ITC Stock Business - Rupeedesk Reports - 11.07.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, July 10, 2023

ITC Stock Business - Rupeedesk Reports - 11.07.2023

SENSEX OPTION TIPS - 11.07.2023

SENSEX OPTION TIPS - 11.07.2023

Sensex(14 Jul) Call Option Tips

12.03 PM STRIKE 65700.00 CE : Buy Sensex(14 Jul) Call Option SA 365 SL 332 Target 399 / 407 / 435

12.03 PM STRIKE 65700.00 CE : Sell Sensex(14 Jul) Call Option SB 349 SL 382 Target 315 / 307 / 279

12.03 PM STRIKE 65800.00 CE : Buy Sensex(14 Jul) Call Option SA 308 SL 275 Target 342 / 350 / 378

12.03 PM STRIKE 65800.00 CE : Sell Sensex(14 Jul) Call Option SB 292 SL 325 Target 258 / 250 / 222

12.03 PM STRIKE 65900.00 CE : Buy Sensex(14 Jul) Call Option SA 254 SL 221 Target 288 / 296 / 324

12.03 PM STRIKE 65900.00 CE : Sell Sensex(14 Jul) Call Option SB 238 SL 271 Target 204 / 196 / 168

Sensex(14 Jul) Put Option Tips

12.03 PM STRIKE 65700.00 PE : Buy Sensex(14 Jul) Put Option SA 243 SL 210 Target 277 / 285 / 313

12.03 PM STRIKE 65700.00 PE : Sell Sensex(14 Jul) Put Option SB 227 SL 260 Target 193 / 185 / 157

12.03 PM STRIKE 65800.00 PE : Buy Sensex(14 Jul) Put Option SA 288 SL 255 Target 322 / 330 / 358

12.03 PM STRIKE 65800.00 PE : Sell Sensex(14 Jul) Put Option SB 272 SL 305 Target 238 / 230 / 202

12.03 PM STRIKE 65900.00 PE : Buy Sensex(14 Jul) Put Option SA 8 SL -25 Target 42 / 50 / 78

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

PREMIUM Package - Short Term Delivery : PEL gives 9% Returns - 11.07.2023

PREMIUM Package - Short Term Delivery : PEL gives 9% Returns - 11.07.2023

PREMIUM Package - Short Term Delivery : Koltepatil gives 21% Returns - 11.07.2023

PREMIUM Package - Short Term Delivery : Koltepatil gives 21% Returns - 11.07.2023

Global-Market insights - 11.07.2023

Global-Market insights - 11.07.2023

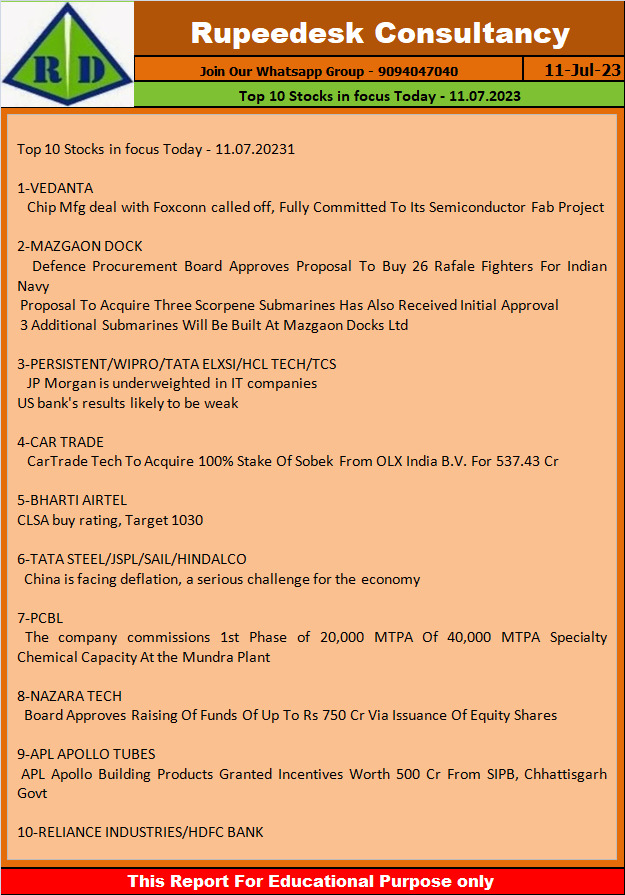

Top 10 Stocks in focus Today - 11.07.2023

Top 10 Stocks in focus Today - 11.07.2023

JPMorgan on IT - 11.07.2023

JPMorgan on IT - 11.07.2023

Stock to Watch Today - Rupeedesk Reports - 11.07.2023

Stock to Watch Today - Rupeedesk Reports - 11.07.2023

Buzzing Stocks: Vedanta, SBI, Sanghvi Movers, Tata Comm, others in news today.

Vedanta: Taiwan's Foxconn said that it is pulling out of a joint venture with billionaire Anil Agarwal-led Vedanta that was set up to produce semiconductors from India. Foxconn further said it was working to remove the Foxconn name from what now is a fully-owned entity of Vedanta. It has no connection to the entity and efforts to keep its original name would cause confusion for future stakeholders, the electronic major added. Meanwhile, Vedanta said it was fully committed to its semiconductor fab project and has lined up other partners to set up India’s first foundry, reports CNBC-TV18.

Results on July 11: PCBL, Elecon Engineering Company, Excel Realty N Infra, Generic Engineering Construction and Projects, Plastiblends India, Eiko Lifesciences, and Welcure Drugs & Pharmaceuticals will be in focus ahead of declaring their quarter earnings on July 11.

State Bank of India: The country's largest lender has proposed to participate in an initial public offering (IPO) of National Securities Depositories (NSDL) through an offer-for-sale of up to 2% equity stake or 40 lakh shares in NSDL. The bank holds 5% stake in NSDL.

APL Apollo Tubes: The State Investment Promotion Board (SIPB) of the Chhattisgarh government has granted incentives of Rs 500 crore to company's subsidiary APL Apollo Building Products. The incentives are granted for setting up manufacturing facility at Baloda Bazar, Chhattisgarh.

Tata Communications: Subsidiary Tata Communications International Pte Ltd (TCIPL) has entered into a share purchase agreement to acquire remaining equity ownership of Oasis Smart Sim Europe SAS (OSSE France). As a result, TCIPL will increase its equity shareholding in OSSE France from its current stake of 58.1% to 100%.

Sanghvi Movers: The crane rental company has received work orders worth Rs 150 crore from Independent Power Producers (IPP) in the renewable energy sector. The company will provide crane rental services along with allied services. Crane services account for approximately 50% of the total contract value. These contracts are of 18 months duration.

Nazara Technologies: The gaming and sports media platform has received approval from its board of directors for raising up to Rs 750 crore from equity shares through one or more qualified institutional placements or preferential allotment.

Satin Creditcare Network: The microfinance company has received the board approval for raising up to Rs 5,000 crore via non-convertible debentures, on a private placement basis, in one or more tranches, within one year from the date of shareholders’ approval. The board also approved an appointment of Vikas Gupta as Chief Compliance Officer with effect from July 11.

PCBL: The RP-Sanjiv Goenka Group company has commissioned the first phase of its specialty chemicals capacity expansion at Mundra in Gujarat. The newly commissioned phase added a capacity of 20,000 metric tons per annum (MTPA). Upon completion, PCBL will have a specialty chemicals production capacity of 40,000 MTPA at its Mundra plant.

Motherson Sumi Wiring India: The joint venture company of Samvardhana Motherson International and Sumitomo Wiring Systems has received approval from its board of directors for appointment of Mahender Chhabra as Chief Financial Officer. Chhabra's appointment as CFO is with effect from July 10.

Vadilal Industries: Home-grown ice cream brand Vadilal has received buyout interest from a private equity firm Bain Capital, sources with direct knowledge of the matter said. Bain Capital is eyeing a controlling stake in the combined entity of Vadilal Industries, Vadilal Enterprises and Vadilal brand. The deal talks value the ice cream maker at over Rs 3,000 crore. However, Vadilal Group clarified saying there is no information which has not been informed to stock exchanges.

Tega Industries: The mining & material handling equipment maker has appointed Sharad Kumar Khaitan as Chief Financial Officer with effect from July 10.

CarTrade Tech: The multi-channel auto platform has entered into a share purchase agreement with Sobek Auto India and its holding company OLX India B V for acquisition of 100% stake of Sobek Auto India from OLX India B V. The acquisition cost is Rs 537.43 crore.

McLeod Russel: The tea producer said the board of directors has approved the execution of an exclusivity agreement with Carbon Resources to evaluate a mutually agreeable mechanism for monetization of identified assets of the company. The proposed asset sale is a one-time settlement of the debt owed by the company to its identified lenders.

SBI Cards and Payment Services: Rama Mohan Rao Amara has resigned as Managing Director & CEO of the credit card issuing company with effect from August 11, owing to his transfer back to the State Bank of India. Company has appointed Abhijit Chakravorty as Managing Director & CEO with effect from August 12.

Cyient DLM: Nippon India Mutual Fund via Power & Infra Fund has bought 5 lakh shares or 0.63% stake in the engineering manufacturing services and solutions provider via open market transactions at an average price of Rs 403 per share. Nippon Life India Trustee Ltd - A/C Nippon India SMA already held 1.14% stake in Cyient DLM.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 10.07.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 10.07.2023

SENSEX OPTION TIPS - 10.07.2023

SENSEX OPTION TIPS - 10.07.2023

Sensex(14 Jul) Call Option Tips

12.42 PM STRIKE 65200.00 CE : Buy Sensex(14 Jul) Call Option SA 443 SL 410 Target 477 / 485 / 513

12.42 PM STRIKE 65200.00 CE : Sell Sensex(14 Jul) Call Option SB 427 SL 460 Target 393 / 385 / 357

12.42 PM STRIKE 65300.00 CE : Buy Sensex(14 Jul) Call Option SA 390 SL 357 Target 424 / 432 / 460

12.42 PM STRIKE 65300.00 CE : Sell Sensex(14 Jul) Call Option SB 374 SL 407 Target 340 / 332 / 304

12.42 PM STRIKE 65400.00 CE : Buy Sensex(14 Jul) Call Option SA 340 SL 307 Target 374 / 382 / 410

12.42 PM STRIKE 65400.00 CE : Sell Sensex(14 Jul) Call Option SB 324 SL 357 Target 290 / 282 / 254

Sensex(14 Jul) Put Option Tips

12.42 PM STRIKE 65200.00 PE : Buy Sensex(14 Jul) Put Option SA 206 SL 173 Target 240 / 248 / 276

12.42 PM STRIKE 65200.00 PE : Sell Sensex(14 Jul) Put Option SB 190 SL 223 Target 156 / 148 / 120

12.42 PM STRIKE 65300.00 PE : Buy Sensex(14 Jul) Put Option SA 247 SL 214 Target 281 / 289 / 317

12.42 PM STRIKE 65300.00 PE : Sell Sensex(14 Jul) Put Option SB 231 SL 264 Target 197 / 189 / 161

12.42 PM STRIKE 65400.00 PE : Buy Sensex(14 Jul) Put Option SA 298 SL 265 Target 332 / 340 / 368

12.42 PM STRIKE 65400.00 PE : Sell Sensex(14 Jul) Put Option SB 282 SL 315 Target 248 / 240 / 212

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc