Changes in tax regime set to broaden taxpayer base and improve collections - Rupeedesk Reports - 07.02.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, February 6, 2023

Changes in tax regime set to broaden taxpayer base and improve collections - Rupeedesk Reports - 07.02.2023

Prime Minister woos oil and gas investors during first India Energy Week - Rupeedesk Reports - 07.02.2023

Prime Minister woos oil and gas investors during first India Energy Week - Rupeedesk Reports - 07.02.2023

India’s pharmaceuticals sector may soon get research linked incentives - Rupeedesk Reports - 07.02.2023

India’s pharmaceuticals sector may soon get research linked incentives - Rupeedesk Reports - 07.02.2023

Many firms specializing in distressed debt snaps up Adani Group’s dollar bonds - Rupeedesk Reports - 07.02.2023

Many firms specializing in distressed debt snaps up Adani Group’s dollar bonds - Rupeedesk Reports - 07.02.2023

Government objects to $3 billion Vedanta zinc business sale to Hindustan Zinc - Rupeedesk Reports - 07.02.2023

Government objects to $3 billion Vedanta zinc business sale to Hindustan Zinc - Rupeedesk Reports - 07.02.2023

India to sell sovereign green bonds worth up to Rs 16,000 crore by September - Rupeedesk Reports - 07.02.2023

India to sell sovereign green bonds worth up to Rs 16,000 crore by September - Rupeedesk Reports - 07.02.2023

Indian rupee declines 1 per cent on fears that US Fed will raise rates on jobs data - Rupeedesk Reports - 07.02.2023

Indian rupee declines 1 per cent on fears that US Fed will raise rates on jobs data - Rupeedesk Reports - 07.02.2023

Market regulator can access all Mauritius information on Adani Group and its affiliates - Rupeedesk Reports - 07.02.2023

Market regulator can access all Mauritius information on Adani Group and its affiliates - Rupeedesk Reports - 07.02.2023

Adani Group shares continue to lose value on stock exchanges, some firms rise - Rupeedesk Reports - 07.02.2023

Adani Group shares continue to lose value on stock exchanges, some firms rise - Rupeedesk Reports - 07.02.2023

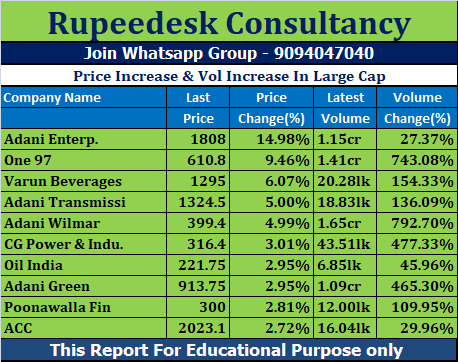

Price Increase & Vol Increase In Large Cap - 07.02.2023

Price Increase & Vol Increase In Large Cap - 07.02.2023

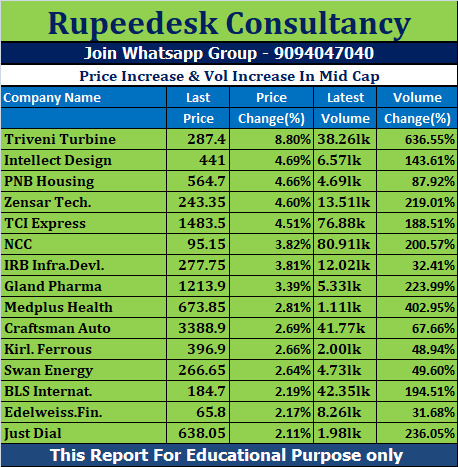

Price Increase & Vol Increase In Mid Cap - 07.02.2023

Price Increase & Vol Increase In Mid Cap - 07.02.2023

Price Increase & Vol Increase In Small Cap - 07.02.2023

Price Increase & Vol Increase In Small Cap - 07.02.2023

Adani prepays $1.1 billion worth of loans backed by share pledges - Rupeedesk Reports - 07.02.2023

Adani prepays $1.1 billion worth of loans backed by share pledges - Rupeedesk Reports - 07.02.2023

US and Asian Market - 07.02.2023

US and Asian Market - 07.02.2023

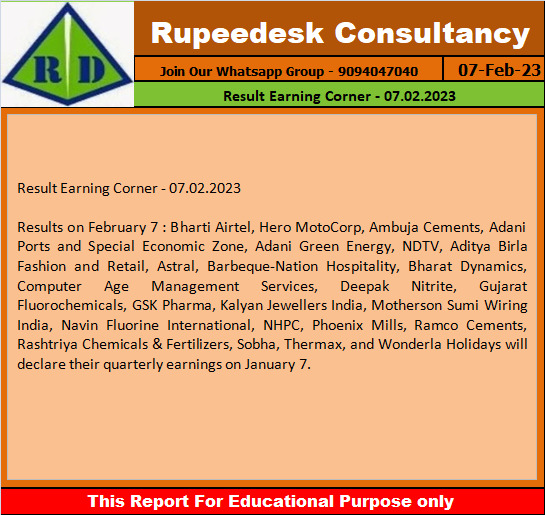

Result Earning Corner - 07.02.2023

Result Earning Corner - 07.02.2023

Stock to Watch Today - Rupeedesk Reports - 07.02.2023

Stock to Watch Today - Rupeedesk Reports - 07.02.2023

Buzzing Stocks: Bharti Airtel, Tata Steel, LIC Housing Finance and others in news today.

Results on February 7: Bharti Airtel to be in focus ahead of its quarterly earnings scheduled to be declared on February 7. Hero MotoCorp, Ambuja Cements, Adani Ports and Special Economic Zone, Adani Green Energy, NDTV, Aditya Birla Fashion and Retail, Astral, Barbeque-Nation Hospitality, Bharat Dynamics, Computer Age Management Services, Deepak Nitrite, Gujarat Fluorochemicals, GSK Pharma, Kalyan Jewellers India, Motherson Sumi Wiring India, Navin Fluorine International, NHPC, Phoenix Mills, Ramco Cements, Rashtriya Chemicals & Fertilizers, Sobha, Thermax, and Wonderla Holidays are among others to share their quarterly earnings on February 7.

Tata Steel: The Tata Group company has posted consolidated loss of Rs 2,502 crore for quarter ended December FY23, against profit of Rs 9,598 crore in year-ago period, impacted by sharp drop in realisations and spreads in Europe. Revenue for the quarter fell 6.1% YoY to Rs 57,083.6 crore with fall in India as well as Europe businesses. On the operating front, EBITDA plunged 74.5% YoY to Rs 4,048 crore and margin dropped 1,906 bps to 7.09% for the quarter. Overall numbers, barring topline, missed analysts' estimates.

LIC Housing Finance: The housing finance company has recorded profit at Rs 480 crore for quarter ended December FY23, down by 37.4% percent compared to year-ago period, impacted by impairment on financial instruments. Net interest income grew by 10.4% year-on-year to Rs 1,605.9 crore for the quarter.

Muthoot Finance: The gold loan financing company has registered a 12.4% year-on-year decline in standalone profit at Rs 902 crore for three-month period ended December FY23 despite fall in impairment on financial instruments, as net interest income fell nearly 10% to Rs 1,704 crore compared to year-ago period.

JK Paper: The paper manufacturer has recorded a 119% year-on-year increase in consolidated profit at Rs 329.3 crore for three-month period ended December FY23, as revenue grew by 60.5% YoY to Rs 1,643 crore for the quarter. On the operating front, EBITDA surged 125% YoY to Rs 565.5 crore and margin expanded by 985 bps to 34.4% in Q3FY23.

UltraTech Cement: The cement major has announced commissioning of 1.5 mpta brownfield cement grinding unit at Jharsuguda in Odisha, taking the total cement capacity in Odisha to 4.1mtpa. With this commissioning, company's total cement manufacturing capacity in India now stands at 122.85 mtpa.

Grasim Industries: The board members of the company has given their approval for appointment of Ananyashree Birla & Aryaman Vikram Birla as additional directors (non-executive directors). Yazdi Piroj Dandiwala is also appointed as an additional director (independent director).

