US & Asian Markets - 16.05.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, May 15, 2023

US & Asian Markets - 16.05.2023

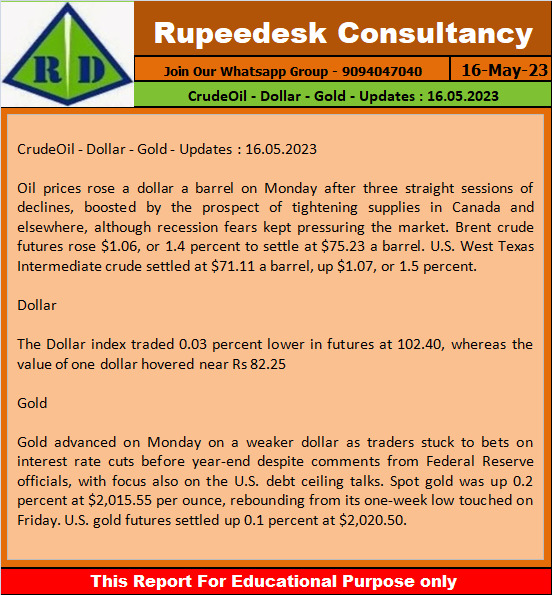

CrudeOil - Dollar - Gold - Updates 16.05.2023

CrudeOil - Dollar - Gold - Updates 16.05.2023

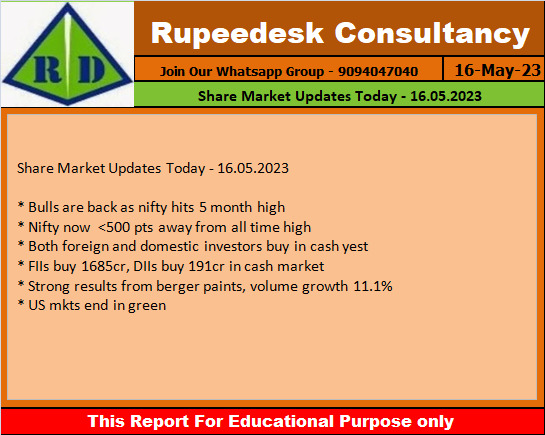

Share Market Updates Today - 16.05.2023

Share Market Updates Today - 16.05.2023

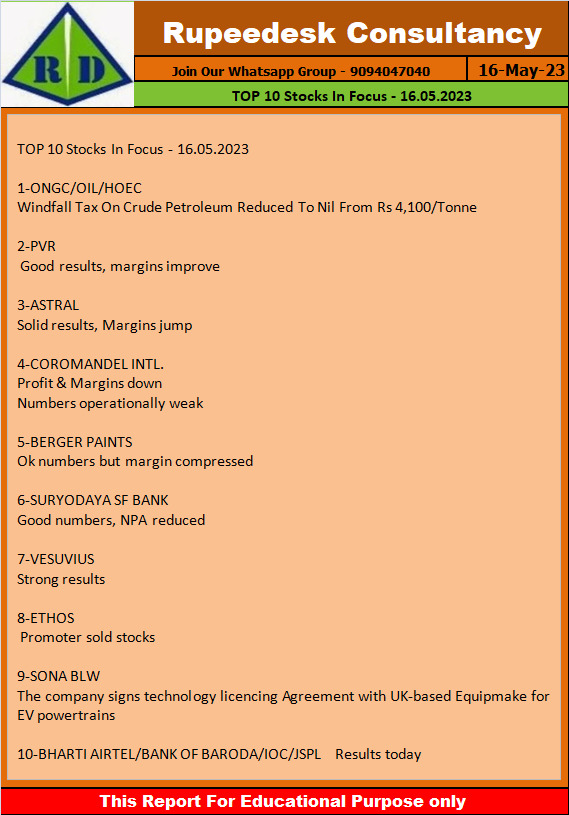

TOP 10 Stocks In Focus - 16.05.2023

TOP 10 Stocks In Focus - 16.05.2023

Stock to Watch Today - Rupeedesk Reports - 16.05.2023

Stock to Watch Today - Rupeedesk Reports - 16.05.2023

Buzzing Stocks: HDFC Bank, Pfizer, Bharti Airtel, UltraTech Cement, PVR Inox and others in focus today

Results on May 16: Bharti Airtel, Bank of Baroda, Indian Oil Corporation, Jindal Steel & Power, Amber Enterprises India, Chemplast Sanmar, CreditAccess Grameen, Granules India, Indo Rama Synthetics, JK Paper, Jubilant Ingrevia, Kajaria Ceramics, LIC Housing Finance, Metropolis Healthcare, Oberoi Realty, Paras Defence and Space Technologies, Talbros Automotive Components, and Triveni Turbine will be in focus ahead of their quarterly earnings on May 16.

HDFC Bank: Sebi has granted approval for the proposed change in control of HDFC Capital Advisors, a subsidiary of HDFC and a co-investment portfolio manager, pursuant to proposed composite scheme of amalgamation for the amalgamation of HDFC with HDFC Bank. The proposed amalgamation is subject to receipt of final approvals from Sebi in respect of change in control of certain subsidiaries of HDFC.

Pfizer: The biopharmaceutical company has recorded a 3% year-on-year growth in profit at Rs 129.65 crore for quarter ended March FY23, and revenue from operations during the same period grew by 4.2% to Rs 572.64 crore. At the operating level, EBITDA (earnings before interest, tax, depreciation and amortisation) increased by 10% to Rs 181.9 crore with margin expansion of 170 bps to 31.8%, compared to same period last year. The board has announced a final dividend of Rs 35 per share, and a special dividend of Rs 5 per share due to gain on sale of business undertaking at Thane.

