US and Asian Market - 25.07.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, July 24, 2022

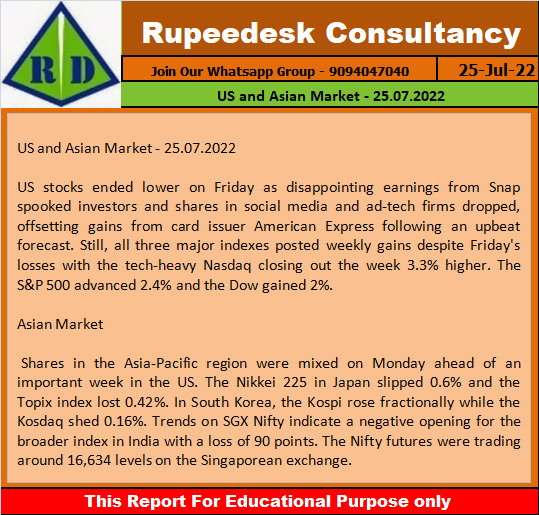

US and Asian Market - 25.07.2022

Earning Results Corner - 25.07.2022

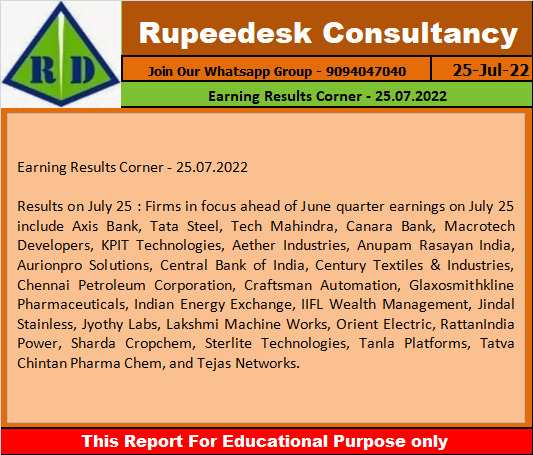

Earning Results Corner - 25.07.2022

Global Market Updates - 25.07.2022

Global Market Updates - 25.07.2022

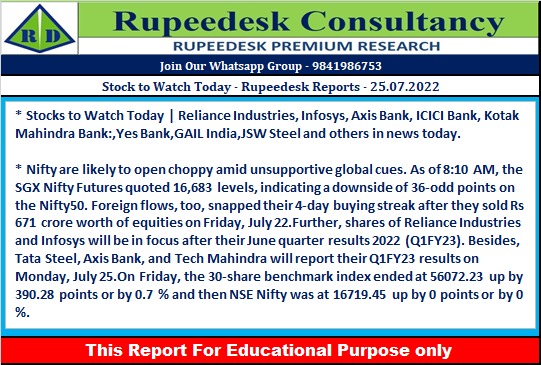

Stock to Watch Today - Rupeedesk Reports - 25.07.2022

Stock to Watch Today - Rupeedesk Reports - 25.07.2022

Stocks to Watch Today | Reliance Industries, Infosys, Axis Bank, and others in news today.

Results on July 25: Axis Bank to be in focus ahead of quarterly earnings on July 25. Others in focus ahead of results on July 25 include Tata Steel, Tech Mahindra, Canara Bank, Macrotech Developers, KPIT Technologies, Aether Industries, Anupam Rasayan India, Aurionpro Solutions, Central Bank of India, Century Textiles & Industries, Chennai Petroleum Corporation, Craftsman Automation, Glaxosmithkline Pharmaceuticals, Indian Energy Exchange, IIFL Wealth Management, Jindal Stainless, Jyothy Labs, Lakshmi Machine Works, Orient Electric, RattanIndia Power, Sharda Cropchem, Sterlite Technologies, Tanla Platforms, Tatva Chintan Pharma Chem, and Tejas Networks.

Reliance Industries: Reliance Industries clocks 41% YoY growth in Q1 profit with best ever quarterly revenue for Reliance Retail, Jio Platforms. The billionaire Mukesh Ambani-owned company reported robust operating and financial performance across all businesses for the quarter ended June 2022, with highest ever quarterly revenue for O2C (oil-to-chemical) business in a volatile environment, and best ever quarterly revenue for Reliance Retail and Jio Platforms. The company clocked 41% year-on-year growth in consolidated profit after tax at Rs 19,443 crore in Q1FY23, and gross revenue grew by 53% to Rs 2,42,982 crore for the quarter YoY, while EBITDA for the quarter at Rs 40,179 crore was higher by 45.8%.

