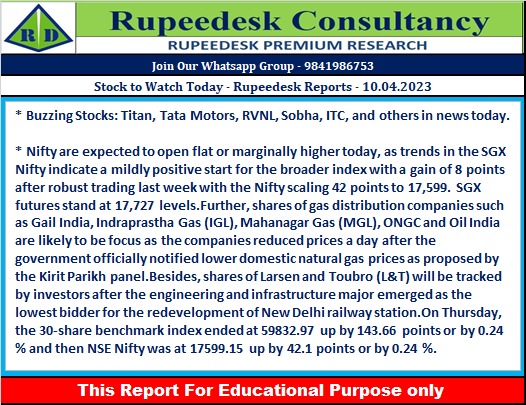

Stock to Watch Today - Rupeedesk Reports - 10.04.2023

Buzzing Stocks: Titan, Tata Motors, RVNL, Sobha, ITC, and others in news today.

Titan Company: The company recorded healthy double-digit growth across all of its key businesses, with revenues growing by 25% YoY aided by higher growth contributions from watches and wearables and emerging businesses. The base quarter of Q4FY22 carried the adverse impacts of partial lockdowns due to the Omicron wave and weak consumer sentiments caused by a fragile geo-political situation due to onset of Russia-Ukraine war. Jewellery business registered 23% growth in Q4 YoY, watches and wearables segment 41%, eyecare segment 22%, and emerging businesses 84% YoY.

Tata Motors: Jaguar Land Rover has registered a 30% year-on-year growth in retail sales at 1.02 lakh units for the quarter ended March FY23 driven by Europe (up 47% YoY), UK (up 42%), China (up 29%), Overseas (up 29%) and North America (up 12%), but for the full year, sales fell 6% to 3.54 lakh units compared to previous year. Wholesales (excluding China JV) in Q4 at 94,649 units grew by 24% YoY, and in FY23, increased by 9% to 3.21 lakh units compared to previous year. Order book remained strong at 2 lakh units as sales increased, reflecting strong client demand, particularly for Range Rover, Range Rover Sport and Defender.

NBCC: The NCLT has directed to dissolve NBCC Engineering & Consultancy Limited (NECL), a wholly owned subsidiary of NBCC, from the date of order i.e. March 16, 2023. In November 2020, the board had approved to close the NECL through winding-up.

Muthoot Finance: The gold loan financing company said board has declared an interim dividend of Rs 22 per share (face value Rs 10 each) for FY23. The total interim dividend outgo will amount to Rs 883.19 crore.

Century Textiles and Industries: Birla Estates, the real estate arm of the Aditya Birla Group housed under Century Textiles and Industries, has entered the Pune residential real estate market by acquiring 5.76 acres of land in Sangamwadi. The land was purchased from Sudarshan Chemical Industries (SCIL). The estimated revenue potential from this land parcel is approximately Rs 2,500 crore.

CreditAccess Grameen: The microfinance company has registered a 24% growth in Q4FY23 disbursements at Rs 7,171 crore compared to year-ago period. Its AUM (assets under management) increased by 27% to Rs 21,032 crore in the same period. Customers increased by 13% to 43.1 lakh as of March FY23 quarter, and branches at 1,782 rose by 9% over a year-ago period.

Axita Cotton: The company has received contract from Badsha Textiles, Bangladesh, for Indian raw cotton valuing $3.28 million (Rs 26.92 crore). Its current export order book as on April 6 stands at $6 million (Rs 49.20 crore).

Power Grid Corporation of India: The Committee of Directors on Investment on Projects of Power Grid has approved investment for transmission system for evacuation of power from Rajasthan REZ Ph-IV (Part-1) at an estimated cost of Rs 146.66 crore. The transmission system is scheduled to be commissioned by May 2024.

Gulshan Polyols: The company has received an order for supplying of country liquor for a quantity of 72 lakhs proof liter in three districts of Madhya Pradesh, for FY24. The tender was floated by Excise Department, Government of Madhya Pradesh.

Mahanagar Gas: The city gas distributor has reduced the retail price of CNG (compressed natural gas) by Rs 8 per kg to Rs 79 per kg and PNG (piped natural gas) by Rs 5 per scm (standard cubic metre) to Rs 49 per scm.

Indraprastha Gas: The company has slashed price of CNG by Rs 6 per kg to Rs 73.59 per kg in Delhi w.e.f. April 9.

Adani Total Gas: The city gas joint venture company of Adani group and French giant Total Energies has announced reduction in CNG price by up to Rs 8.13 per kg. It also reduced PNG price by up to Rs 5.06 per scm with effect from April 8.

Sobha: The south-based real estate firm has achieved highest ever quarterly sales value at Rs 1,463.4 crore for Q4FY23, up by 2.7% over Q3FY23 and 31.9% compared to Q4FY22. It also reported highest ever sales volume at 1.48 million square feet, growing 0.2% QoQ and 10.1% YoY. Average Price realization improved by 2.5% over Q3FY23 to Rs 9,898 per square feet and there was 19.8% growth over same period last year. Sobha’s share of quarterly sales value of Rs 1,207.4 crore is also at historical highest, up by 8.7% QoQ and 29.1% YoY.

ICICI Lombard General Insurance Company: The company has recorded 7 percent growth in total premium for March 2023 compared to same month last year. In FY23, premium growth was 17% and market share increased by 4 bps compared to FY22, reports CNBC-TV18.

Adani Wilmar: The food FMCG company has registered a year-on-year volume growth of close to 14% in FY23, which enabled it to cross Rs 55,000 crore of revenue for the year. It closed the financial year 2023 with around Rs 3,800 crore of revenue in Food & FMCG segment, a strong growth of about 40% YoY in volumes and 55% YoY in revenue terms, while seeding multiple new avenues of growth during the year.

Oil and Natural Gas Corporation: ONGC has acquired additional 23% stake in Mangalore SEZ, the multiproduct special economic zone, for Rs 40.3 crore. After the said acquisiton, ONGC's equity stake in Mangalore SEZ increased to 49%, from 26% earlier.

ITC: The FMCG major has divested its entire shareholding of 4.65 crore equity shares (of Rs 10 each) or 26% equity stake held in its joint venture company Espirit Hotels. With the stake sale, Espirit has ceased to be ITC's joint venture company.

PNC Infratech: The infrastructure company has received Letter of Acceptance for a project worth Rs 771.4 crore from Haryana Rail Infrastructure Development Corporation.

IndusInd Bank: The private sector lender has appointed Sunil Mehta as Non-Executive Independent Director and part-time Chairman for 3 years with effect from January 31, 2023.

Godrej Consumer Products: The company will be investing Rs 100 crore in Early Spring, a new Rs 300-crore early-stage consumer fund being set up by Spring Marketing Capital (Spring). Company will anchor the fund in addition to offering its expertise and experience to help founders build strong, sustainable companies.

Rail Vikas Nigam: RVNL has emerged as the lowest bidder (L1) for Mumbai Metro line 2B project of MMRDA. RVNL had participated in consortium with Siemens India. Siemens is the lead partner with 60% share & RVNL as consortium partner with 40% share. The cost of project is Rs 378.2 crore.

Mahindra & Mahindra Financial Services: The RBI has imposed a monetary penalty of Rs 6.77 crore on Mahindra & Mahindra Financial Services for non-compliance with the RBI's Non-Banking Financial Company - Systemically Important Non-Deposit taking Company and Deposit taking Company (Reserve Bank) Directions.

Indian Bank: The Reserve Bank of India has imposed a monetary penalty of Rs 55 lakh on Indian Bank for non-compliance with certain know your customer (KYC) norms.

IIFL Finance: Fairfax-backed non-banking financial company IIFL Finance has secured $100 million in long-term funding, jointly, from Export Development Canada (EDC) and Deutsche Bank. The NBFC secured $50 million from EDC and $50 million from Deutsche Bank.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc