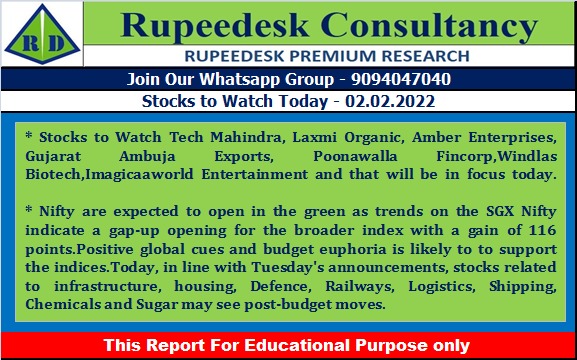

Buzzing Stocks: Tech Mahindra, Laxmi Organic, Amber Enterprises, and others in news today

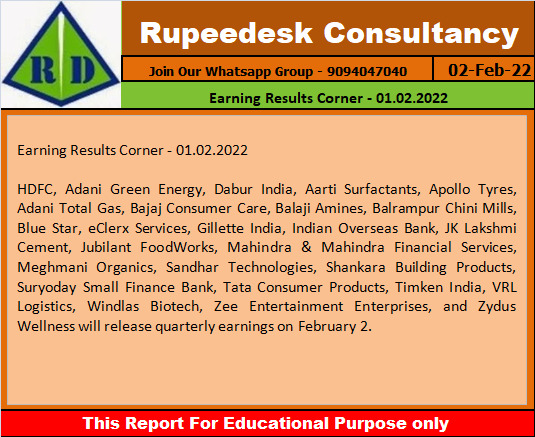

Results on February 2 | HDFC, Adani Green Energy, Dabur India, Aarti Surfactants, Apollo Tyres, Adani Total Gas, Bajaj Consumer Care, Balaji Amines, Balrampur Chini Mills, Blue Star, eClerx Services, Gillette India, Indian Overseas Bank, JK Lakshmi Cement, Jubilant FoodWorks, Mahindra & Mahindra Financial Services, Meghmani Organics, Sandhar Technologies, Shankara Building Products, Suryoday Small Finance Bank, Tata Consumer Products, Timken India, VRL Logistics, Windlas Biotech, Zee Entertainment Enterprises, and Zydus Wellness will release quarterly earnings on February 2.

Tech Mahindra | The company reported higher consolidated profit at Rs 1,378.2 crore in Q3FY22 against Rs 1,340.9 crore in Q2FY22, revenue rose to Rs 11,450.8 crore from Rs 10,881.3 crore QoQ.

Laxmi Organic Industries | The company reported higher consolidated profit at Rs 82.09 crore in Q3FY22 against Rs 45.21 crore in Q3FY21, revenue jumped to Rs 859.87 crore from Rs 435.5 crore YoY.

Amber Enterprises India | The company has entered into the definitive agreements with Pravartaka Tooling Services and acquired 60 percent stake in Pravartaka, which is engage in the business of injection mould tool manufacturing and injection moulding components manufacturing for various industries.

Gujarat Ambuja Exports | The company reported lower consolidated profit at Rs 105.13 crore in Q3FY22 as against Rs 109.62 crore in Q3FY21, revenue rose to Rs 1,238 crore from Rs 1,211.20 crore YoY.

Poonawalla Fincorp | The company reported higher consolidated profit at Rs 96.47 crore in Q3FY22 as against Rs 12.99 crore in Q3FY21, revenue fell to Rs 507.96 crore from Rs 589.33 crore YoY.

Windlas Biotech | The company concluded SAHPRA (South African Health Products Regulatory Authority) inspection audit report for the Plant-IV situated at Dehradun with zero critical observations/ deficiencies, zero major deficiencies and some minor deficiencies.

Imagicaaworld Entertainment | The company will re-open its Park from February 4.

Ceinsys Tech | Chanchal Bhaiyya has tendered his resignation from the post of Chief Financial Officer of the company due to personal reasons.

Anupam Rasayan | The company will acquire 24.96 percent stake in Tanfac Industries from Birla Group Holdings and Others.

Bharat Forge | The company, along with subsidiary Bharat Forge International (BFIL), has acquired an additional 3,66,451 equity shares of Tevva Motors (Jersey), after the conversion of convertible loan note (CLN). As a result, the shareholding of the company increased to 39.71 percent in Tevva.

VIP Industries | The company reported a consolidated profit of Rs 33.47 crore in Q3FY22 against loss of Rs 7 crore in Q3FY21, revenue rose to Rs 397.34 crore from Rs 232.53 crore YoY.

ASM Technologies | The company and Hind High Vacuum formed a joint venture for semiconductor equipment manufacturing.

MMTC | The government approved Tata Steel Long Products as a strategic buyer for privatization of Neelachal Ispat Nigam, a joint venture of 4 CPSEs (MMTC, NMDC, BHEL, MECON) and 2 Odisha government PSUs (OMC and IPICOL).

Virtual Global Education | Board of Directors of the company will consider Rights Issue on February 11.

Eicher Motors | Royal Enfield sold 58,838 motorcycles in January 2022, down 15 percent compared to 68,887 motorcycles sold in January 21.

Adani Ports & Special Economic Zone | The company reported lower consolidated profit at Rs 1,478.76 crore in Q3FY22 against Rs 1,576.53 crore in Q3FY21, revenue increased to Rs 3,797.10 crore from Rs 3,746.49 crore YoY.

Procter & Gamble Hygiene & Health Care | The company reported profit at Rs 212.06 crore in Q2FY22 against Rs 250.62 crore in Q2FY21, revenue rose to Rs 1,092.98 crore from Rs 1,018.44 crore YoY.

Indian Hotels | The company reported consolidated profit at Rs 95.96 crore in Q3FY22 against loss of Rs 133.22 crore in Q3FY21, revenue jumped to Rs 1,111.22 crore from Rs 559.86 crore YoY.

Sona BLW Precision Forgings | The company reported higher consolidated profit at Rs 86.44 crore in Q3FY22 against Rs 83.48 crore in Q3FY21, revenue rose to Rs 494.15 crore from Rs 489.29 crore YoY.

Triveni Turbine | The company reported higher consolidated profit at Rs 35.67 crore in Q3FY22 against Rs 27.54 crore in Q3FY21, revenue rose to Rs 225.15 crore from Rs 173.56 crore YoY.