Stock to Watch Today - Rupeedesk ReportStock to Watch Today - Rupeedesk Reports

Buzzing Stocks: Paytm, Eicher Motors, TCS, Tata Motors, PB Fintech, JK Cement, others in news.

One 97 Communications: Warren Buffet's investment arm, BH International Holdings, exited the Paytm operator by selling its entire shareholding in the company through open market transactions. Berkshire Hathaway's entity sold 1.56 crore equity shares, which is equivalent to 2.46 percent of paid-up equity, at an average price of Rs 877.29 per share, amounting to Rs 1,370.6 crore. However, foreign investors Copthall Mauritius Investment and Ghisallo Master Fund LP were the buyers for some of those shares sold by BH, buying 75.75 lakh shares and 42.75 lakh shares, respectively, at an average price of Rs 877.2 per share.

Eicher Motors: Royal Enfield has launched its adventure tourer, the all-new Himalayan, at the motorcycling festival Motoverse 2023. It is now available for bookings in retail stores in India starting today (November 24) and will be available across Europe starting in March 2024. The motorcycle will be available at a starting price of £5,750 in the UK and €5900 across Europe, while in India, the Himalayan will be available at a special introductory price of Rs 2.69 lakh till December 31, 2023.

PB Fintech: PB Fintech made a further investment of Rs 350 crore in its wholly owned subsidiary, Policybazaar Insurance Brokers. This will strengthen the financial health of the said wholly-owned subsidiary to meet its general operating expenses and enhance brand awareness, office presence, and strategic initiatives.

Tata Motors: Subsidiary Tata Technologies, in consultation with book-running lead managers for the IPO, has finalised the offer price (including the anchor investor offer price) at Rs 500 per share. Accordingly, the size of the IPO aggregated to Rs 3,042.51 crore.

JK Cement: The company's unit, JK Cement Works, Ujjain, has successfully commenced cement grinding unit capacity of 1.5 million tonne per annum at its newly set-up cement manufacturing facility situated in Ujjain, Madhya Pradesh.

Wipro: The technology services and consulting company has helped Stockholm Exergi AB, Stockholm's energy company, build a new information technology (IT) infrastructure, helping it take a significant step towards achieving its and Stockholm City's overall climate transformation targets.

HDFC Bank: The country's largest private sector lender, said the board has appointed Harsh Kumar Bhanwala as an Additional Independent Director of the bank for three years, from January 25, 2024, to January 24, 2027. Further, the board has appointed V Srinivasa Rangan as Executive Director (whole-time Director) of the bank for three years, with effect from November 23.

Tata Steel: The Tata Group company has appointed Akshay Khullar as Vice President, Engineering & Projects, with effect from February 1, 2024, after the superannuation of Avneesh Gupta as Vice President, TQM and Engineering & Projects of the company. Peeyush Gupta will be re-designated as the Vice President, TQM, Group Strategic Procurement and Supply Chain, with effect from February 1, 2024. Peeyush is currently serving as the Vice President of Group Strategic Procurement and Supply Chain.

Maruti Suzuki India: The company has planned to increase the prices of its cars in January 2024 due to increased cost pressure driven by overall inflation and increased commodity prices. While the company makes maximum efforts to reduce costs and offset the increase, it may have to pass on some of the increase to the market.

Tata Consultancy Services: The IT services company has launched its AWS generative AI practice to help customers harness the full potential of AI and AWS generative AI services to transform different parts of their value chain and achieve superior business outcomes.

Sheela Foam: Vivek Kumar Bajpai is appointed as Chief of Staff of the company with effect from November 27.

Balkrishna Industries: The tyre manufacturing company said the board has approved the re-appointment of Rajiv Poddar as Joint Managing Director of the company for five years with effect from January 22, 2024. The board also reappointed Shruti Shah as Independent Director and appointed Laxmidas Merchant as Additional Director (Independent Director) and Rahul Dutt as Additional Director (Independent Director) of the company for five years. The appointments are subject to the approval of the shareholders of the company.

Cipla: Subsidiary Cipla EU has completed the acquisition of an additional 15.10 percent of Cipla Maroc SA, Morocco, (the joint venture company) from The Pharmaceutical Institute (PHI) for MAD 81.1 million. Accordingly, Cipla EU will now hold a 75.10 percent stake in the joint venture company, and the remaining 24.90 percent stake will be held by Societe Marocaine de Cooperation Pharmaceutique (Cooper Pharma).

Avenue Supermarts: The DMart operator has opened a new store at Nizampet, Telangana. The total number of stores as of today stands at 339.

Cello World: The consumerware company has recorded a 4.5 percent sequential growth in consolidated net profit at Rs 86.6 crore for the quarter ended September FY24, despite weak operating margins supported by other income. Consolidated revenue from operations during the quarter increased by 3.6 percent to Rs 489 crore compared to the previous quarter. EBITDA for the quarter rose by 0.9 percent QoQ to Rs 120.3 crore, but margin fell by 70 basis points to 24.6 percent with a jump in input costs.

DLF: The Enforcement Directorate (ED) on November 25 searched the premises of the realty major in Gurugram as part of a money laundering investigation against real estate firm Supertech and its promoters. According to the officials, the ED has recovered some documents during the search over the past few days and said the action is linked to an investigation against Supertech.

Indian Overseas Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 1 crore on the PSU for non-compliance with certain directions on loans and advances—statutory and other restrictions. The bank sanctioned term loans to three corporate entities without undertaking due diligence on the viability and bankability of the projects to ensure that revenue streams from the projects were sufficient to take care of the debt servicing obligations.

Bank of Baroda: The Reserve Bank of India (RBI) has imposed a monetary penalty of Rs 4.34 crore on the public sector lender for non-compliance with certain directions on the creation of a central repository of large common exposures across banks, loans and advances, statutory and other restrictions, and interest rates on deposits. The bank failed to ensure the accuracy and integrity of data on large exposures submitted to the RBI with respect to some accounts, sanctioned a working capital demand loan to a corporation against amounts receivable from the government by way of subsidies, and did not pay interest on the deposits accepted from senior citizens.

Siemens: The technology company said the Board of Directors will be meeting on November 28 to approve the standalone and consolidated audited financial results of the company for the financial year ended September 2023 and consider the recommendation of a dividend on equity shares, if any.

PNB Housing Finance: The housing finance company said the board of directors has approved the issuance of non-convertible debentures up to Rs 3,500 crore on a private placement basis in tranches over the next six months.

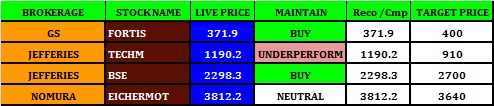

Fortis Healthcare: The healthcare services provider said its certain subsidiaries signed definitive agreements for the sale of the business operations along with the land and building assets pertaining to Fortis Malar Hospital at Gandhi Nagar, Chennai, to MGM Healthcare. The divestment in Fortis Malar Hospital will take place for Rs 128 crore. The transaction will be an all-cash deal and is estimated to be consummated by the end of January 2024.

KPI Green Energy: Subsidiary Sun Drops Energia has bagged a new order of 4.66 MW for executing solar power projects under the captive power producer (CPP) segment. With the addition of the new order, its cumulative orders of solar power projects till date have crossed 143+ MW under the CPP segment.

Bandhan Bank: The Kolkata-based private sector lender said its Board of Directors has approved the re-appointment of Chandra Shekhar Ghosh as the Managing Director and Chief Executive Officer (MD and CEO) of the bank for three years, with effect from July 10, 2024. He is not liable to retire by rotation. The reappointment is subject to the approval of the Reserve Bank of India and the shareholders of the bank. The current tenure of Ghosh as the MD and CEO of the bank will expire on July 9, 2024.

Arvind SmartSpaces: Real estate developer Arvind SmartSpaces, part of the Lalbhai group, has successfully given exit to HDFC Capital Affordable Real Estate Fund -3 (HCARE-3) on the project Arvind Fruits of Life. This is a premium plotting development at Bavlu, Gandhinagar, and the first project added under HDFC Platform 2 in Q2 FY23. The funds invested by HCARE-3 have been repaid in full from the project cash flows, driven by strong sales momentum and collections from the project.

AU Small Finance Bank: The Reserve Bank of India has approved the appointment of Harun Rasid Khan as Part-Time Chairman of the bank, with effect from January 30, 2024, until the completion of his 1st tenure as Independent Director of the bank, i.e., December 27, 2024. H. R. Khan has been associated with the bank as an independent director since December 28, 2021, and he will assume the position of part-time chairman upon the completion of the tenure of the current part-time chairman, Raj Vikash Verma, on January 29, 2024.

Khadim India: The retail footwear company is going to raise about Rs 15 crore. It has received approval from the board for raising funds via the preferential issue of fully convertible equity share warrants on a private placement basis to one of the promoters and a few other identified non-promoter entities. The company will issue 4,08,768 fully convertible equity share warrants of Rs 10 each, which will be converted into equity shares of Rs 10 each. The warrants will be issued at a price of Rs. 365 per share. The company will use the funds largely for the nationwide retail expansion and revamping of existing stores.

Spencer’s Retail: While opening a Natures Basket store at Phoenix Palladium, Mumbai, the company said its subsidiary Natures Basket is expected to reduce its debt in due course by approximately Rs 100 crore through a mix of loan restructuring and repayment of loans. "The sale of a certain part of the company's minority stake is under consideration, and Spencer’s business will take some more time to generate net profit. It is expected to have positive EBITDA during the current year."

Syrma SGS Technology: The company has incorporated a wholly owned subsidiary company named Syrma Semicon. Subsidiary intends to carry on the business of designers and manufacturers, buyers, sellers, assemblers, exporters, importers, distributors, agents, and dealers in memory chips, memory modules, PCB assemblies and other storage products, printers, readers magnetic or otherwise, CRT displays and terminals, and all other electronic and communication equipment and parts, components, assemblies, and subassemblies to be used in the computer and electronic industry.

Newgen Software Technologies: The company said the board has recommended the issue of bonus shares in the proportion of 1:1 (one bonus equity share of Rs 10 each for every one share of Rs 10 each held by the members of the company).

Stove Kraft: The Income Tax Department concluded search operations at some of the premises and manufacturing plants of the company. The I-T Department started the said search operations on November 22. The operations at the manufacturing plants of the company were disrupted on November 22–26 in Bengaluru and on November 21–23 in Baddi. Manufacturing operations at the Bengaluru plant have fully resumed as of November 27, and at the Baddi plant as of November 24.

CE Info Systems: The company has received board approval for raising funds via the issuance of equity shares worth up to Rs 500 crore by way of qualified institutional placement (QIP).

Salzer Electronics: The electrical solutions provider, has received a patent for the heavy-duty, energy-efficient Automatic Source Changeover (ACCL). The patent is valid for a period of 20 years. This patented innovation, introduced in 2016, has generated revenues of approximately Rs 10 crore, primarily within the building segment business division.

Prism Johnson: The board members have appointed Arun Kumar Agarwal as Chief Financial Officer and key managerial personnel of the company with effect from November 26. However, Manish Bhatia has resigned as Chief Financial Officer of the company due to personal reasons.

Satin Creditcare Network: The microfinance institution has raised Rs 35 crore via NCDs. Its Working Committee has allotted 3,500 NCDs (non-convertible debentures) with a face value of Rs 1 lakh each.

Techknowgreen Solutions: The company is now accredited as a Category-A organisation under the QCI-NABET Scheme for Accreditation of Environmental Impact Assessment (EIA) Consultant Organisation, Version 3. The company will prepare Environmental Impact Assessment-Environmental Management Plan (EIA-EMP) reports in 13 sectors.

MosChip Technologies: The board has approved the issue of 52,70,100 equity shares, amounting to Rs 50.34 crore, on a preferential basis, to Citrus Global Arbitrage Fund. The shares will be issued at a price of Rs 95.52 per share. This is subject to the approval of members of the company.

Fino Payments Bank: The Reserve Bank of India has approved the appointment of Rajat Kumar Jain, Independent Director, as Part-time Chairman of Fino Payments Bank, with effect from November 24 until November 1, 2025.

Vascon Engineers: Vascon Engineers said the board of directors will be meeting on November 30 to consider the raising of funds via the issue of equity shares.

Integra Essentia: The company said the board of directors has given approval for a bonus issue of equity shares in the ratio of 1:1 (one equity share of Re 1 each for every one equity share of Re 1 each). The board also approved the fund raising up to Rs 100 crore via preferential allotment, QIP’s, ADR, GDR, and FCCB. Pankaj Sardan is appointed as Chief Financial Officer of the company, with effect from November 27.

Dynamatic Technologies: The company has completed the first delivery of the Airbus A220 escape hatch door to Airbus Atlantic. The escape hatch door is integrated into the Airbus Atlantic's A220 nose fuselage, produced in Mirabel, Canada.

Transindia Real Estate: Ashok Khimji Parmar has resigned as Chief Financial Officer (CFO) of the company with effect from November 27.