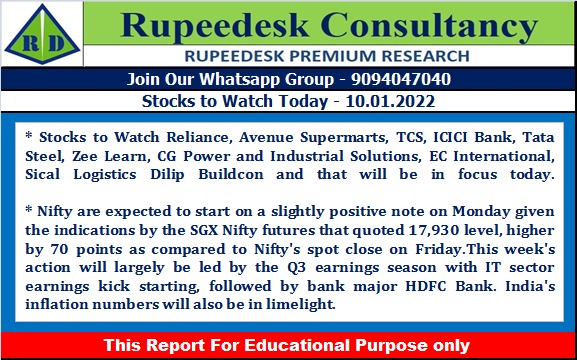

Buzzing Stocks | RIL, Avenue Supermarts, TCS, ICICI Bank and others in news today.

Results today: 5paisa Capital, Ganga Papers India, GI Engineering Solutions, GNA Axles, Thambbi Modern Spinning Mills, and Vikas Lifecare will release their quarterly earnings.

Reliance Industries: Subsidiary Reliance Industrial Investments and Holdings (RIIHL) entered into an agreement to acquire the entire issued share capital of Columbus Centre Corporation (Cayman), a company incorporated in the Cayman Islands and the indirect owner of a 73.37% stake in Mandarin Oriental New York, one of the premium luxury hotels in New York City, for $98.15 million.

Tata Steel: The company increased stake in Medica TS Hospital (MTSHPL), a joint venture company, from 26% to 51%.

ICICI Bank: RBI has approved the re-appointment of Anup Bagchi as an Executive Director of ICICI Bank for a period of three years. The shareholders at the Annual General Meeting held on August 20, 2021 had already approved his re-appointment for a period of five years.

Tata Consultancy Services: The company on January 12 will consider a proposal for buyback of equity shares, along with December 2022 quarter earnings.

Avenue Supermarts: The company reported 24.6% higher standalone profit at Rs 586 crore, and 22 percent higher revenue at Rs 9,065 crore in Q3FY22, YoY.

Zee Learn: Morgan Stanley Asia (Singapore) Pte - ODI sold 19,90,685 equity shares in the company at Rs 19.18 per share, however, Spring Ventures sold 40 lakh shares at Rs 18.59 per share on the NSE, the bulk deals data showed.

CG Power and Industrial Solutions; American Funds Fundamental Investors acquired 1,76,30,108 equity shares in the company at Rs 199 per share, however, Amansa Holding Private Ltd sold 1,76,32,000 equity shares at Rs 199 per share on the NSE, the bulk deals data showed.

KEC International: A global infrastructure EPC major has secured new orders of Rs 1,025 crore across its various businesses including transmission & distribution, railways, and civil.

Sical Logistics: The Resolution Professional has received 4 resolution plans for the company.

Dilip Buildcon: Subsidiary Sannur Bikarnakette Highways Private Limited has received the financial closure letter from the National Highways Authority of India, for four Laning of Sannur to Bikarnakette section of NH-769 under Bharathmala Pariyojana on Hybrid Annuity Mode in Karnataka.

Diamines & Chemicals: The company has received a letter, from the State Level Environment Impact Assessment Authority (SEIAA), for environment clearance for setting up expansion in manufacturing plant of 'synthetic organic chemicals' in Vadodara.

Cyient: Aditya Birla Sun Life AMC sold 21.16 lakh equity shares in the company via open market transactions on January 6, reducing shareholding to 33.93 lakh shares from 56.1 lakh shares earlier.

CSB Bank: C VR Rajendran decided to take early retirement from the post of MD & CEO and to continue leading the bank till March 31, 2022.

Jyoti: The company has done one time settlement with Technology Development Board, New Delhi for Rs 1.35 crore. The reason for settlement is that the company has taken part funding under indigenous technology for wind Turbine project from Technology Development Board which has been shelved long time back.

Wonderla Holidays: Considering the directions given by the Government of Karnataka to contain COVID, the Bangalore park operations are temporarily shut for the two weekends.

Filatex India: Penguin Trading & Agencies bought 25,85,700 equity shares in the company at Rs 117 per share on the NSE, the bulk deals data showed.

Indostar Capital Finance: The company approved appointment of Deep Jaggi as Chief Executive Officer (CEO).

Sobha: The company reported sales volume of 13,22,684 square feet of super built-up area valued at Rs 1,047.5 crore in Q3FY22, up from sales volume of 11,33,574 square feet of super built-up area valued at Rs 887.6 crore in Q3FY21. Sobha share of sale value stood at Rs 908.2 crore during the quarter, up from Rs 677.7 crore in same quarter last year.

SIS: SIS Australia Group Pty Limited, a subsidiary of the company, has completed the acquisition of the remaining 49% shareholding of Platform 4 Group Limited.

Gulshan Polyols: The company has received, signed and executed a Long Term Offtake Agreement, for setting up of upcoming standalone dedicated ethanol plant of 250 KLPD at Industrial Growth Centre, Matia, Goalpara and 500 KLPD (kiloliters per day) at M P A K V N Industrial Area, Borgaon, Madhya Pradesh.

HKG: The company on January 12, will consider the issue of fully paid-up bonus equity shares issue, and the migration from SME Platform of BSE (BSE-SME) to Main Board of BSE.