52 Week High In Large Cap - 07.11.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, November 6, 2022

52 Week High In Large Cap - 07.11.2022

Price Increase & Vol Increase In Large Cap - 07.11.2022

Price Increase & Vol Increase In Large Cap - 07.11.2022

Price Increase & Vol Increase In Mid Cap - 07.11.2022

Price Increase & Vol Increase In Mid Cap - 07.11.2022

Price Increase & Vol Increase In Small Cap - 07.11.2022

Price Increase & Vol Increase In Small Cap - 07.11.2022

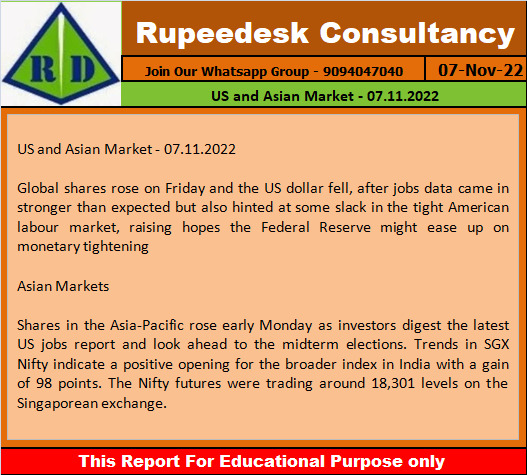

US and Asian Market - 07.11.2022

US and Asian Market - 07.11.2022

Stock to Watch Today - Rupeedesk Reports - 07.11.2022

Stock to Watch Today - Rupeedesk Reports - 07.11.2022

Buzzing Stocks | SBI, Britannia Industries, Titan Company, and others in news today.

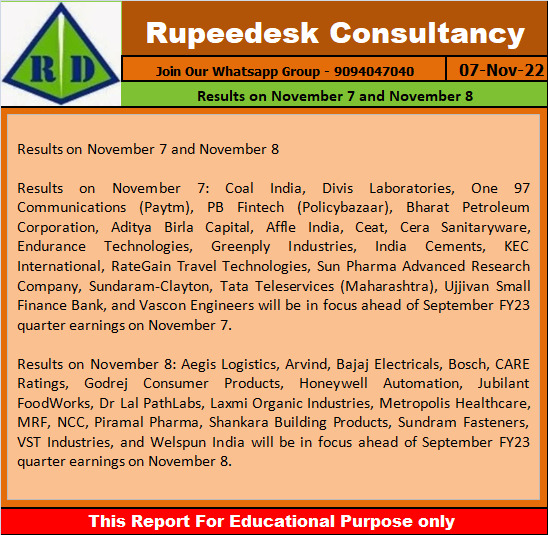

Results on November 7: Paytm to be in focus ahead of September FY23 quarter earnings on November 7. Coal India, Divis Laboratories, One 97 Communications (Paytm), PB Fintech (Policybazaar), Bharat Petroleum Corporation, Aditya Birla Capital, Affle India, Ceat, Cera Sanitaryware, Endurance Technologies, Greenply Industries, India Cements, KEC International, RateGain Travel Technologies, Sun Pharma Advanced Research Company, Sundaram-Clayton, Tata Teleservices (Maharashtra), Ujjivan Small Finance Bank, and Vascon Engineers will be in focus ahead of September FY23 quarter earnings on November 7.

Results on November 8: Jubilant FoodWorks to be in focus ahead of September FY23 quarter earnings on November 8. Aegis Logistics, Arvind, Bajaj Electricals, Bosch, CARE Ratings, Godrej Consumer Products, Honeywell Automation, Jubilant FoodWorks, Dr Lal PathLabs, Laxmi Organic Industries, Metropolis Healthcare, MRF, NCC, Piramal Pharma, Shankara Building Products, Sundram Fasteners, VST Industries, and Welspun India will be in focus ahead of September FY23 quarter earnings on November 8.

State Bank of India: State Bank of India Q2 profit jumps 74% YoY to Rs 13,265 crore on decline in loan loss provisions. Net interest income rises 13%. The country's largest bank reported highest ever quarterly net profit at Rs 13,265 crore, growing 74% YoY as loan loss provisions fell sharply by 25% during the same period. Its operating profit for Q2FY23 at Rs 21,120 crore increased 16.82% YoY and net interest income rose by 12.83% YoY to Rs 35,183 crore with loan book growing 20% and deposits rising 10% in the same period.

Bank of Baroda: Bank of Baroda Q2 profit jumps 59% YoY to Rs 3,313 crore on fall in provisions, other income. Net interest income rises 34.5%. The public sector undertaking recorded a 59% YoY growth in profit at Rs 3,313 crore for the quarter ended September FY23 as total provisions at Rs 1,628 crore fell by 41% YoY and other income fell 18.4% to Rs 745 crore in the same period. Net interest income for the quarter jumped 34.5% YoY to Rs 10,174 crore, with global deposits rising 13.6% and global advances growing 19% YoY.

Power Grid Corporation of India: Power Grid Corporation of India Q2 profit rises 8% YoY to Rs 3,650 crore. Revenue increases 8.6%. The state-owned company reported a 8% year-on-year growth in consolidated profit at Rs 3,650 crore for the quarter ended September FY23, with EBITDA growing 3.4% YoY to Rs 9,426 crore in the same quarter. Revenue from operations at Rs 11,151 crore increased by 8.6% compared to year-ago period.

Britannia Industries: Britannia Q2 profit grows 28.5% YoY to Rs 490.6 crore driven by strong operating performance & top line. Revenue jumps 21.4%. The food company has recorded a 28.5% year-on-year growth in consolidated profit at Rs 490.6 crore for the quarter ended September FY23, driven by strong operating performance and top line. Consolidated revenue from operations at Rs 4,379.6 crore for the quarter increased by 21.4% compared to year-ago period aided by mid-single digit volume growth, with reaching market share to new 15-year high. EBITDA at Rs 711.7 crore for the quarter grew by 27.5% and margin expanded by 78 bps YoY to 16.25% in Q2FY23.

Marico: Marico Q2 profit declines 2.8% YoY to Rs 307 crore, with tepid top line & operating profit growth and pressure in margin. The FMCG company reported a 2.8% year-on-year decline in consolidated profit at Rs 307 crore for September FY23 quarter, with tepid top line & operating profit growth and pressure in margin. There was increase in other expenses including advertisement & sales promotion. Revenue for the quarter increased by 3.2% to Rs 2,496 crore YoY.

Titan Company: Titan Company Q2 profit jumps 30% YoY to Rs 835 crore on strong operating performance, top line growth. The company recorded a 30.3% year-on-year growth in consolidated profit at Rs 835 crore for the quarter ended September FY23 despite higher input cost, supported by strong operating performance and top line growth. Total income for the quarter grew by 22% YoY to Rs 9,224 crore with jewellery business growing 18%, and watches & wearables segment showing a 21% growth YoY.

Fineotex Chemical: Nippon Life India Trustee lowers stake in Fineotex Chemical. Nippon Life India Trustee sold 0.33% equity stake in the company via open market transactions. With this, its shareholding in the company reduced to 3.64%, down from 3.98% earlier.

City Union Bank: City Union Bank Q2 profit jumps 52% YoY to Rs 276.5 crore on lower provisions. Net interest income rises 19%. The bank reported a 52% year-on-year growth in profit at Rs 276.46 crore for the quarter ended September FY23 supported by lower provisions and pre-provision operating profit. Net interest income for the quarter at Rs 567.91 crore increased by 19% compared to corresponding quarter of last fiscal.

InterGlobe Aviation: InterGlobe Aviation Q2 loss widens to Rs 1,583 crore impacted by foreign exchange loss, higher fuel cost. The IndiGo operator posted loss of Rs 1,583 crore for the quarter ended September FY23 (including foreign exchange loss of Rs 1,201.5 crore), widening from Rs 1,435.7 crore in same period last year, as EBITDAR fell 33% to Rs 229.2 crore during the same period on higher fuel prices, but revenue from operations increased by 122.8% YoY to Rs 12,497.6 crore during the quarter.

TVS Motor Company: TVS Motor Company posts highest ever revenue, EBITDA, profit in Q2. Profit increases 59%. The two-and-three-wheeler company reported a 59.3% year-on-year increase in consolidated profit at Rs 373.4 crore for the quarter ended September FY23 supported by strong operating as well top line performance. Revenue for the quarter at Rs 8,561 crore increased by 32% compared to same period last year and EBITDA rose by 31% to Rs 737 crore during the same period.