UltraTech Cement: Subsidiary UltraTech Nathdwara Cement (UNCL) has commissioned 0.8 mtpa brownfield cement capacity at Neem Ka Thana, Rajasthan. The company, along with its subsidiary, now has 17.05 mtpa grey cement capacity in Rajasthan and its total grey cement manufacturing capacity, including that of UNCL, now stands at 129.95 mtpa in India.

Berger Paints: The paint manufacturing company has recorded nearly 16% year-on-year decline in consolidated profit at Rs 185.7 crore for quarter ended March FY23 impacted by fall in operating margin performance. Revenue from operations for the quarter at Rs 2,443.6 crore grew by 11.7 percent over a year-ago period. On the operating front, EBITDA increased by 6.4% year-on-year to Rs 368.8 crore, but margin falling 70 bps YoY to 15.1% in Q4FY23. The board has announced dividend of Rs 3.20 per share for FY23.

Coromandel international: The fertiliser company has recorded a 15% year-on-year decline in consolidated profit at Rs 246.44 crore for quarter ended March FY23, dented by contraction in operating profit margin. Revenue from operations remained strong, rising 29.5% to Rs 5,476 crore compared to year-ago period. At the operating level, EBITDA (earnings before interest, tax, depreciation and amortisation) in Q4FY23 increased by 6.2% YoY to Rs 403.2 crore, but margin fell by 160 bps to 7.4% compared to corresponding period last fiscal. The company announced a final dividend of Rs 6 per share for FY23.

Uttam Sugar Mills: The double refined sugar producer has recorded a 14.6% year-on-year growth in profit at Rs 70 crore for March FY23 quarter, driven by better operating performance. Revenue from operations at Rs 527.4 crore increased by 7.5% over a year-ago period, with growth across segments - sugar, cogeneration, and distillery. EBITDA in Q4 grew by 16% to Rs 111.7 crore with margin expansion of 153 bps to 21.18% compared to same period last year.

PVR Inox: The multiplex chain operator has reported first quarterly earnings performance after merged entity, posting consolidated loss of Rs 333.4 crore for quarter ended March FY23. Consolidated revenue from operations for the quarter stood at Rs 1,143.2 crore and EBITDA at Rs 263.9 crore with margin at 23.1 percent. It had one-time loss of Rs 10.8 crore for the quarter. The board has approved fund raising up to Rs 100 crore through issuance of non-convertible debentures, in one or more tranches, on a private placement basis.

Astral: The CPVC pipes and fitting manufacturer has reported a massive 45.5% year-on-year growth in consolidated profit at Rs 205.7 crore for quarter ended March FY23, driven by healthy operating performance. Revenue from operations for the quarter grew by 8.3% to Rs 1,506.2 crore compared to same period last year with plumbing business growing 3.6% and paints & adhesives business showing a 25% growth. On the operating front, EBITDA surged 42.5% YoY to Rs 309 crore with margin expansion of 490 bps at 20.5% in Q4FY23.

Wipro: Its FullStride Cloud Studio has partnered with Google Cloud’s Rapid Migration Program (RaMP) to help clients accelerate their journey to the cloud and pursue a migration strategy anchored in business outcomes. This partnership with Google builds on Wipro’s existing collaboration with Google and Google Cloud Professional Services Organization. This partnership aims to deepen the value delivered to joint clients.

Procter & Gamble Health: The vitamins, minerals, and supplements manufacturer has recorded a 15.7% year-on-year growth in profit at Rs 59.2 crore for quarter ended March FY23. Revenue from operations for the quarter grew by 19.8% to Rs 321 crore compared to year-ago period.

HCL Technologies: The technology company announced the expansion of its long-standing partnership with SAP to drive digital transformation for enterprises. As part of the expanded collaboration, HCL has become a customer of and a global strategic service partner for SAP SuccessFactors Human Experience Management Suite.

Suryoday Small Finance Bank: The bank has recorded profit at Rs 38.9 crore for quarter ended March FY23, against loss of Rs 48.1 crore in year-ago period as provisions and contingencies dropped 54% in same period. Net interest income grew by 43.5% to Rs 210.1 crore compared to same period last fiscal, with gross advances rising 20.7% and deposits growth at 34.2%. Asset quality improved with the gross non-performing assets (NPA) falling 110 bps QoQ to 3.13% and net NPA declining 119 bps to 1.55% for the quarter.

Emkay Global Financial Services: The company has posted standalone loss at Rs 3.7 crore for March FY23 quarter, against profit of Rs 1.4 crore in same period last fiscal. Revenue from operations for the quarter at Rs 39.7 crore declined by 0.7% compared to corresponding period last fiscal.

Ugro Capital: The non-banking finance company has registered a 130.77% year-on-year growth in profit at Rs 14.04 crore for March FY23 quarter. Total income for the quarter grew by 92.44% to Rs 217.2 crore compared to same quarter previous fiscal.

NGL Fine-Chem: The pharmaceutical company has recorded a 35.8% year-on-year growth in consolidated profit at Rs 9.3 crore for quarter ended March FY23, driven by strong operating performance. Raw material cost and finance cost declined sharply YoY. Revenue from operations in Q4 fell by 12% to Rs 73.9 crore compared to year-ago period.

Home First Finance Company India: Norges Bank on Account of the Government Pension Fund Global acquired 21 lakh equity shares in the company via open market transactions at an average price of Rs 700 per share, and Societe Generale bought 7.1 lakh shares at same average price. However, Orange Clove Investments BV sold 18.85 lakh shares at an average price of Rs 700 per share, Aether Mauritius offloaded 11.31 lakh shares at Rs 700 per share, and True North Fund V LLP sold 16.97 lakh shares at an average price of Rs 700.97 per share.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc