Financial Services Sector Analysis – 08.03.2025 - K Karthik Raja Rupeedesk Share Market Training

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Friday, March 7, 2025

Financial Services Sector Analysis – 08.03.2025 - K Karthik Raja Rupeedesk Share Market Training

Financial Services Sector Analysis – 08.03.2025 - K Karthik Raja Rupeedesk Share Market Training

Financial Services Sector Analysis – 08.03.2025 - K Karthik Raja Rupeedesk Share Market Training

Financial Services Sector Analysis – 08.03.2025

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant Key Factors Affecting & Reasons

1. Global market trends, including the impact of economic conditions, interest rates, and inflation.

2. Performance of the banking and financial sector, influencing index movement.

3. Institutional activity, including FII and DII buying/selling trends.

4. Monetary policies and RBI announcements affecting banks and NBFCs.

5. Corporate earnings and quarterly results of major financial companies.

Key Watch

- Resistance and support levels:

- Resistance: 23,982

- Support: 19,579

- Indicators:

- Moving averages: 50 MA (23,088), 150 MA (20,281), 200 MA (19,579)

- RSI: 48.10 (neutral zone)

- MACD: Bearish crossover detected

Volume Analysis

- Current volume: 422.717M (weekly average: 538.971M)

- Decrease in volume suggests possible consolidation before the next breakout.

Dow Theory Chart Analysis & Observations

- Long-term uptrend remains intact, but signs of short-term correction are visible.

- The pattern of higher highs and higher lows is still strong.

- Crucial support at 200-day MA (19,579) must hold for further upside.

Stocks to Watch

- HDFC Bank, ICICI Bank, SBI, Bajaj Finance, Kotak Bank – key drivers of NIFTYFIN.

- Insurance & NBFCs: Positive outlook for HDFC Life, SBI Life, and Bajaj Finserv.

Market Insights: Short-Term & Long-Term View

Short-Term (Next Few Weeks)

- Possible sideways movement unless strong buying interest emerges.

- Resistance at 23,982 is crucial – a breakout above this can lead to new highs.

- If support at 23,088 breaks, expect a dip toward 20,281.

Long-Term (6+ Months Outlook)

- The bullish trend remains intact, with potential to cross 25,000+ levels.

- Strong fundamentals in the financial sector support continued uptrend.

Disclaimer : This article is for informational purposes only and should not be considered financial advice. Do your own research before making any investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

Dowjones Market Insights Smart Traders’ Blueprint for Breakout & Breakdown Levels!

Dowjones Market Insights Smart Traders’ Blueprint for Breakout & Breakdown Levels!

Dowjones Market Insights Smart Traders’ Blueprint for Breakout & Breakdown Levels!

Dowjones Market Insights Smart Traders’ Blueprint for Breakout & Breakdown Levels!

Dowjones Market Insights Smart Traders’ Blueprint for Breakout & Breakdown Levels!

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

Chart Pattern

- The Dow Jones Industrial Average (DJI) is showing signs of consolidation after a prolonged uptrend.

- Price action suggests weakness as it trades below the 50 EMA.

- No confirmed breakout or breakdown yet, but momentum is fading.

Trend Analysis

- Short-term trend: Bearish (Price below 50 EMA).

- Medium-term trend: Sideways to Weak (Price testing 150 MA).

- Long-term trend: Bullish (Price above 200 EMA, but losing momentum).

Dow Theory

- The market has been making higher highs and higher lows, but recent price action hints at a possible reversal.

- A lower high formation could trigger a correction if key support levels break.

Moving Averages Insights

- 50 EMA (43687.65): Price trading below, signaling short-term weakness.

- 150 MA (42734.57): Crucial support level being tested.

- 200 EMA (42035.75): Last line of defense for long-term bulls.

Volume Analysis

- Declining volume indicates weakening buying interest.

- Higher selling volume near resistance suggests profit booking by institutions.

Upcoming Events

- US inflation data & Fed interest rate decision – High-impact events that could move markets.

- Job reports & earnings season – Volatility expected.

Observations

- RSI (37.40): Nearing oversold, signaling possible short-term bounce.

- MACD bearish crossover: Indicates further downside risk.

- ADX (24.43): Weak trend strength, no clear dominant direction.

Trend Confirmation Indicators

- Bullish above 43700 (Above 50 EMA).

- Bearish below 42500 (Below 150 MA).

- Wait for confirmation before entering trades.

RSI Divergence Reason

- RSI declining while price holds support, indicating weakness.

- No bullish divergence yet, but oversold conditions suggest a possible bounce.

Final Takeaway

- If 42734 support breaks, expect more downside.

- A bounce from 150 MA could trigger short-term recovery.

- Wait for confirmation before taking aggressive positions.

Breakout Strategy (Bullish)

- Entry above: 43700

- Stop-loss: 42800

- Target: 45000+

Breakdown Strategy (Bearish)

- Entry below: 42500

- Stop-loss: 43000

- Target: 41500

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Please consult with a professional before making investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

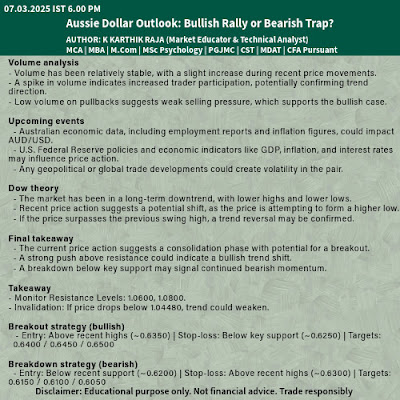

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

- Volume analysis

- Volume has been relatively stable, with a slight increase during recent price movements.

- A spike in volume indicates increased trader participation, potentially confirming trend direction.

- Low volume on pullbacks suggests weak selling pressure, which supports the bullish case.

- Upcoming events

- Australian economic data, including employment reports and inflation figures, could impact AUD/USD.

- U.S. Federal Reserve policies and economic indicators like GDP, inflation, and interest rates may influence price action.

- Any geopolitical or global trade developments could create volatility in the pair.

- Dow theory

- The market has been in a long-term downtrend, with lower highs and lower lows.

- Recent price action suggests a potential shift, as the price is attempting to form a higher low.

- If the price surpasses the previous swing high, a trend reversal may be confirmed.

- Final takeaway

- The current price action suggests a consolidation phase with potential for a breakout.

- A strong push above resistance could indicate a bullish trend shift.

- A breakdown below key support may signal continued bearish momentum.

- Breakout strategy (bullish)

- Entry: Above recent highs (~0.6350) | Stop-loss: Below key support (~0.6250) | Targets: 0.6400 / 0.6450 / 0.6500

- Confirmation: Breakout with strong volume

- Breakdown strategy (bearish)

- Entry: Below recent support (~0.6200) | Stop-loss: Above recent highs (~0.6300) | Targets: 0.6150 / 0.6100 / 0.6050

- Confirmation: Strong selling pressure and close below moving averages

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Please consult with a professional before making investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

GBP/USD Forecast: Will the Pound Soar or Sink?

GBP/USD Forecast: Will the Pound Soar or Sink?

GBP/USD Forecast: Will the Pound Soar or Sink?

GBP/USD Forecast: Will the Pound Soar or Sink?

GBP/USD Forecast: Will the Pound Soar or Sink?

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

Trend Analysis

- The price has shifted from a downtrend to a strong uptrend.

- The recent breakout above key resistance confirms bullish momentum.

- Higher highs and higher lows indicate a continuation of the trend.

Moving Averages Insights

- The price has moved above the 200-day moving average, signaling a long-term trend reversal.

- The price is currently extended above short-term moving averages, indicating possible overbought conditions.

Upcoming Events

- Interest rate decisions from the Bank of England (BoE) and Federal Reserve (Fed) could impact GBP/USD.

- Economic data releases such as GDP, inflation, and employment figures may influence market direction.

Observations

- RSI is approaching overbought levels (68), suggesting a potential short-term pullback.

- Momentum is strong, but a consolidation phase may occur before further upside.

- Volume has been increasing, confirming buying pressure.

Final Takeaway

- The bullish trend remains intact as long as the price stays above key support levels.

- A breakout above resistance could fuel further upside.

- A breakdown below moving averages may signal a trend reversal.

Breakout Strategy (Bullish)

- Entry: Above recent highs (1.2960-1.3000) | Stop-loss: Below key support (1.2850)

- Targets: 1.3100 / 1.3200 / 1.3300

Breakdown Strategy (Bearish)

- Entry: Below support (1.2750-1.2800) | Stop-loss: Above recent highs (1.2900)

- Targets: 1.2600 / 1.2500 / 1.2400

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Please consult with a professional before making investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

XAUUSD Breakout Coming Don’t Miss This Gold Prediction!

XAUUSD Breakout Coming Don’t Miss This Gold Prediction!

XAUUSD Breakout Coming Don’t Miss This Gold Prediction!

XAUUSD Breakout Coming Don’t Miss This Gold Prediction!

XAUUSD Breakout Coming Don’t Miss This Gold Prediction!

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

Chart Pattern

- The price is forming higher highs and higher lows, indicating an uptrend.

- Recently, a consolidation phase is visible, which could be a potential bullish flag or pennant.

- The 200-day moving average (green) is sloping upwards, confirming a long-term uptrend.

- The 50-day and 100-day moving averages are also supporting the trend.

Dow Theory

- Primary Trend: Uptrend as higher highs and higher lows are visible.

- Secondary Trend: Recent consolidation may lead to a continuation or reversal.

- Minor Trend: Currently sideways with some pullbacks.

Volume Analysis

- Increasing volume during rallies, confirming strong demand.

- Decreasing volume during pullbacks, showing weak selling pressure.

- Breakout attempts with high volume would confirm further upside momentum.

Upcoming Events

- Economic data releases (like US Non-Farm Payrolls, CPI, or Fed Meetings) could impact gold prices.

- Geopolitical tensions or interest rate decisions may also influence the trend.

Final Takeaway

- Bullish bias as long as price stays above major moving averages.

- Risk if breakdown occurs, key support levels must hold.

- Strategy: Look for a breakout confirmation or wait for a retest of support.

Breakout Strategy (Bullish)

- Entry: Above previous high breakout level (~2930-2950) | Stoploss: Below support zone (~2880) | Targets: 2980 / 3020 / 3050

- Confirmation: High volume breakout

Breakdown Strategy (Bearish)

- Entry: Below key support (2840-2860) | Stoploss: Above recent highs (2900) | Targets: 2800 / 2750 / 2700

- Confirmation: Strong selling pressure and closing below support level

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Please consult with a professional before making investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

Subscribe to:

Comments (Atom)