Infosys: Profit rises 3.2% YoY to Rs 5,360 crore; revenue jumps 23.6% to Rs 34,470 crore. India’s second largest IT services provider Infosys on July 24 reported a consolidated net profit of Rs 5,360 crore for the first quarter ended June 2022, up 3.2 percent year-on-year from Rs 5,195 crore recorded in Q1FY22. Sequentially, the profit declined 5.7 percent in the said quarter as against a profit of Rs 5,686 crore in Q4FY22. The profit missed the estimates of a poll conducted by Moneycontrol.com, which had forecast growth of 5.5-9.5 percent in consolidated net profit.

ICICI Bank: ICICI Bank posts 50% growth in profit at Rs 6,905 crore for June quarter, provisions decline sharply. The country's second-largest private sector lender clocked 50 percent year-on-year growth in standalone profit at Rs 6,905 crore for the quarter ended June 2022, as bad loan provisions declined sharply YoY. Net interest income increased by 20.8 percent to Rs 13,210 crore, compared to Rs 10,936 crore reported in corresponding period of previous fiscal, with 21 percent growth in advances and 13 percent increase in deposits YoY. Asset quality showed improvement on a sequential basis.

Kotak Mahindra Bank: Kotak Mahindra Bank reports 26% YoY growth in Q1 profit on lower bad loan provisions; asset quality improves. The bank clocked 26.1% year-on-year increase in standalone profit at Rs 2,071.15 crore for the quarter ended June 2022, aided by lower bad loan provisions, with improving asset quality performance. Net interest income grew by 19.2% YoY to Rs 4,697 crore for the quarter.

Yes Bank: Yes Bank Q1 profit jumps 50% YoY to Rs 310.63 crore, with significant fall in bad loan provisions. The private sector lender has reported 50.17 percent year-on-year growth in profit after tax at Rs 310.63 crore for Q1FY23, with significant fall in bad loan provisions and higher net interest income. Net interest income for the quarter rose 32% YoY to Rs 1,850 crore, with 14 percent YoY credit growth and 18 percent increase in deposits.

GAIL India: GAIL India to consider bonus issue on July 27. The state-owned natural gas company said the board will hold a meeting on July 27 to consider issuance of bonus shares. Hence, the trading window for dealing in securities of GAIL for designated persons and their immediate relatives will remain closed till the approval of financial results for the quarter ended June 2022.

JSW Steel: JSW Steel Q1 profit declines 86% to Rs 839 crore on weak operating performance. The steel company has recorded a 86% year-on-year decline in consolidated profit at Rs 839 crore for the quarter ended June 2022, impacted by weak operating performance. Operating expenses were higher including higher input cost, finance cost, and power & fuel cost. Revenue increased 32% to Rs 38,086 crore during the quarter YoY.

Bharat Electronics: Bharat Electronics signs Rs 250 crore contract with Ministry of Defence. The state-owned defence company has signed a Rs 250 crore contract with the Ministry of Defence. It will supply nine integrated ASW complex (IAC) MOD 'C' systems. IAC MOD 'C' is an integrated anti-submarine warfare system for all surface ships of the Indian Navy.

Granules India: USFDA issues 6 observations to Granules Pharmaceuticals facility. The USFDA has completed an inspection of the facility of Granules Pharmaceuticals Inc, with six observations. Granules Pharmaceuticals Inc is a wholly-owned foreign subsidiary of the company located at Virginia, USA and inspection of the said facility by USFDA completed on July 22.

Dhruv Consultancy Services: Dhruv Consultancy Services receives project management consultancy services contract. The company has received the Letter of Acceptance (LOA) for the project management consultancy services for upgrade of new NH 216E in Andhra Pradesh. The company has bagged this contract in association with KAIUS Consulting. Project management consultancy services fees for the said project will be Rs 5.88 crore and the contract period will be of 96 months.

Finolex Industries: Finolex Industries Q1 profit falls 32% YoY to Rs 99.22 crore impacted by weak operating performance. The company reported a 32% year-on-year fall in consolidated profit at Rs 99.22 crore in the quarter ended June 2022, impacted by weak operating performance. Revenue grew by 23.2 percent to Rs 1,189.8 crore during the same period with PVC pipes & fittings volume growing 29% and PVC resin volume rising 25% YoY. EBITDA at Rs 126 crore fell by 40% and margin halved to 11 percent from 22 percent on year-on-year basis, hit by falling PVC prices. The board has appointed Ajit Venkataraman as Chief Executive Officer (CEO) of Finolex.

Vodafone Idea: Vodafone Idea to raise Rs 436 crore from promoter via issue of warrants. The company said the board has approved issuance of 42.76 crore warrants (each convertible into one equity share) to promoter Euro Pacific Securities at an issue price of Rs 10.20 per warrant. The fundraising through this warrants issuance is Rs 436.21 crore on a preferential basis.

