52 Week High In Large Cap - 12.08.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Thursday, August 11, 2022

52 Week High In Large Cap - 12.08.2022

Price Increase & Vol Increase In Large Cap - 12.08.2022

Price Increase & Vol Increase In Large Cap - 12.08.2022

Price Increase & Vol Increase In Mid Cap - 12.08.2022

Price Increase & Vol Increase In Mid Cap - 12.08.2022

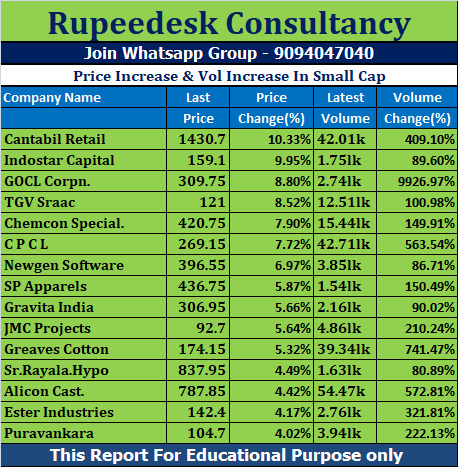

Price Increase & Vol Increase In Small Cap - 12.08.2022

Price Increase & Vol Increase In Small Cap - 12.08.2022

MEDIUM TERM - ONGC - Oil and Natural Gas Corporation Ltd - Rupeedesk - 12.08.2022

MEDIUM TERM - ONGC - Oil and Natural Gas Corporation Ltd - Rupeedesk - 12.08.2022

SHORT TERM - POONAWALLA - RUPEEDESK SHARES - 12.08.2022

SHORT TERM - POONAWALLA - RUPEEDESK SHARES - 12.08.2022

Nifty Aug Futures Holding Support at 17600/17509 - 12.08.2022

Nifty Aug Futures Holding Support at 17600/17509 - 12.08.2022

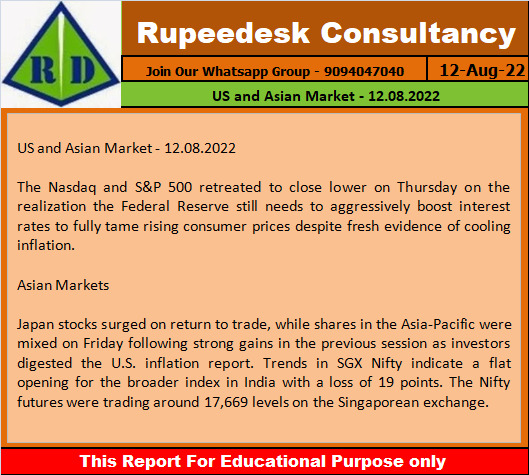

US and Asian Market - 12.08.2022

US and Asian Market - 12.08.2022

Earning Result Corner - 12.08.2022

Earning Result Corner - 12.08.2022

Global Market Updates - 12.08.2022

Global Market Updates - 12.08.2022

USDINR Pivot Levels - 12.08.2022

USDINR Pivot Levels - 12.08.2022

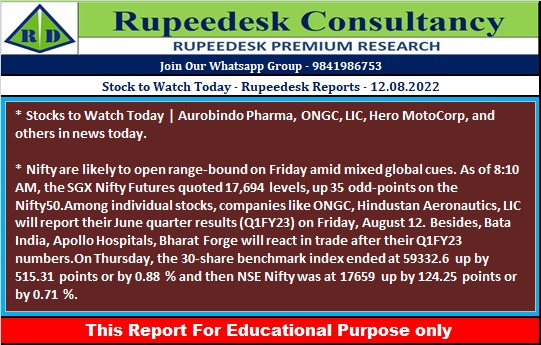

Stock to Watch Today - Rupeedesk Reports - 12.08.2022

Stock to Watch Today - Rupeedesk Reports - 12.08.2022

Stocks to Watch Today | Aurobindo Pharma, ONGC, LIC, Hero MotoCorp, and others in news today

Results on August 12: More than 700 companies including ONGC, Life Insurance Corporation of India, Hero MotoCorp, Grasim Industries, Divis Labs, Zee Entertainment Enterprises, Aegis Logistics, Ahluwalia Contracts, Apollo Tyres, Astral, Bajaj Electricals, Bajaj Healthcare, Bajaj Hindusthan Sugar, Balaji Amines, Bharat Dynamics, Campus Activewear, Dilip Buildcon, Dhani Services, Finolex Cables, Godrej Industries, Hindustan Aeronautics, Indiabulls Real Estate, India Cements, Kolte-Patil Developers, Muthoot Finance, Info Edge India, Power Finance Corporation, SJVN, Sun TV Network, Supriya Lifescience, Timken India, Varroc Engineering, Voltamp Transformers, and Wockhardt will be in focus ahead of June quarter earnings on August 12.

Aurobindo Pharma: The pharma company reported a 32.4% year-on-year growth in consolidated profit at Rs 520.4 crore for the quarter ended June FY23, impacted by lower other income and operating income. Revenue grew by 9.4% to Rs 6,236 crore compared to year-ago period, with US formulations business increasing 10.8%, but Europe formulation business fell 2.2% mainly due to euro currency depreciation.

Sterling and Wilson Renewable Energy: Promoter Shapoorji Pallonji and Company is going to sell up to 23.7 lakh shares or 1.25% stake via offer for sale on August 12 and August 16. The floor price of the offer will be Rs 270 per share.