Godrej Agrovet: Godrej Agrovet Q2 profit falls 38% YoY to Rs 69.62 crore due to volatility in commodity price. Revenue rises 13.5%. The company recorded a 38% year-on-year decline in consolidated profit at Rs 69.62 crore due to commodity price volatilities, sustained cost inflation, limited transmission and unfavourable macro environment. Revenue for the quarter at Rs 2,445 crore increased by 13.5% compared to year-ago period.

IDFC First Bank: IDFC First Bank gets board nod for fund raising of Rs 4,000 crore. The bank said it has received board approval for the capital raise plan of Rs 4,000 crore for the next one year. The said funds will be raised in one or more tranches by way of issuance of equity shares/ Tier 1 capital, with the intent to further strengthening the balance sheet.

Mahindra Logistics: Mahindra Logistics Q2 profit more than doubled to Rs 11 crore, revenue increases 28%. The stock will be in focus as the logistics & mobility solutions provider's profit for the quarter ended September FY23 more than doubled to Rs 11 crore from Rs 5 crore YoY. Revenue at Rs 1,326 crore for the quarter increased by 28% compared to year-ago period and EBITDA jumped 45% YoY to Rs 71 crore in Q2FY23, driven by continuing recovery in automotive industry and sustained growth in consumption end markets including telecom.

Bank of India: Bank of India to raise Rs 2,500 crore via issue of bonds. The bank has received board approval for raising of Tier-1 capital by issue of AT-I bonds for Rs 2,500 crore.

Paradeep Phosphates: Paradeep Phosphates Q2 profit tanks 71% YoY to Rs 51 crore impacted by higher input cost. Revenue jumps 48%. The phosphatic fertilizer manufacturing company has reported a 71% year-on-year increase in consolidated profit at Rs 51.1 crore for quarter ended September FY23, impacted by higher input cost and other expenses. Revenue at Rs 2,863.7 crore for the quarter increased by 48% compared to year-ago period.

Jagran Prakashan: Jagran Prakashan Q2 profit falls 17% to Rs 50.6 crore, gets board approval for share buyback worth Rs 345 crore. The company said its board of directors has given approval for buyback of shares worth Rs 345 crore of the company from shareholders. The number of shares proposed for buyback would be 4.6 crore, and the price has been fixed at Rs 75 per share. Jagran clocked a 17% year-on-year decline in consolidated profit at Rs 50.6 crore for the quarter ended September FY23, impacted by increase in input cost and higher other expenses. Revenue for the quarter grew by 13% to Rs 454.2 crore compared to year-ago period.

NIIT: NIIT acquires St. Charles Consulting Group. The company has acquired 100% membership interest in St. Charles Consulting Group LLC (StC) through subsidiary NIIT (USA), Inc. StC is a leading provider of consulting, design, and implementation solutions for strategic learning programs to professional services firms and Fortune 500 companies. The acquisition was completed at a cost of $23.428 million.

DreamFolks Services: DreamFolks Services Q2 profit jumps 745% YoY to Rs 14.78 crore on healthy growth in number of passengers availing lounge access. The airport lounges access aggregator clocked a massive 745% on-year growth in profit at Rs 14.78 crore for the quarter ended September FY23 as operating and top line numbers were strong. Revenue from operations grew by 183% to Rs 171.24 crore during the quarter YoY, while EBITDA increased by 195% to Rs 21.1 crore and margin nearly doubled to 12.33% compared to same period last year on healthy growth in number of passengers availing lounge access & other touchpoints.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Results on November 7 and November 8

Results on November 7 and November 8

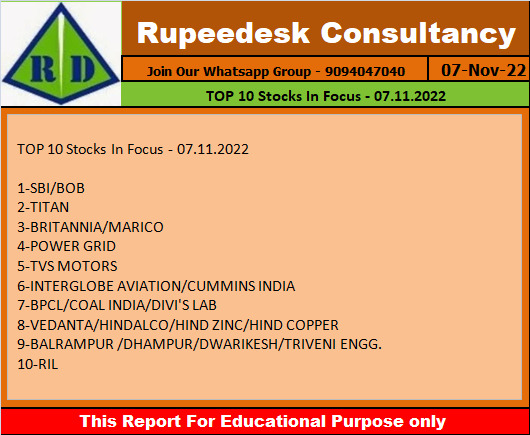

TOP 10 Stocks In Focus - 07.11.2022

TOP 10 Stocks In Focus - 07.11.2022

Global Market Updates - 07.11.2022

Global Market Updates - 07.11.2022