BLS International Services: The company has reported robust earnings for quarter ended December FY23 with profit growing 62% year-on-year to 45.85 crore on strong operating performance. Revenue for the quarter grew by 93% YoY to Rs 438 crore led by sharp recovery in visa & consular business, and increase in revenue from ZMPL. On the operating front, EBITDA at Rs 66.3 crore increased by 160% YoY in Q3FY23 with margin rising 390 bps to 15.1% on improvement in operational efficiencies.

Nuvoco Vistas Corporation: The cement company has narrowed its loss to Rs 75.3 crore for December FY23 quarter, from loss of Rs 85.5 crore in same period last year. Higher input cost, power & fuel expenses, and freight & forwarding cost impacted bottomline. Revenue for the quarter at Rs 2,605 crore grew by 20.3% over a year-ago period with increase in sales volume by 6% and better prices. At the operating level, EBITDA increased by 18.2% YoY to Rs 268.3 crore but margin fell by 18 bps to 10.3% for the quarter.

Vakrangee: The Reserve Bank of India has provided the renewal of authorization for the company and extended the validity of authorization issued to setup, own and operate the white label atms (WLA) in India till March 31, 2024. It has 6,283 white label ATMs by January 2023) and 77% of these outlets are in Tier 4 and 6 locations.

Kirloskar Ferrous Industries: The company has announced the commissioning of its second coke oven plant in Koppal, Karnataka. The plant has production capacity of 2 lakh metric tonnes per annum. After commencement of operations of said plant, total production capacity of coke increased to 4 lakh Metric Tonnes per annum. Coke will be used mainly for captive consumption.

SJVN: The state-owned hydroelectric power generation company has recorded profit at Rs 287.42 crore for three months period ended December FY23, up 22% YoY despite weak operating performance and higher finance cost, mainly supported by other income. Revenue for the quarter at Rs 552 crore grew by half a percent, but EBITDA fell 0.7% to Rs 380.56 crore and margin declined by 88 bps to 68.94% for the quarter YoY.

Tejas Networks: The networking equipment maker has managed to narrow its consolidated loss to Rs 10.9 crore for quarter ended December FY23, against loss of Rs 24.3 crore led by healthy topline and profit at operating level. Revenue for the quarter at Rs 274.55 crore grew by 156% YoY. Company reported EBITDA profit of Rs 8 crore for the quarter against EBITDA loss of Rs 28.3 crore in year-ago period.

Action Construction Equipment: The construction equipment manufacturer has recorded a 70% year-on-year growth in consolidated profit at Rs 46.5 crore for December FY23 quarter, driven by healthy topline and operating performance. Revenue at Rs 556.33 crore for the quarter grew by 27.4% YoY. At the operating level, EBITDA jumped 57% YoY to Rs 61.86 crore and margin improved by 208 bps to 11.1% for the quarter.

Indo Count Industries: The home textile bed linen manufacturer has recorded a 47% year-on-year decline in consolidated profit at Rs 37.71 crore for quarter ended December FY23, impacted by weak topline and operating performance. Revenue for the quarter at Rs 657.3 crore fell by 13% compared to year-ago period. At the operating level, EBITDA dropped 36.67% YoY to Rs 73.35 crore and margin fell 410 bps to 11.2% for the quarter.

Monte Carlo Fashions: The retail clothing chain has reported consolidated profit at Rs 86.3 crore for three months period ended December FY23, growing 11.4% over a year-ago period, partly hit by higher input cost. Revenue for the quarter at Rs 519.54 crore increased by 12.5% YoY. On the operating front, EBITDA grew by 14.5% YoY to Rs 130.12 crore and margin rose by 43 bps to 25.04% for the quarter.

Balaji Amines: The specialty chemicals company has registered a 30% year-on-year decline in consolidated profit at Rs 62.6 crore for quarter ended December FY23, impacted by higher input cost. Revenue for the quarter at Rs 586 crore increased by 3.7% over a year-ago period. On the operating front, EBITDA fell nearly 18% YoY to Rs 128 crore and margin weakened by 567 bps to 21.8% for the quarter YoY.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc