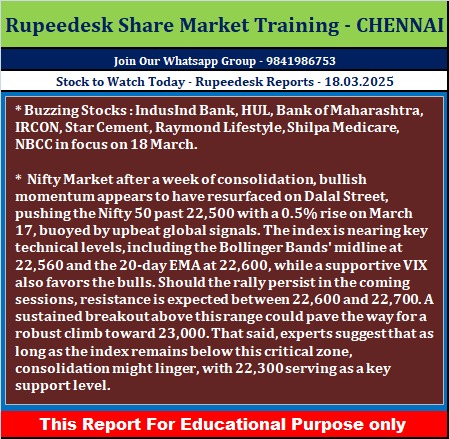

Buzzing Stocks : IndusInd Bank, HUL, Bank of Maharashtra, IRCON, Star Cement, Raymond Lifestyle, Shilpa Medicare, NBCC in focus on 18 March.

IndusInd Bank : Moody’s Ratings has affirmed IndusInd Bank's credit ratings, placing the Baseline Credit Assessment (BCA) on review for downgrade. The rating agency maintained a stable outlook for the long-term foreign currency deposit ratings at Ba1.

Hindustan Unilever : The Competition Commission of India (CCI) has approved Hindustan Unilever's proposal to acquire the beauty and personal care brand Minimalist's parent company, Uprising Science.

Bank of Maharashtra : The Securities and Exchange Board of India (SEBI) has issued an administrative warning letter to the bank for the non-conduct of at least one meeting of the Nomination & Remuneration Committee in FY23 and FY24. The warning letter will not have any impact on the financial, operational, or other activities of the bank.

IRCON International : IRCON has received an EPC contract worth Rs 1,096.2 crore from the Government of Meghalaya. It has won this contract in a joint venture with Badri Rai and Company, with IRCON holding a 26% share and Badri Rai holding 74%. The contract involves the construction of a new Secretariat Complex, including campus infrastructure, on an engineering, procurement, and construction (EPC) basis in New Shillong city, Meghalaya.

Star Cement : The company's subsidiary, Star Cement Meghalaya, has been declared the preferred bidder for the composite license of the Boro Hundong Limestone Block in e-auctions conducted by the Government of Assam. This block covers an area of 400 hectares, with an estimated limestone resource of 146.75 million tonnes.

Raymond Lifestyle : Raymond Lifestyle will replace ICICI Securities in Nifty 500, Nifty Smallcap 250, Nifty MidSmallcap 400 indices, effective March 21, especially after the NSE announced suspension of trading in equity shares of ICICI Securities.

Aditya Birla Real Estate : The company's subsidiary, Birla Estates, launched its first project in Pune, Birla Punya, with an estimated revenue potential value of Rs 2,700 crore. This is the company’s first residential project in Pune, spread over 5.76 acres, and will feature 1.6 million square feet of saleable area.

Samvardhana Motherson International : The Board will meet on March 21 to consider and approve the declaration of an interim dividend for FY25.

NBCC (India) : The company has received a work order worth Rs 44.62 crore from the Mahatma Gandhi Institute for Rural Industrialisation (MGIRI), Wardha.

Coffee Day Enterprises : The company has negotiated with IDBI Trusteeship Services and agreed to settle the outstanding debt of the two debenture holders for Rs 205 crore, payable in three tranches.

Triveni Engineering & Industries : The company has reported an incident of an explosion at the CO2 plant at its Sabitgarh sugar unit in Uttar Pradesh. There were no casualties or loss of life reported. The cause of the explosion is yet to be ascertained. Further, business operations at the premises are not affected.

Morepen Laboratories : The company has launched Empamore for Type 2 Diabetes Mellitus (T2DM), heart failure with reduced ejection fraction (HFrEF), and chronic kidney disease (CKD).

Shilpa Medicare : The company's subsidiary, Shilpa Biologicals, has entered into a binding term sheet with Switzerland-based mAbTree Biologics AG for the development, manufacture, marketing, and sale of a new biological entity (NBE).

Life Insurance Corporation of India : The Board has approved the appointment of Shatmanyu Shrivastava as Chief Risk Officer of LIC, effective March 19.

Suryoday Small Finance Bank : Baskar Babu Ramachandran, the Promoter and Managing Director & CEO of the bank, has purchased 1.5 lakh equity shares from the open market. Post the transaction, the total promoter group holding in the bank will stand at 22.44%, up from 22.30% earlier. Baskar Babu Ramachandran’s individual holding increased to 5.18% from 5.04%.

Religare Enterprises : The Board has commissioned a governance review of Religare Enterprises and its subsidiaries, Religare Finvest (RFL) and Religare Housing Development Finance Corporation (RHDFCL). For conducting this review, the Board has resolved to engage a law firm, Trilegal, which will be assisted by Grant Thornton Bharat LLP. Further, the Board has reviewed the fund flow position of the company and observed a cash flow gap over the next few months. After examining various options, the Board has unanimously decided to approach the new promoters, the Burman Group, for immediate funding support to sustain the operations of the company.

Indian Renewable Energy Development Agency : The Board has approved the enhancement of the borrowing program for FY25 by Rs 5,000 crore. The borrowing limit for FY25 has been increased from Rs 24,200 crore to Rs 29,200 crore.

Gopal Snacks : The Board has appointed Rigan Hasmukhrai Raithatha as Chief Financial Officer of the company, effective March 17.

JM Financial : The Board has approved a Business Transfer Agreement with the company's subsidiary, JM Financial Services, for the transfer of the company's private wealth business through a slump sale on a going concern basis, for Rs 11.08 crore. The business transfer will become effective from April 1, 2025.

RITES : Ntokoto Rail Holdings Pty has awarded an additional work order to RITES for the supply and commissioning of overhauled in-service Cape Gauge ALCO Diesel Electric Locomotives fitted with new Cape Gauge bogies, traction motors, control systems, air brakes, etc., overhauled at the nominated facility, and on-site warranty support for one year. The revised order stands at $10.8 million (CIF), increasing from $5.40 million (CIF) earlier.

Tata Motors : The company has announced the incorporation of its wholly-owned subsidiary, Tata Motors Digita.AI Labs.

Motherson Sumi Wiring India : The Board will meet on March 21 to consider an interim dividend for FY25.

Alembic Pharmaceuticals : The company's subsidiary, Alembic Global Holding SA, has incorporated a wholly-owned subsidiary in the USA, named Alembic Lifesciences Inc.

SpiceJet : Promoter Ajay Singh sold 1.56% of his stake in the airline company at an average price of Rs 45 per share. However, Plutus Wealth Management LLP bought 0.58% of the stake in SpiceJet at the same price.

%20%E2%80%93%20Technical%20Analysis%20Report%20-%20Rupeedesk%20Share%20Market%20Training%20Chennai%20-%2017.03.2025.jpeg)