Parag Milk Foods: Blue Daimond Properties offloads 1.39% stake in Parag Milk Foods. Investor Blue Daimond Properties has offloaded 13.25 lakh equity shares or 1.39% stake in the company via open market transactions during July 13-19. With this, its shareholding in the company has reduced to 4.91% from 6.3% earlier.

Mahindra CIE Automotive: Mahindra CIE Automotive Q2 profit jumps 39% YoY to Rs 189 crore backed by revenue, other income. The company clocked nearly 39% year-on-year growth in consolidated profit at Rs 188.85 crore for the quarter ended June 2022, backed by revenue and other income. Revenue grew by 32.5% to Rs 2,707.2 crore for the quarter.

Ugro Capital: Ugro Capital Q1 profit jumps more than 4-fold to Rs 7.34 crore, total income more than doubles to Rs 123.8 crore. The company has recorded a 332% year-on-year growth in profit at Rs 7.34 crore for the quarter ended June 2022, compared to Rs 1.70 crore in same period last year. Total income jumped 141.4% to Rs 123.80 crore during the same period.

Seshasayee Paper & Boards: Seshasayee Paper & Boards Q1 profit trebled to Rs 60.3 crore on strong topline, operating performance. The company has reported consolidated profit at Rs 60.3 crore for the quarter ended June 2022, which trebled compared to Rs 19.86 crore profit in corresponding period last fiscal, on strong topline and operating performance. Revenue nearly doubled to Rs 430.91 crore during the quarter, compared to Rs 218 crore in same period last fiscal.

JTL Infra: JTL Infra clocks 37% YoY growth in Q1 profit at Rs 11 crore aided by topline, lower finance cost. The company reported 36.6% year-on-year growth in consolidated profit at Rs 11 crore for the quarter ended June 2022, aided by topline and lower finance cost. Revenue increased by 43.5% to Rs 256.94 crore during the same period.

SMS Pharmaceuticals: SMS Pharmaceuticals receives CEP approval for Ibuprofen from EDQM. The pharma company has received CEP (Certificate of Suitability) approval for Ibuprofen from the European Directorate for the Quality of Medicines & HealthCare (EDQM). With this, the company can start selling Ibuprofen in European markets.

PVP Ventures: Investment Opportunities V offloads 2.83% stake in PVP Ventures. Investor Investment Opportunities V Pte Ltd sold 69.37 lakh equity shares or 2.83% stake in the company via open market transactions on July 22. With this, its shareholding in the company stands reduced to 7.16% from 9.99% earlier.

HFCL: HFCL Q1 profit falls 42% YoY to Rs 53 crore on spillover of service billing, shortage of semiconductors. The telecom equipment & optical fibre solutions provider has registered 42% year-on-year decline in profit at Rs 53 crore for the quarter ended June 2022 due to spillover of service billing followed by non-availability of required infrastructure from the customer end and continued shortage of semiconductors. Revenue declined 13% to Rs 1,051 crore during the same period, but exports grew by 167% YoY, with strong order book worth more than Rs 5,300 crore as of June 2022.

Supreme Petrochem: Supreme Petrochem Q1 profit rises 29% to Rs 189 crore on healthy topline. The company clocked 29.3% year-on-year growth in profit at Rs 189 crore for the quarter ended June 2022, following healthy topline growth. Revenue grew by 41.7% YoY to Rs 1,485.4 crore during the same period.

Supreme Petrochem: Supreme Petrochem Q1 profit rises 29% to Rs 189 crore on healthy topline. The company clocked 29.3% year-on-year growth in profit at Rs 189 crore for the quarter ended June 2022, following healthy topline growth. Revenue grew by 41.7% YoY to Rs 1,485.4 crore during the same period.

Panache Innovations: Panache Innovations bags order of Rs 5.58 crore from AGS Transact Technologies. The company has received a purchase order of Rs 5.58 crore from AGS Transact Technologies. The company will supply and install security kit for ATM and batteries. The firm will provide 1,000 units over a period of 3 months.

Huhtamaki India: Huhtamaki India reports Q1 profit at Rs 8.15 crore, plans to monetise land assets in Maharashtra. The company plans to monetise its land assets as the board gave its in-principle approval for exploring the possibility of monetising the firm's freehold land and building in Thane, Maharashtra. The company clocked a profit of Rs 8.15 crore for the June quarter, against loss of Rs 3.5 crore in the year-ago period, and revenue grew by nearly 20% to Rs 792.67 crore in Q1FY23 YoY.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc