52 Week High In Large Cap - 16.08.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Monday, August 15, 2022

52 Week High In Large Cap - 16.08.2022

Price Increase & Vol Increase In Large Cap - 16.08.2022

Price Increase & Vol Increase In Large Cap - 16.08.2022

Price Increase & Vol Increase In Mid Cap - 16.08.2022

Price Increase & Vol Increase In Mid Cap - 16.08.2022

Price Increase & Vol Increase In Small Cap - 16.08.2022

Price Increase & Vol Increase In Small Cap - 16.08.2022

Banknifty Aug Futures in buy zone with strong support 38868/38520 - 16.08.2022

Banknifty Aug Futures in buy zone with strong support 38868/38520 - 16.08.2022

USDINR Aug likely to trade in a range : 79.70 - 79.90 - 16.08.2022

USDINR Aug likely to trade in a range : 79.70 - 79.90 - 16.08.2022

MEDIUM TERM - Granules india ltd - Target 347/374 -Rupeedesk Shares - 16.08.2022

MEDIUM TERM - Granules india ltd - Target 347/374 -Rupeedesk Shares - 16.08.2022

US and Asian Market - 16.08.2022

US and Asian Market - 16.08.2022

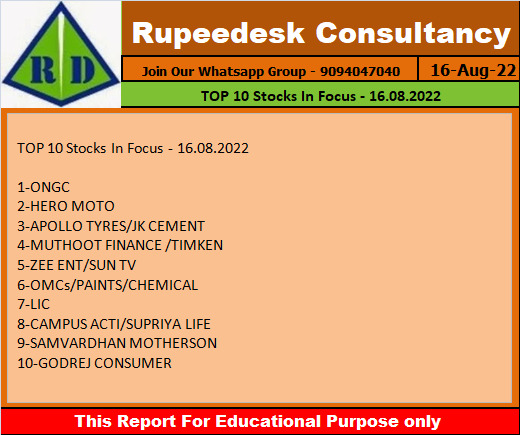

TOP 10 Stocks In Focus - 16.08.2022

TOP 10 Stocks In Focus - 16.08.2022

Global Market Updates - 16.08.2022

Global Market Updates - 16.08.2022

Stock to Watch Today - Rupeedesk Reports - 16.08.2022

Stock to Watch Today - Rupeedesk Reports - 16.08.2022

Stocks to Watch Today | LIC, ONGC, Hero MotoCorp, and others in news today.

Life Insurance Corporation of India: The life insurance major registered an increase of 20.35 percent in total premium income at Rs 98,352 crore in the June FY23 quarter, as against Rs 81,721 crore a year back. The profit for the quarter was Rs 682.88 crore against Rs 2.94 crore in corresponding period last fiscal. The market share of LIC in individual first year premium income was 43.86 percent for June FY23 quarter and in the group first year premium income, the market share was 76.43 percent.

Oil and Natural Gas Corporation: ONGC reported a standalone profit of Rs 15,206 crore for the quarter ended June FY23, up 251 percent on-year, driven by strong operating performance and top line growth. Standalone revenue for the June FY23 quarter grew 84 percent on-year to Rs 42,321 crore. EBITDA came in at Rs 24,731 crore for the June FY23 quarter, rising 125 percent YoY, and margin jumped by 1,065 bps YoY to 58.43 percent during the quarter led by higher crude realisation following spike in oil prices and increase in domestic gas prices.

Hero MotoCorp: The two-wheeler maker recorded a 71 percent year-on-year increase in profit at Rs 625 crore for the quarter ended June FY23 on a low base. Revenue grew 53 percent YoY to Rs 8,393 crore and EBITDA surged 83 percent to Rs 941 crore, compared to the year-ago period. The company sold 13.90 lakh units of motorcycles and scooters in Q1FY23, a growth of 36 percent over the corresponding quarter in the previous fiscal. The year-ago quarter was affected by second Covid wave.

Zee Entertainment Enterprises: The company recorded a 49 percent year-on-year decline in profit at Rs 106.6 crore for the quarter ended June FY23 dented by dismal operating performance and tepid top line growth. Revenue grew by 4 percent to Rs 1,846 crore compared to year-ago period with 5.4 percent on-year increase in advertising revenue and 5 percent fall in subscription segment.

Apollo Tyres: The tyre maker clocked a 49 percent year-on-year growth in consolidated profit at Rs 190.7 crore for the quarter ended June FY23 on low base. Strong operating income and top line lifted bottomline. Revenue grew by 30 percent to Rs 5,942 crore compared to year-ago period.

Dhani Services: The company posted a consolidated loss of Rs 103.91 crore for the quarter ended June FY23, which narrowing from loss Rs 192.4 crore in corresponding period last fiscal, supported largely by a sharp decline in impairment on financial assets, fall in employee expenses, and increase in other income, but impacted by lower revenue from operations that declined 19 percent YoY to Rs 246.4 crore during the quarter.

Sun TV Network: The company reported a 35.3 percent year-on-year growth in consolidated profit at Rs 494 crore for the quarter ended June FY23 driven by operating income and top line growth. Revenue from operations grew by 49 percent to Rs 1,219 crore compared to year-ago period.

Wockhardt: The company recorded consolidated loss of Rs 75 crore for the quarter ended June FY23, against loss Rs 7 crore in year-ago period. Revenue fell 31% to Rs 595 crore compared to year-ago period. The corresponding quarter of previous year included revenue and profitability from the UK Vaccines business.

Varroc Engineering: The company posted loss of Rs 3.88 crore for the quarter ended June FY23, narrowing loss from Rs 16.36 crore in year-ago period, aided by strong operating income and top line growth, but impacted by forex loss and loss from joint ventures. Revenue grew by 36 percent to Rs 1,635 crore and EBITDA increased by 93 percent to Rs 134.70 crore compared to same period last year.

Dilip Buildcon: The road developer has posted consolidated loss of Rs 55.1 crore for the quarter ended June FY23, against profit of Rs 32.86 crore in year-ago period, but sequentially the loss widened from Rs 41.09 crore in previous quarter on weak operating performance. The input cost was very high YoY. Revenue grew by 18.3% to Rs 2,884.4 crore compared to corresponding period last fiscal. The net order book as on June 2022 stood at Rs 25,160.2 crore.

Elgi Equipments: The company reported a 305% year-on-year growth in consolidated profit at Rs 48.7 crore for the quarter ended June FY23 driven by low base and strong operating performance. Revenue grew by 42% to Rs 693.8 crore compared to year-ago period.

Muthoot Finance: The gold financing company reported a 17.4% year-on-year decline in standalone profit at Rs 802 crore for the quarter ended June FY23 impacted by lower total income, but supported by lower tax cost and writeback of impairment on financial instruments. Total income declined 7.6% to Rs 2,509.27 crore compared to year-ago period.

Astral: The company recorded a 25% year-on-year increase in consolidated profit at Rs 93.80 crore for the quarter ended June FY23 despite higher input cost, partly aided by low base. The Q1FY22 earnings were affected by second Covid wave. Revenue increased 73% to Rs 1,213 crore compared to corresponding period last fiscal.

Aegis Logistics: The logistics company reported a 55% year-on-year increase in consolidated profit at Rs 103.37 crore for the June FY23 quarter driven by other income and healthy revenue growth. Revenue from operations increased 230% to Rs 2,235.5 crore compared to year-ago period.

Repco Home Finance: The company recorded a 93.2% YoY increase in standalone profit at Rs 62.07 crore for the quarter ended June FY23 on decline in impairment of financial instruments, but revenue from operations fell 5.5% to Rs 302.32 crore compared to year-ago period. Net interest income fell 5% to Rs 137 crore YoY in Q1FY23, while disbursements jumped 168% YoY to Rs 642.2 crore and sanctions increased 236% YoY to Rs 690.9 crore.

Heranba Industries: The agrochemical company's profit fell 29% year-on-year to Rs 33.7 crore for the quarter ended June FY23, impacted by lower operating performance. EBITDA dropped 26.6% to Rs 50.7 crore and margin declined 570 bps to 14 percent compared to year-ago period. Revenue increased 3% to Rs 361.9 crore during the same period despite of adverse macro-economic environment and delay in monsoons in the domestic markets.

Bajaj Healthcare: The company reported a 37.5% year-on-year decline in profit at Rs 12.02 crore for the quarter ended June FY23 impacted by weak operating income and lower top line. Revenue fell 7.3% to Rs 172 crore compared to year-ago period.

ITD Cementation India: The company recorded a 68.2% year-on-year increase in consolidated profit at Rs 30.2 crore for the quarter ended June FY23 on strong operating income and top line growth. The revenue from operations during the quarter at Rs 1,098 crore grew by 33% YoY. The company secured orders worth over Rs 6,000 crore in Q1FY23, taking the total orderbook to all-time high of Rs 20,641 crore as of June FY23.

Ahluwalia Contracts (India): The company reported a 8.6% year-on-year increase in consolidated profit at Rs 37.77 crore for the quarter ended June FY23 and its revenue from operations grew by 5% to Rs 609.25 crore compared to year-ago period.

Hinduja Global Solutions: The company clocked a 869% year-on-year increase in consolidated profit at Rs 73.26 crore for the quarter ended June FY23, driven by healthy other income, and low base in Q1FY22 due to exceptional loss. Revenue grew by 14% to Rs 912 crore compared to year-ago period.

Kennametal India: The company reported a 30% year-on-year growth in consolidated profit at Rs 28.10 crore for the quarter ended June FY23 despite higher input cost, with revenue rising 27% to Rs 268.60 crore and EBITDA growing 21% to Rs 45.10 crore compared to year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc