Nifty Futures Significant levels - 17.09.2020

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Wednesday, September 16, 2020

Nifty Futures Significant levels - 17.09.2020

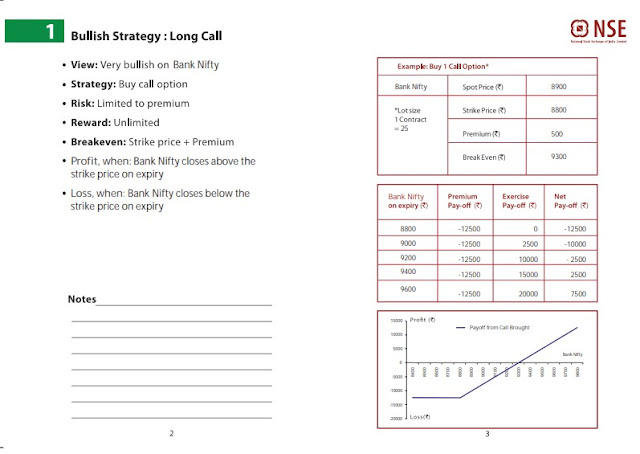

Banknifty Option Strategy - Bullish Strategy - LONG CALL

Free Stock Options Tips : Join Whatsapp : 9841986753

Free Stock Options Tips : Join Whatsapp : 9841986753

Free Nifty Options Tips : Join Whatsapp : 9841986753

Free BankNifty Options Tips : Join Whatsapp : 9841986753

WHY TO TRADE IN OPTIONS ?

* To safe-guard your investments - Its most important that you do not loose your capital invested in

shares. Options provide you excellent techniques to hedge your investments. So markets may fall,

rise or remain static, losses can always be avoided.

* To earn Regular and Consistent returns month after month - Need not wait for months or years to

get some returns from your portfolio. You can take good returns every month if you trade smartly

through options.

* To leverage your investments - You can start trading with small capital and slowly and steadily build

capital from markets. Options give you big exposure with small investment only.

* Flexibility to device your own strategies - Learn the standard strategies and then device your own

strategies that suit your investment style , risk appetite and knowledge.

Nifty-Sensex View - 17.09.2020: 09.00 Am

Nifty-Sensex View - 17.09.2020: 09.00 Am

Stocks to Watch; RIL, Infosys, Pharma Stocks, BPCL, Motherson Sumi : 17.09.2020

Stocks to Watch; RIL, Infosys, Pharma Stocks, BPCL, Motherson Sumi : 17.09.2020

Computer Age Management Services Ltd IPO (CAMS IPO) - Sep21 - Sep23 ) 2020

CAMS IPO: Price band set at Rs 1,229-1,230/share

The company is going to raise Rs 2,240-2,242 crore from the public issue.

Computer Age Management Services (CAMS) has fixed the price band for its public offer at Rs 1,229-1,230 per share on September 16.

The IPO is set to open for subscription on September 21 and will close on September 23. The bidding by anchor investors will take place for a day on September 18.

The initial public offering consists an offer for sale of 1,82,46,600 equity shares by the NSE Investments, the subsidiary of National Stock Exchange of India.

In fact, SEBI had asked NSE to divest entire stake in the firm.

CAMS, which is the largest registrar and transfer agent of mutual funds with an aggregate market share of approximately 70 percent based on mutual fund average assets under management, has reserved 1,82,500 equity shares for employees who will get these shares at a discount of Rs 122 per equity share. Bids can be made for a minimum 12 equity shares and in multiples of 12 shares thereafter.

The company is going to raise Rs 2,240-2,242 crore at lower-upper end of price band respectively.

CAMS is a technology-driven financial infrastructure and services provider to mutual funds and other financial institutions with over two decades of experience. CAMS charges a percentage of AUM to AMC and charges more fees from equity mutual funds as compared to other categories of mutual funds.

"Change in the mix of the mutual fund industry towards higher equity and the buoyant market will be beneficial for CAMS revenue growth. Considering a healthy balance sheet, high return ratio, and market leadership position, IPO will see strong interest across market participants,"

"CAMS business model is asset-light, earnings are generously distributed among shareholders. It reported return on equity of more than 25 percent,"

The offer would constitute at least 37.40 percent of post-offer paid-up equity share capital.

Great Terrain, an affiliate of Warburg Pincus, held 43.50 percent equity stake in the company at the time of filing RHP on September 11, while NSE Investment held 37.48 percent, HDFC group held 12.51 percent, Faering Capital India around 4 percent and Acsys 1.94 percent.

Equity shares will get listed on the BSE. Kotak Mahindra Capital Company, HDFC Bank, ICICI Securities and Nomura Financial Advisory and Securities (India) are the book running lead managers to the issue. Link Intime India is the registrar to the issue.

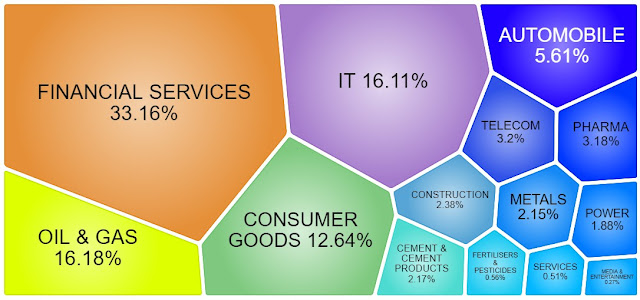

Nifty Index Sector Weightage as on Sep2020

Nifty Index Sector Weightage as on Sep2020

Free Stock Options - Rupeedesk

Free Stock Option tips (Call and Put) - RupeeDesk Free Indian stocks Option tips ,Nifty Options Tips,Free stock Call Option and free stock put options, Nifty Put Option with 90% accuracy Free Stock and Nifty Tips, Live Option Market Quotes,Online Option Trading Tips,Stock,rupeedesk Option Tips, Prices,Nifty Option Quotes. (Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

Market Highlights - 16.09.2020

Market Highlights - 16.09.2020

Mcx Commodity Trend at 2.00 Pm - 16.09.2020

Mcx Commodity Trend at 2.00 Pm - 16.09.2020

Free Stock Options - Rupeedesk

Free Stock Option tips (Call and Put) - RupeeDesk Free Indian stocks Option tips ,Nifty Options Tips,Free stock Call Option and free stock put options, Nifty Put Option with 90% accuracy Free Stock and Nifty Tips, Live Option Market Quotes,Online Option Trading Tips,Stock,rupeedesk Option Tips, Prices,Nifty Option Quotes. (Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

Price and Volume increase in Small cap - Buying Strength - 16.09.2020

Price and Volume increase in Small cap - Buying Strength - 16.09.2020

Free Stock Options - Rupeedesk

Free Stock Option tips (Call and Put) - RupeeDesk Free Indian stocks Option tips ,Nifty Options Tips,Free stock Call Option and free stock put options, Nifty Put Option with 90% accuracy Free Stock and Nifty Tips, Live Option Market Quotes,Online Option Trading Tips,Stock,rupeedesk Option Tips, Prices,Nifty Option Quotes. (Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)