Indigo Paints to launch IPO on January 20 - Fixes price band at Rs 1488-1490

Join Our Whatsapp Group : 9841986753

Twitter : https://twitter.com/rupeedesk12

Indigo Paints to launch IPO on January 20, fixes price band at Rs 1,488-1,490

The company will utilise funds from its fresh issue for the expansion of the manufacturing facility at Pudukkottai in Tamil Nadu, purchasing tinting machines and gyroshakers and repaying borrowings.

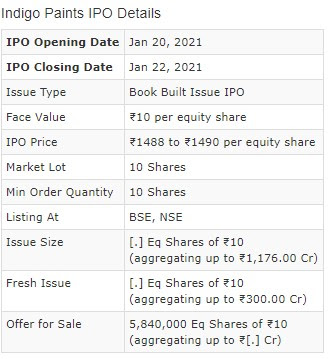

Indigo Paints IPO Details

Indigo Paints is one of the fastest-growing paint companies in India and in terms of revenue, it is the 5th largest company in the decorative paint industry. The company is engaged in manufacturing different types of decorative paints like enamels, emulsions, wood coatings, primers, distempers, putties, and cement paints.

It is the first company that started manufacturing certain differentiated products like Metallic Emulsions, Bright Ceiling Coat Emulsions, Tile Coat Emulsions, Dirtproof & Waterproof Exterior Laminate, Floor Coat Emulsions, Exterior and Interior Acrylic Laminate, and PU Super Gloss Enamel. The sales from these differentiated products are continuously growing as it was 26.68% in 2018 increased to 28.62% in fiscal 2020.

Indigo Paints has a strong market network with dealers in Tier 1, Tier 2, and Metros as well. It has 3 manufacturing facilities situated in Jodhpur (Rajasthan), Kochi (Kerala), and Pudukkottai (Tamil Nadu). It is further looking to expand its manufacturing capacities at Pudukkottai to manufacture water-based paints.

* Company Strengths

Large product portfolio with differentiated products.

Well-proven, and consistent growth track record.

Strong brand equity.

Extensive network distribution.

Strategically located manufacturing facilities.

* Company Promoters:

Hemant Jalan, Anita Jalan, Parag Jalan, Kamala Prasad Jalan, Tara Devi Jalan and Halogen Chemicals Private Limited are the promoters of the company.

* Objects of the Issue:

The net proceed from the Indigo Paints IPO will be used against following objectives.

To meet the capital expenditure requirements for manufacturing facility expansion at Pudukkottai, Tamil Nadu

To purchase tinting machines and gyroshakers.

To repay all or certain borrowings.

To meet general corporate purposes.

The public issue comprises a fresh issue of Rs 300 crore and an offer for sale of 58.40 lakh equity shares by promoters and investors. The offer for sale consists of 20.05 lakh equity shares by Sequoia Capital India Investments IV, 21.65 lakh equity shares by SCI Investments V and 16.7 lakh equity shares by promoter Hemant Jalan.

The public offer, which will close on January 22, includes a reservation of 70,000 equity shares for subscription by eligible employees.

Promoters and investors, in consultation with merchant bankers, have fixed a price band of Rs 1,488-1,490 per share for the public issue. One can bid for a minimum of 10 equity shares and in multiples of 10 equity shares thereafter.

The company will utilise funds from its fresh issue for the expansion of the manufacturing facility at Pudukkottai in Tamil Nadu by setting up another facility (Rs 150 crore) nearby, purchase of tinting machines and gyroshakers (Rs 50 crore), repayment of borrowings (Rs 25 crore); and general corporate purposes.

Indigo Paints is the fastest-growing among the top five paint companies in India and is the fifth-largest company in the Indian decorative paint industry in terms of revenue from operations for FY2020, as per F&S Report.

The company sells its products under the brand of 'Indigo', through its distribution network across 27 states and seven union territories, as on September 2020. Former Indian team cricket captain Mahendra Singh Dhoni is its brand ambassador.

As of September 2020, the company owns and operates three manufacturing in Jodhpur (Rajasthan), Kochi (Kerala) and Pudukkottai, with an aggregate estimated installed production capacity of 1,01,903 kilolitres per annum for liquid paints and 93,118 metric tonnes per annum (MTPA) for putties and powder paints.

The company also plans to expand capacity at Pudukkottai by adding capacities to manufacture water-based paints to cater to the growing demand for these paints. The proposed installed production capacity of the expansion unit is 50,000 KLPA and it is expected to be operational during fiscal 2023.

Kotak Mahindra Capital Company, Edelweiss Financial Services and ICICI Securities are the book-running lead managers to the issue.

Free Intraday Tips : Join Our Whatsapp No : 9841986753

Free Commodity Tips : Join our Whatsapp No : 9094047040

RUPEEDESK PREMIUM RESEARCH

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE,BSE,MCX,NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753