K Karthik Raja - Bombay Stock Exchange - Webinar - Rupeedesk - 31.01.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, January 30, 2023

K Karthik Raja - Bombay Stock Exchange - Webinar - Rupeedesk - 31.01.2023

Global-Market Updates - 31.01.2023

Global-Market Updates - 31.01.2023

Earning Results Corner - 31.01.2023

Earning Results Corner - 31.01.2023

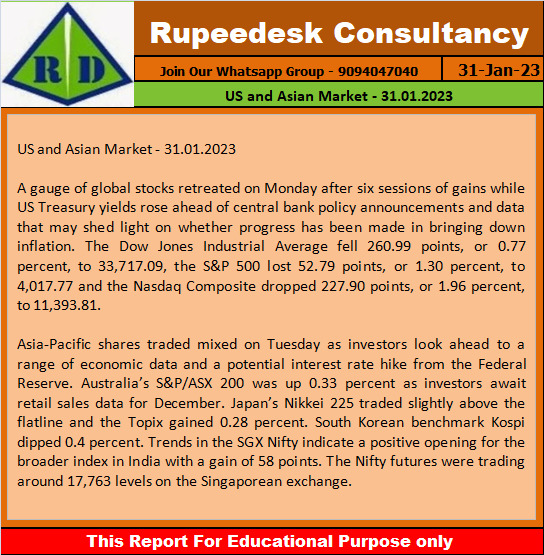

US and Asian Market - 31.01.2023

US and Asian Market - 31.01.2023

Stock to Watch Today - Rupeedesk Reports - 31.01.2023

Stock to Watch Today - Rupeedesk Reports - 31.01.2023

Buzzing Stocks: Larsen & Toubro, Tech Mahindra, Coal India, and others in news today.

Results on January 31: Coal India to be in focus ahead of its quarterly earnings scheduled to be published on January 31. Besides CIL, Power Grid Corporation of India, Sun Pharmaceutical Industries, UPL, ACC, BASF India, Blue Star, Edelweiss Financial Services, Great Eastern Shipping, Godrej Consumer Products, Indian Hotels, Indian Oil Corporation, Jindal Steel & Power, KEC International, KPIT Technologies, Max Financial Services, MOIL, RailTel Corporation of India, Spandana Sphoorty Financial, Star Health, and TTK Prestige will release their earnings reports for the December quarter today.

Larsen & Toubro: The infrastructure major has reported a robust 24% year-on-year growth in consolidated profit at Rs 2,553 crore despite weak operating margin performance. Consolidated revenues at Rs 46,390 crore for the quarter grew by 17% YoY aided by improved execution in the infrastructure projects segment and continued growth momentum in the IT&TS portfolio. The company received orders worth Rs 60,710 crore during the quarter, a 21% YoY growth, taking the consolidated order book to Rs 3.86 lakh crore as of December FY23.

Tech Mahindra: The IT services company has clocked a 0.9% sequential growth in consolidated profit at Rs 1,297 crore for quarter ended December FY23, with revenue rising 4.6% QoQ to Rs 13,735 crore, beating analysts' estimates. Revenue in dollar terms grew by 1.8% QoQ to $1,668 million with constant currency revenue growth at 0.2%. Operating numbers were ahead of expectations while deal wins at $795 million for the quarter.

Bharat Petroleum Corporation: The state-owned oil retailer clocked standalone profit at Rs 1,960 crore for December FY23 quarter against loss of Rs 304.2 crore in previous quarter, with strong operating performance with fall in oil prices. Revenue grew by nearly 4% sequentially to Rs 1.19 lakh crore.

UltraTech Cement: UAE subsidiary UltraTech Cement Middle East Investments has signed agreement to acquire 70% stake in Duqm Cement Project International, LLC, Oman, for $2.25 million.

Trident: The company reported a 32% year-on-year decline in consolidated profit at Rs 144.2 crore for quarter ended December FY23, impacted by weak topline and operating performance. Revenue from operations at Rs 1,641 crore fell by 17% compared to year-ago period.

Life Insurance Corporation of India: LIC's total holding under equity and debt is Rs 35,917.31 crore under Adani group of companies as of December FY23. The total purchase value of equity under all the Adani group companies is Rs 30,127 crore and the market value for the same as at close of market hours on January 27 was Rs 56,142 crore.

Inox Leisure: The multiplex chain operator has reported a net loss of Rs 40.4 crore for quarter ended FY23 against loss of Rs 1.3 crore in same period last year, impacted by exceptional loss related to amalgamation expenses. Revenue grew by 74% YoY to Rs 515.6 crore for the quarter, with highest ever quarterly average ticket price of Rs 230 and highest ever quarterly spends per head at Rs 106.

KEC International: The infrastructure EPC major and an RPG Group company secured new orders of Rs 1,131 crore across various businesses including transmission and distribution, and civil. With these orders, the YTD order intake stands at over Rs 15,500 crore, a growth of 10% YoY.

Astec Lifesciences: The company has received board approval to raise funds - Rs 50 crore - through issuance of non-convertible debentures (NCD) for expansion and development of business operations and meeting the short term and long-term financial requirements. The company recorded consolidated profit at Rs 0.85 crore for quarter ended December FY23, falling 97% YoY on lower topline. Revenue from operations at Rs 117.2 crore for the quarter grew by 32.4% YoY.

Adani Enterprises: International Holding Company, the diversified Abu Dhabi-based conglomerate, will be investing $400 million into Adani Enterprises' further public offering (FPO), through its subsidiary Green Transmission Investment Holding RSC Limited. The Rs 20,000 crore FPO subscribed 3% on second day of bidding.

Cupid: The company reported a massive 302% year-on-year growth in profit at Rs 10.03 crore for December FY23 quarter aided by healthy operating performance. Revenue from operations grew by 16% YoY to Rs 42.9 crore for the quarter.

Dhampur Sugar Mills: The sugar company has registered a 20% year-on-year fall in profit at Rs 46.4 crore for quarter ended December FY23 with 14% decline in operating profit and tepid topline. Revenue from operations grew by 2% YoY to Rs 642 crore for the quarter.

Orient Electric: The company recorded a 14.5% year-on-year decline in profit at Rs 32.56 crore for December FY23 quarter, impacted by weak operating performance. Revenue from operations at Rs 739 crore for the quarter increased by 9% over a year-ago period.

IIFL Finance: The company has clocked a massive 37% year-on-year growth in profit at Rs 423.2 crore for quarter ended December FY23, with revenue from operations rising 18% YoY to Rs 2,121 crore for the quarter. Pre-provision operating profit at Rs 773 crore grew by 26% YoY. Overall core loan portfolio grew by 26% YoY, but non-core (primarily construction & real estate finance) portfolio shrunk by 7%. Asset quality improved with gross non-performing assets (NPA) falling 30 bps QoQ to 2.1% and net NPA declining 10 bps QoQ to 1.1% for the quarter.

Mangalore Refinery & Petrochemicals: The subsidiary of ONGC has posted standalone loss of Rs 188 crore for December FY23 quarter, narrowing from loss of Rs 1,789 crore in previous quarter with improving operating performance. Revenue from operations grew by 8% QoQ to Rs 26,557.4 crore for the quarter.

REC: The power projects finance company has recorded a 4% year-on-year growth in standalone profit at Rs 2,878 crore for quarter ended December FY23, with weak topline. Standalone revenue from operations at Rs 9,695 crore fell by 3.1% compared to year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

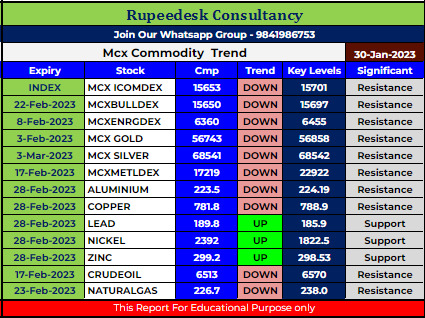

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.01.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 30.01.2023

Currency Market Intraday Trend Rupeedesk Reports - 30.01.2023

Currency Market Intraday Trend Rupeedesk Reports - 30.01.2023

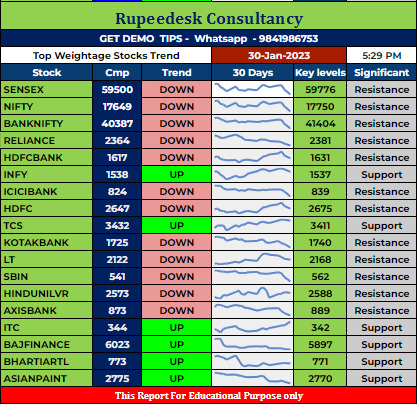

Top Weightage Stocks Trend Rupeedesk Reports - 30.01.2023

Top Weightage Stocks Trend Rupeedesk Reports - 30.01.2023

Market Highlights - 30.01.2023

Market Highlights - 30.01.2023

US Dollar Trend Update - Rupeedesk Reports - 30.01.2023

US Dollar Trend Update - Rupeedesk Reports - 30.01.2023

DATAPATTNS Stock Analysis - Rupeedesk Reports - 30.01.2023

DATAPATTNS Stock Analysis - Rupeedesk Reports - 30.01.2023

MCX to soon restart trading in cotton futures, textile secretary says - Rupeedesk Reports - 30.01.2023

MCX to soon restart trading in cotton futures, textile secretary says - Rupeedesk Reports - 30.01.2023

New competition law may allow settlement route to business cartels - Rupeedesk Reports - 30.01.2023

New competition law may allow settlement route to business cartels - Rupeedesk Reports - 30.01.2023

Rebound in Adani stocks vital for the success of Adani Enterprises FPO - Rupeedesk Reports - 30.01.2023

Rebound in Adani stocks vital for the success of Adani Enterprises FPO - Rupeedesk Reports - 30.01.2023

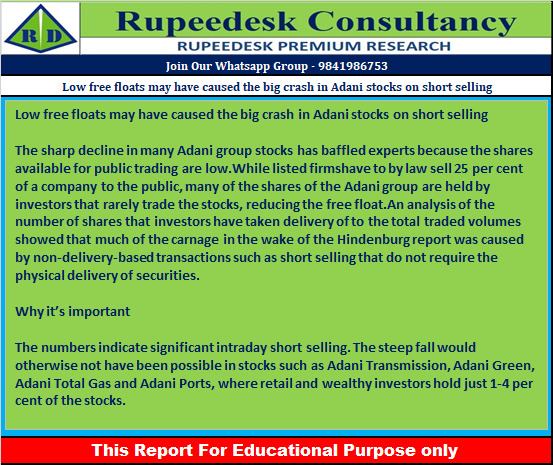

Low free floats may have caused the big crash in Adani stocks on short selling - Rupeedesk Reports - 30.01.2023

Low free floats may have caused the big crash in Adani stocks on short selling - Rupeedesk Reports - 30.01.2023

Central government to prioritize 18 road projects in Gati Shakti push - Rupeedesk Reports - 30.01.2023

Central government to prioritize 18 road projects in Gati Shakti push - Rupeedesk Reports - 30.01.2023

Tata Trusts to set up endowment funding entities to increase charitable spending - Rupeedesk Reports - 30.01.2023

Tata Trusts to set up endowment funding entities to increase charitable spending - Rupeedesk Reports - 30.01.2023

Lower operating profits keep corporate India’s earnings muted in December quarter - Rupeedesk Reports - 30.01.2023

Lower operating profits keep corporate India’s earnings muted in December quarter - Rupeedesk Reports - 30.01.2023

All eyes on growth as Nirmala Sitharaman prepares her final full-year budget on February 1 - Rupeedesk Reports - 30.01.2023

All eyes on growth as Nirmala Sitharaman prepares her final full-year budget on February 1 - Rupeedesk Reports - 30.01.2023