Likhitha Infrastructure IPO (Sep 29-Oct1,2020)

Company says there are no listed companies in India which are engaged in the same line of business.

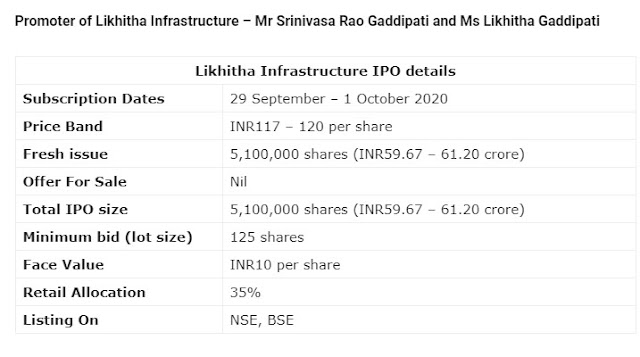

Hyderabad-headquartered Likhitha Infrastructure's initial public offering will open for subscription on September 29. The issue will close on October 1.

Shares are expected to list on BSE as well as National Stock Exchange on October 12.

Unistone Capital is the book running lead manager to the issue.

) Public Issue

The IPO consists a fresh issue of up to 51 lakh equity shares representing 25.86 percent of the post issue paid up equity capital of the company.

2) Price Band

It is a book building issue. The price band has been fixed at Rs 117-120 per share.

3) Fund Raising

The company targets to raise up to Rs 59.67 crore-Rs 61.20 crore at a price band of Rs 117 - Rs 120 per share, respectively.

4) Objectives of Issue

The proceeds of the IPO will be utilised towards working capital requirements and general corporate purposes.

5) Company Profile

Likhitha is an oil & gas pipeline infrastructure service provider in India, focused on laying pipeline networks along with construction of associated facilities; and providing operations & maintenance services to the City Gas Distribution (CGD) companies in India.

Company has presence (including past operation) in more than 16 states and 2 Union Territories in India. It has successfully laid over 600 Kms of oil and gas pipelines including steel and medium-density polyethylene (MDPE) network in past 5 fiscals. Additionally, it has laid approximately 800 kms of oil and gas pipelines for on-going projects.

Company has executed the first trans-national cross-country pipeline of South-East Asia connecting India to Nepal, in 2019, for supply of petroleum products.

6) Order Book

The company has a strong client base consisting of leading gas distribution companies in India including both the private and public players and a strong order book (i.e. the unexecuted portion of the much larger total contract value) of approximately Rs 663 crore as on July 2020.

7) Financials and Peers

Likhitha Infrastructure's revenue from operations grew by 15.6 percent to Rs 161.24 crore in year ended March 2020 compared to previous year and in FY19, revenue increased 60.2 percent to Rs 139.48 crore compared to FY18. Revenue growth in FY15-FY20 stood at a 38.96 percent CAGR and profit 58.56 percent CAGR.

Profit for the financial year 2019-20 rose 11.3 percent to Rs 19.88 crore YoY and the same grew by 149.3 percent to Rs 17.85 crore in FY19 YoY, while on the operating front, its earnings before interest, tax, depreciation and amortisation (EBITDA) increased 2.6 percent YoY to Rs 29.67 crore in FY20 and 158.7 percent YoY to Rs 28.9 crore in FY19.

EBITDA margin for the FY20 stood at 18.40 percent against 20.72 percent in FY19 and 12.83 percent in FY18.

Company says there are no listed companies in India which are engaged in the same line of business.

8) Strengths

A) We have a strong presence in India and significant experience;

B) Growth is largely attributable to its efficient business model which involves careful identification and assessment of the project with emphasis on cost optimization which is a result of executing projects with careful planning and strategy

C) Strong financial performance with emphasis on having a strong balance sheet and increased profitability;

D) Scalability of operations;

E) Strong Project execution capabilities;

F) Long term relationship with clients and repeat business;

G) Highly experienced management team;

H) Diverse fleet of sophisticated equipment.

9) Business Strategies

A) Continue to expand and enhance presence in regions where it has previously developed a strong base of operations;

B) Further growth in operation & maintenance services offerings;

C) Retaining skilled manpower;

D) Company constantly endeavours to improve business operations to optimise the utilisation of resources;

E) Continue to develop client relationship and expand client base;

F) Focus on performance and project execution;

G) Continue to focus on safety and environment standards.

10) Management, Promoters and Shareholding

Sivasankara Parameshwara Kurup Pillai is the Chairman and Non-executive Independent Director of the company. Earlier, he had worked with Newton Engineering and Construction under different capacities, last one being as its Deputy General Manager. He had also served as a Vice-President with Chemie-Tech Projects and had handled activities relating to design & construction of fuel oil refinery plant at Bahrain.

Srinivasa Rao Gaddipati is the Managing Director and is having vast technical experience of over three decades in the oil & gas infrastructure business.

Srinivasa Rao Gaddipati and Likhitha Gaddipati are promoters of the company, holding 1,42,52,875 equity shares, which constitutes 97.46 percent of the pre-issue paid-up equity share capital. Sri Lakshmi Gaddipati owns 2.5 percent shareholding in the company.

Likhitha Gaddipati, Sri Lakshmi Gaddipati and Kutumba Rao Gaddipati are Non-executive directors, while Talpa Sai Venkata Sesha Munupalle and Jnanindra Kumar Dhar are Non-executive and Independent directors.

Sudhanshu Shekhar is the Chief Executive Officer while Sambasiva Rao Ketineni is Chief Financial Officer of the company.

No comments:

Post a Comment