Stock to Watch Today - Rupeedesk Reports - 19.07.2023

Stock to Watch Today - Rupeedesk ReportStock to Watch Today - Rupeedesk Reports

Buzzing Stocks: IndusInd Bank, L&T Technology, BL Kashyap, CIE Automotive & others in focus today.

Results on July 19: L&T Finance Holdings, Tata Coffee, Tata Communications, TRF, Alok Industries, Can Fin Homes, Century Textiles & Industries, Finolex Industries, Hatsun Agro Product, Jubilant Pharmova, Bank of Maharashtra, Mastek, Newgen Software Technologies, and Shemaroo Entertainment will be in focus ahead of quarterly earnings on July 19.

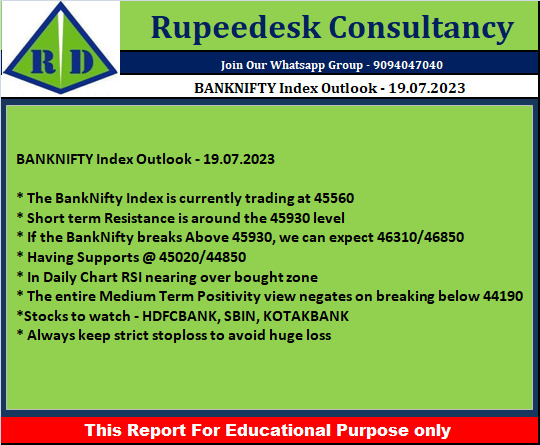

State Bank of India: The country's largest public sector lender has received approval from its competent authority to set up a new trustee company as its wholly owned subsidiary for managing Corporate Debt Market Development Fund. SBI Funds Management is identified as the investment manager cum sponsor of the said fund.

IndusInd Bank: The private sector lender has registered a 32.5 percent year-on-year rise in standalone profit at Rs 2,123.6 crore for the quarter ended June FY24 as provisions and contingencies dropped 20.7 percent YoY to Rs 991.6 crore. Net interest income grew by 18 percent YoY to Rs 4,867.1 crore for the quarter, with net interest margin expanding to 4.29 percent from 4.21 percent in the same period. Asset quality improved a bit with the gross non-performing assets falling 4 bps sequentially to 1.94 percent, and net NPA declining 1 bp to 0.58 percent for the quarter.

CIE Automotive India: The automotive components manufacturer has recorded nearly 60 percent year-on-year growth in consolidated profit at Rs 301.7 crore for the quarter ended June 2023 (Q2CY23), backed by higher other income, and strong operating income. The profit also included higher income from discontinued operations. Revenue for the quarter grew by 4.7 percent YoY to Rs 2,320.3 crore, while EBITDA increased by 21.1 percent YoY to Rs 370.4 crore with a margin expansion of 220 bps YoY.

Avanti Feeds: The shrimp exporter has incorporated a new subsidiary Avanti Pet Care in Hyderabad, Telangana. The new subsidiary will be into manufacturing & trading of pet food & pet care products.

L&T Technology Services: The engineering services company has recorded a 13 percent year-on-year growth in profit at Rs 311 crore for the quarter ended June FY24 and revenue from operations grew by 15 percent YoY to Rs 2,301.4 crore for the quarter, but sequentially dropped 8.5 percent and 2.9 percent respectively. Revenue in dollar terms for the quarter grew by 9.1 percent YoY to $280 million, but fell 2.9 percent QoQ. Revenue in constant currency terms dropped 2.9 percent QoQ but increased 10 percent YoY. The company closed a $50 million plus deal and 5 additional deals of $10 million plus each across segments in Q1FY24 and maintained USD revenue growth guidance of 20 percent plus in constant currency for the full year.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 369 crore. With this, the company's total orderbook as of date stands at Rs 3,086 crore. The said order is expected to be executed within 33 months.

Godrej Industries: Atul Prakash has resigned as Chief Operating Officer - GIL Chemicals (senior management personnel) due to unavoidable personal reasons, with effect from October 17, 2023.

Mazagon Dock Shipbuilders: Sanjeev Singhal, who is currently Director (Finance), has been given an additional charge of Chairman & MD of the shipbuilding company for a further period of six months with effect from August 1.

Himadri Speciality Chemical: The speciality chemical company has registered a massive 123.2 percent year-on-year growth in consolidated profit at Rs 86.15 crore for the quarter ended June FY24 on lower input cost and other expenses. Revenue dropped 9.1 percent to Rs 950.91 crore compared to the year-ago period. Operating numbers were strong as EBITDA surged 87.2 percent year-on-year to Rs 134 crore with a margin expansion of 730 bps.

Amara Raja Batteries: Foreign investor Clarios ARBL Holding LP has exited the automotive battery manufacturer by selling entire stake of 2.39 crore equity shares via open market transactions at an average price of Rs 652.97 per share. However, Tata AIA Life Insurance Company, BNP Paribas Arbitrage, Kotak Mahindra Mutual Fund, Nippon India Mutual Fund, Pinebridge Investments Asia Limited A/C PB Global Funds - Pinebridge India EqFund, and Societe Generale bought 1.2 crore equity shares or 7.07% stake in the company at an average price of Rs 652 per share.

Rallis India: Rekha Jhunjhunwala, the wife of late Rakesh Jhunjhunwala, has sold 5.5% stake in the Tata Group company via open market transactions. She sold 9.96 lakh shares at an average price of Rs 220.35 per share, and 97 lakh shares at an average price of Rs 215.05 per share. However, promoter Tata Chemicals bought 97 lakh shares or 4.99% stake in Rallis India at an average price of Rs 215.05 per share, and Ratnabali Investment purchased 10 lakh shares at an average price of Rs 223.29 per share.

Rama Steel Tubes: Europe-based financial services group Societe Generale has bought 60 lakh equity shares or 1.21% stake in the steel pipes maker via open market transactions at an average price of Rs 38.17 per share.

Eris Lifesciences: HDFC Mutual Fund has bought 8.29 lakh equity shares or 0.61% stake in the pharma company at an average price of Rs 728.49 per share. However, high networth individual Rakesh Shah has sold 9 lakh shares at an average price of Rs 728.5 per share. Rakesh held 11.53% stake or 1.56 crore shares in the company as of June 2023.

Lemon Tree Hotels: The company has signed a License Agreement for a 72-room property in Lucknow, Uttar Pradesh. The hotel is expected to be operational by Q3 of FY 2026. Subsidiary Carnation Hotels will be operating this hotel.

Tilaknagar Industries: Manju Anand has resigned as President - Governance & Compliance of the company with effect from July 18, to pursue new challenges and opportunities.

Adani Transmission: The Adani Group company has maintained transmission availability upwards of 99.77%, and has added 550 ckm (circuit kilometer) to operational network in Q1FY24 with total network at 19,778 ckms. The distribution loss improved and stood at 4.85% in Q1 FY24 against 6.95% in Q1 FY23. The company received letter of award for three smart metering projects in Andhra Pradesh totaling 2.7 million smart meters with a contract value of Rs 3,700 crore during the quarter.

Network18 Media & Investments: The company has posted consolidated loss of Rs 38.73 crore for quarter ended June FY24 against loss of Rs 3.32 crore in same period last year. Consolidated revenue surged 141.7% year-on-year to Rs 3,238.9 crore during the quarter, driven by the performance of IPL on JioCinema. Advertising environment continued to be soft with improvement in some pockets. Consolidated operating EBITDA for the quarter at Rs (-84) crore against Rs 46 crore in same period last year.

ICICI Lombard General Insurance Company: The private general insurance company has reported a 12% year-on-year growth in profit at Rs 390.4 crore for quarter ended June FY24. The operating profit increased by 4.5% year-on-year to Rs 331.2 crore during the quarter, and gross premium jumped 19.7% to Rs 6,622 crore compared to year-ago period. The underwriting loss for the quarter stood at Rs 319.5 crore, against loss of Rs 193 crore in year-ago period. The combined ratio at 103.8% in Q1FY24, against 104.1% in Q1FY23.

TV18 Broadcast: The company has recorded a strong 31.7% year-on-year growth in consolidated profit at Rs 44.33 crore for June FY24 quarter, against profit of Rs 33.66 crore in corresponding period last fiscal. Revenue from operations grew by 151% YoY to Rs 3,176 crore, driven by the performance of IPL on JioCinema. Consolidated operating EBITDA stood at Rs (-54) crore for quarter ended June FY24 against Rs 58 crore in year-ago period.

Bank of India: The public sector lender has appointed Yusuf H Roopwalla as Chief Technology Officer for 3 years on contractual basis.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

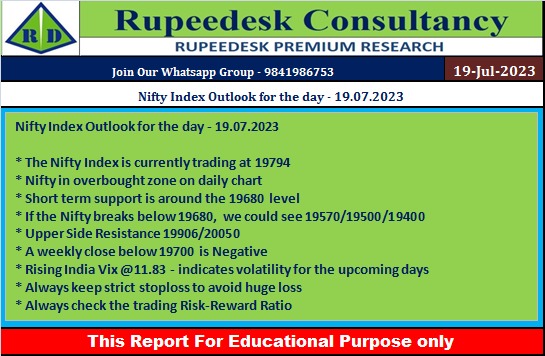

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc