4FY23.

ACC: The cement company has reported a 40.5% year-on-year decline in consolidated profit at Rs 235.7 crore for Q4FY23, impacted partly by weak operating performance and exceptional loss. Revenue grew by 8.2% YoY to Rs 4,790.9 crore for the quarter. On the operating front, EBITDA fell 26.2% YoY to Rs 468.52 crore with margin falling 456 bps YoY to 9.78% during the quarter. The board has recommended dividend of Rs 9.25 per share for FY23.

Wipro: The IT company has recorded a 0.7% sequential growth in consolidated profit at Rs 3,074.5 crore for quarter ended March FY23, while revenue declined 0.2% QoQ to Rs 23,190.3 crore for the quarter. IT services business revenue increased by 0.7% sequentially to $2,823 million, with constant currency revenue growth declining 0.6%. Wipro said the board has approved share buyback worth Rs 12,000 crore at Rs 445 per share.

LTIMindtree: The IT company said its consolidated profit grew by 11.3% QoQ to Rs 1,113.7 crore and revenue increased by 0.8% to Rs 8,691 crore compared to previous quarter. Operating numbers remained strong, boosting bottomline. Revenue in dollar terms increased by 1% QoQ to $1,057.5 million and the same in constant currency grew 0.7%. The board recommended final dividend of Rs 40 per share for FY23.

Godrej Consumer Products: The company has acquired FMCG business of Raymond Consumer Care. The acquisition cost is Rs 2,825 crore and the deal is expected to be completed by May 10.

HDFC Bank: The country's largest private sector lender said the board of directors has approved the appointment of Kaizad Bharucha as Deputy Managing Director, and Bhavesh Zaveri as Executive Director of the bank for three years from April 19, 2023.

IRB Infrastructure Developers: The infrastructure company has emerged as the selected bidder for the project of tolling, operation, maintenance & transfer (TOT) of Nehru Outer Ring Road in Hyderabad, Telangana. The total length of the project road is 158 km. The company has received Letter of Award from Hyderabad Metropolitan Development Authority (HMDA). IRB will pay upfront concession fee of Rs 7,380 crore to HMDA for revenue-linked concession period of 30 years.

HFCL: The company along with its material subsidiary HTL has received the purchase orders of Rs 65.72 crore from Reliance Retail for supply of optical fiber cables to one of the leading private telecom operators of the country.

PI Industries: The company through subsidiaries will acquire 100% stake in Therachem Research Medilab (TRM India) for $42 million, 100% stake in Solis Pharmachem for $3 million, and 100% stake in Archimica S.p.A. for 34.2 million euro, and certain assets of TRM US for $5 million.

Radiant Cash Management Services: BNP Paribas Arbitrage acquired 10.5 lakh shares in the company via open market transactions at an average price of Rs 95.5 per share. However, Dovetail India Fund Class 5 Shares was the seller in the deal.

Esab India: Nippon India Mutual Fund bought 3.26 lakh equity shares in the company via open market transactions at an average price of Rs 3,345.25 per share. However, PGIM India Mutual Fund sold 3.28 lakh shares in the company at an average price of Rs 3,345.25 per share.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc