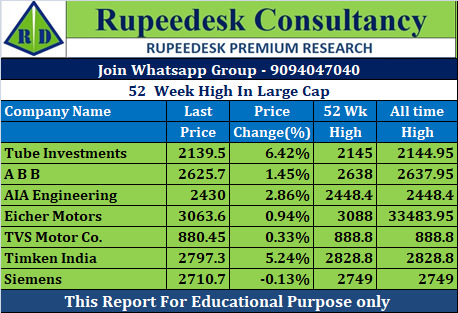

52 Week High In Large Cap - 19.07.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, July 18, 2022

52 Week High In Large Cap - 19.07.2022

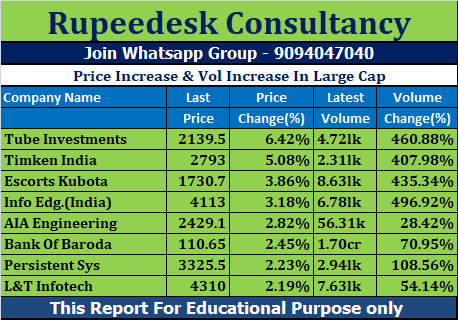

Price Increase & Vol Increase In Large Cap - 19.07.2022

Price Increase & Vol Increase In Large Cap - 19.07.2022

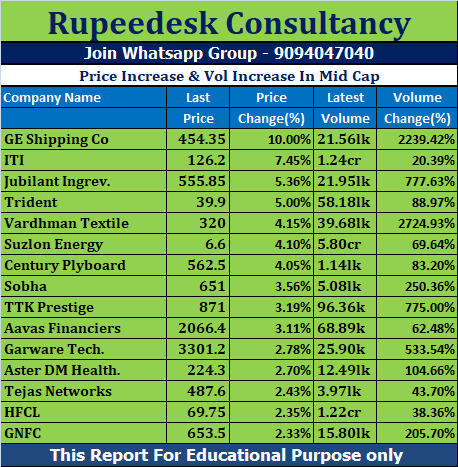

Price Increase & Vol Increase In Mid Cap - 19.07.2022

Price Increase & Vol Increase In Mid Cap - 19.07.2022

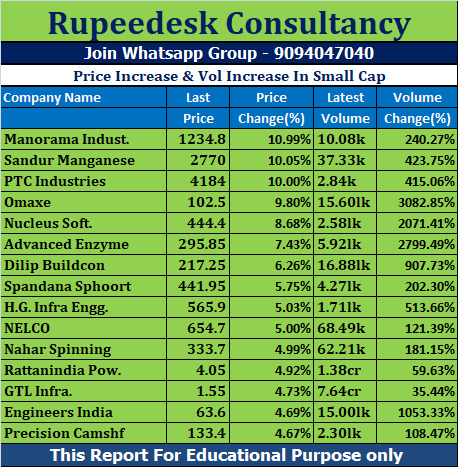

Price Increase & Vol Increase In Small Cap - 19.07.2022

Price Increase & Vol Increase In Small Cap - 19.07.2022

USDINR OUTLOOK - Rupeedesk Reports - 19.07.2022

USDINR OUTLOOK - Rupeedesk Reports - 19.07.2022

Earning Results Corner - 19.07.2022

Earning Results Corner - 19.07.2022

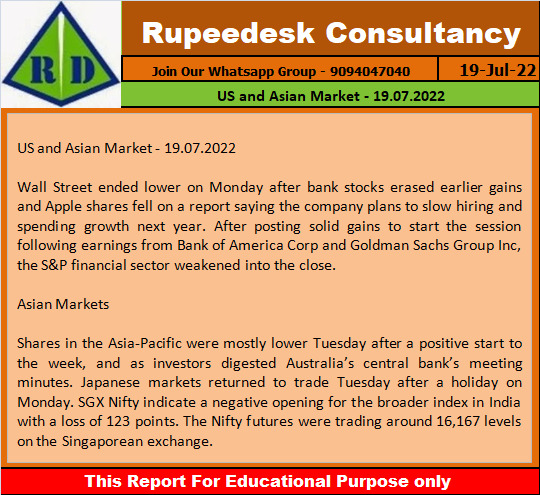

US and Asian Market - 19.07.2022

US and Asian Market - 19.07.2022

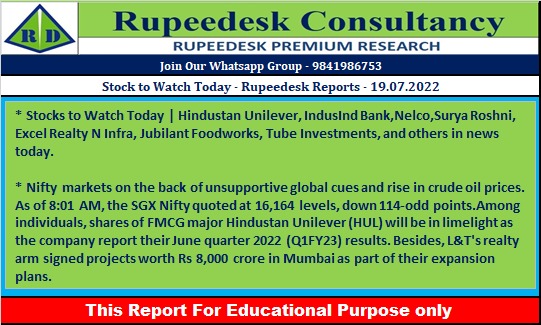

Stock to Watch Today - Rupeedesk Reports - 19.07.2022

Stock to Watch Today - Rupeedesk Reports - 19.07.2022

Stocks to Watch Today | Hindustan Unilever, Jubilant Foodworks, Tube Investments, and others in news today.

Results on July 19: Hindustan Unilever to be in focus ahead of quarterly earnings on July 19. Hindustan Unilever, HDFC Life Insurance Company, ICICI Lombard General Insurance Company, Ambuja Cements, L&T Finance Holdings, Network18 Media & Investments, TV18 Broadcast, Polycab India, AU Small Finance Bank, DCM Shriram, Garware Synthetics, Hatsun Agro Product, Kirloskar Pneumatic, Ponni Sugars (Erode), Rallis India, Shemaroo Entertainment, and Steel Strips Wheels will be in focus ahead of quarterly earnings on July 19.

IndusInd Bank: IndusInd Bank says board approves Rs 20,000 crore fundraising. The private sector lender says the board has approved raising of funds up to Rs 20,000 crore through debt securities on a private placement basis. The fundraising is subject to approval of members of the bank.

Tube Investments of India: The company's arm acquires 65.2% stake in IPLTech Electric. The company through its subsidiary TI Clean Mobility Pvt Ltd (TICMPL) acquired 65.2% stake in IPLTech Electric (IPLT) through a combination of equity shares from founders and other shareholders of IPLT. The acquisition cost is Rs 246 crore. IPLT is a startup engaged in manufacturing and sale of electric heavy commercial vehicles. In addition, the company decided to make a further investment of up to Rs 150 crore in subsidiary TICMPL and make a provision of inter-corporate deposit of an amount up to Rs 100 crore to TICMPL.

Jubilant Foodworks: Jubilant Foodworks arm raises stake in DP Eurasia N V (DPEU) to 44.75%. Subsidiary Jubilant Foodworks Netherlands BV (JFN) has increased its stake by 2.06% in DPEU to 44.75%. DPEU is the exclusive master franchisee of Domino’s Pizza brand in Turkey, Russia, Azerbaijan and Georgia.

Nelco: Nelco reports 7.8% growth in Q1 profit at Rs 4.72 crore, revenue grew 48%. The company clocked 7.8% year-on-year growth in consolidated profit at Rs 4.72 crore for the quarter ended June supported by robust topline. Revenue grew 48% to Rs 81.68 crore.

Surya Roshni: Surya Roshni bags orders worth Rs 91.27 crore from Bharat Gas Resources. The company received orders worth Rs 91.27 crore for API-5L-grade 3LPE-coated pipes from Bharat Gas Resources. The contract will be executed within 12 months.

Excel Realty N Infra: Excel Realty N Infra to consider sub-division of shares and bonus issue. The company said the board will hold a meeting on August 4 to consider the sub-division of face value of equity shares, and the issue of bonus shares.

Alok Industries: Alok Industries Q1 loss widens to Rs 141.58 crore on higher raw material and power & fuel costs. The textile company posted consolidated loss of Rs 141.58 crore for the quarter ended June, which widened from Rs 97.65 crore in the same period last year, due to higher raw material and power & fuel costs. Revenue increased by 56 percent to Rs 1,971.52 crore.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

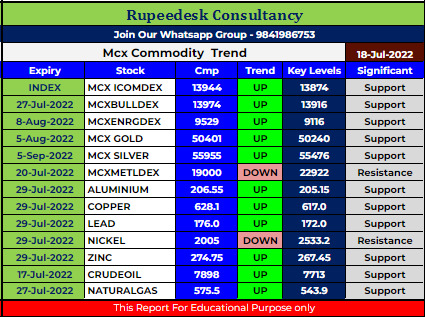

Mcx Commodity Intraday Trend Rupeedesk Reports - 18.07.2022

Mcx Commodity Intraday Trend Rupeedesk Reports - 18.07.2022

Currency Market Intraday Trend Rupeedesk Reports - 18.07.2022

Currency Market Intraday Trend Rupeedesk Reports - 18.07.2022

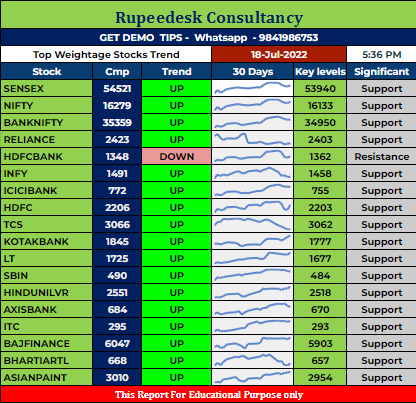

Top Weightage Stocks Trend Rupeedesk Reports - 18.07.2022

Top Weightage Stocks Trend Rupeedesk Reports - 18.07.2022

Festive season hiring rises 25-30 percent after two-year pandemic gap - Rupeedesk Reports - 18.07.2022

Festive season hiring rises 25-30 percent after two-year pandemic gap - Rupeedesk Reports - 18.07.2022

Traders’ association plans nationwide agitation over GST rate hikes - Rupeedesk Reports - 18.07.2022

Traders’ association plans nationwide agitation over GST rate hikes - Rupeedesk Reports - 18.07.2022

Rules soon on carbon trading, mandatory green energy use - Rupeedesk Reports - 18.07.2022

Rules soon on carbon trading, mandatory green energy use - Rupeedesk Reports - 18.07.2022

Government draws up plan to strengthen boards of state-run banks - Rupeedesk Reports - 18.07.2022

Government draws up plan to strengthen boards of state-run banks - Rupeedesk Reports - 18.07.2022

Concerns raised over duty differences on phone touch displays - Rupeedesk Reports - 18.07.2022

Concerns raised over duty differences on phone touch displays - Rupeedesk Reports - 18.07.2022

Ashish Chauhan of BSE to take over as new chief of NSE - Rupeedesk Reports - 18.07.2022

Ashish Chauhan of BSE to take over as new chief of NSE - Rupeedesk Reports - 18.07.2022

Companies look to locking in interest rates to brace for hikes - Rupeedesk Reports - 18.07.2022

Companies look to locking in interest rates to brace for hikes - Rupeedesk Reports - 18.07.2022

Worst might be over for the rupee, experts say in a poll - Rupeedesk Reports - 18.07.2022

Worst might be over for the rupee, experts say in a poll - Rupeedesk Reports - 18.07.2022

Firms with overseas liabilities scramble to hedge currency risk - Rupeedesk Reports - 18.07.2022

Firms with overseas liabilities scramble to hedge currency risk - Rupeedesk Reports - 18.07.2022