Balaji Amines: Balaji Amines subsidiary, Balaji Speciality Chemicals, has filed a draft red herring prospectus with the Sebi for fund raising via initial public offering. The offer consists of a fresh issue of equity shares worth Rs 250 crore and an offer for sale of 2.6 crore shares by certain existing and eligible shareholders of Balaji Speciality Chemicals. Balaji Amines will not be participating in the proposed offer.

Puravankara: The company reported a 78% year-on-year decline in consolidated profit at Rs 34.40 crore in June FY23 quarter impacted by high base. Revenue grew by 18.4% to Rs 214.85 crore compared to year-ago period.

KSB: The company reported a 74.3% year-on-year increase in consolidated profit at Rs 47.40 crore in the quarter ended June FY23, driven by higher top line, operating income and other income. Low base in Q1FY22 also supported earnings. Revenue grew by 48% to Rs 448.40 crore compared to year-ago period.

Garden Reach Shipbuilders & Engineers: The company recorded a 144% year-on-year rise in profit at Rs 50.18 crore for the quarter ended June FY23, supported by higher top line and operating income. Revenue increased by 91% to Rs 579.77 crore compared to corresponding period last fiscal.

Aster DM Healthcare: The company reported a 35% year-on-year increase in consolidated profit at Rs 79.77 crore in the quarter ended June FY23, driven by operating performance, other income and top line. Revenue grew by 12% to Rs 2,662 crore compared to year-ago period.

Sunteck Realty: The company reported a 726% year-on-year increase in consolidated profit at Rs 24.94 crore for the quarter ended June FY23, driven by low base. The Q1FY22 earnings were affected by second Covid wave. Revenue increased 55% to Rs 143.50 crore compared to corresponding period last fiscal.

Gujarat Ambuja Exports: The company recorded a 0.7% year-on-year rise in consolidated profit at Rs 114.60 crore for the quarter ended June FY23 impacted by higher input cost and fall in operating income. Consolidated revenue grew by 24.2% to Rs 1,272.86 crore compared to year-ago period.

Shilpa Medicare: The company reported a 46.6% year-on-year decline in consolidated profit at Rs 0.85 crore for the quarter ended June FY23, impacted by weak operating performance. Revenue rose by 10% to Rs 261.15 crore, but EBITDA fell by 35.5% to Rs 20.57 crore compared to corresponding period last fiscal.

KNR Constructions: The company registered a 20.3% year-on-year decline in consolidated profit at Rs 89.61 crore for the quarter ended June FY23, impacted by tepid growth in operating income and higher raw material cost. Revenue grew by 21.5% to Rs 980.45 crore and EBITDA increased by 4.2% to Rs 211.25 crore compared to year-ago period.

Apollo Hospitals Enterprise: The healthcare services provider reported a 35.3% year-on-year decline in consolidated profit at Rs 323.8 crore for the June FY23 quarter on a high base. Revenue increased by 0.94% to Rs 3,795.60 crore compared to corresponding period last fiscal.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Nifty Outlook for Upcoming Sessions - 11.08.2022

Nifty Outlook for Upcoming Sessions - 11.08.2022

Market Highlights - 11.08.2022

Market Highlights - 11.08.2022

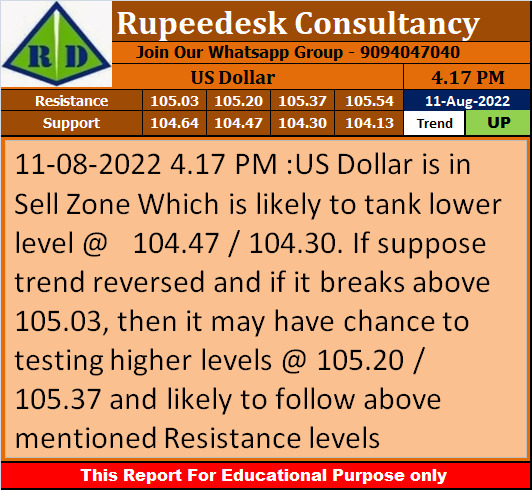

US Dollar Trend Update - Rupeedesk Reports - 11.08.2022

US Dollar Trend Update - Rupeedesk Reports - 11.08.2022

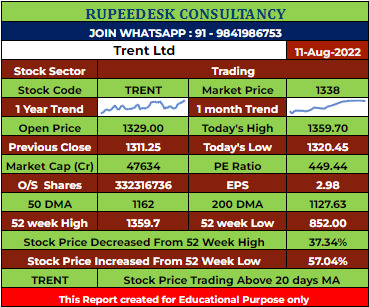

TRENT Stock Analysis - Rupeedesk Reports - 11.08.2022

TRENT Stock Analysis - Rupeedesk Reports - 11.08.2022

EURINR Outlook - Rupeedesk Report - 11.08.2022

EURINR Outlook - Rupeedesk Report - 11.08.2022

Medium Term - WIPRO Target 469/495 - Rupeedesk Shares - 11.08.2022

Medium Term - WIPRO Target 469/495 - Rupeedesk Shares - 11.08.2022

Medium Term - Wonderla - Wonderla Holidays Ltd - Target Price 380/400 - 11.08.2022

Medium Term - Wonderla - Wonderla Holidays Ltd - Target Price 380/400 - 11.08.2022

Hindalco posts record quarterly profit of Rs 4,119 crore, a rise of 48 percent - Rupeedesk Reports - 11.08.2022

Hindalco posts record quarterly profit of Rs 4,119 crore, a rise of 48 percent - Rupeedesk Reports - 11.08.2022