Gland Pharma IPO Analysis - 09.11.2020

Twitter : https://twitter.com/rupeedesk12

Telegram Channel : https://t.me/rupeedesk

KEEP REFRESH FOR NEXT UPDATE

Gland Pharma IPO Analysis

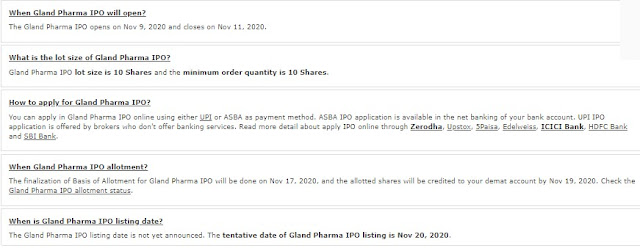

The issue will close on November 11 and equity shares are expected to list on the BSE and National Stock Exchange of India on November 20.

China's Fosun Pharma-owned Gland Pharma is set to launch its initial public offering for subscription on November 9.

The issue will close on November 11 and equity shares are expected to list on the BSE and National Stock Exchange of India on November 20.

The book running lead managers to the offer are Kotak Mahindra Capital Company, Citigroup Global Markets India, Haitong Securities India and Nomura Financial Advisory and Securities (India)

Public Issue

The public issue comprises of a fresh issue of Rs 1,250 crore and an offer for sale of 3,48,63,635 equity shares by the promoter and selling shareholders.

Gland Pharma IPO Analysis - Rupeedesk Reports

The offer for sale consists a sale of 1,93,68,686 equity shares by promoter Fosun Pharma Industrial Pte, 1,00,47,435 equity shares by Gland Celsus Bio Chemicals, 35,73,014 equity shares by Empower Discretionary Trust, and 18,74,500 equity shares by Nilay Discretionary Trust.

Bids can be made for a minimum of 10 equity shares and in multiples of 10 equity shares thereafter.

Price Band

The company in consultation with merchant bankers has fixed issue price band at Rs 1,490-1,500 per share.

Fund Raising

Gland Pharma is aimed to raise Rs 6,444.68 crore at lower price band and Rs 6,479.54 crore at higher price band.

The company already raised Rs 1,943.86 crore from 70 anchor investors on November 6, a day ahead of the issue opening.

Objects Of Issue

The company will utilise the net fresh issue proceeds towards funding incremental working capital requirements, funding capital expenditure requirements and general corporate purposes.

However, the company will not receive any proceeds from the offer for sale. The offer for sale proceeds will be received by selling shareholders.

Company Profile

Gland Pharma sells products primarily under a business to business (B2B) model in over 60 countries as of June 2020 including the United States, Europe, Canada, Australia, India and the Rest of the world.

After establishing in Hyderabad in 1978, it has expanded from liquid parenteral to cover other elements of the injectables value chain, including contract development, own development, dossier preparation and filing, technology transfer and manufacturing across a range of delivery systems.

It was one of the fastest-growing generic injectables-focused companies by revenue in the United States from 2014 to 2019 as per IQVIA report.

The company is expanding development and manufacturing capabilities in complex injectables such as peptides, long-acting injectables, suspensions and hormonal products as well as new delivery systems such as pens and cartridges.

It has seven manufacturing facilities in India, comprising four finished formulations facilities with a total of 22 production lines and three API facilities. As of June 2020, it had manufacturing capacity for finished formulations of approximately 755 million units per annum.

As of June 2020, it had 267 ANDA filings including from partners in the United States, of which 215 were approved and 52 were pending approval.

The company said it had a successful track record of operating a B2B model with leading pharmaceutical companies such as Sagent Pharmaceuticals Inc and Apotex Inc as well as Fresenius Kabi USA, LLC and Athenex Pharmaceutical Division, LLC in the United States and the Rest of the world using long-term development, licensing and manufacturing and supply agreements.

Company's Strengths

A) It has extensive and vertically integrated injectable manufacturing capabilities with a consistent regulatory compliance track record.

B) It has diversified B2B-led model across markets, complemented by a targeted B2C model in India.

C) It has an extensive portfolio of complex products supported by internal R&D and regulatory capabilities.

D) It has a track record of growth and profitability from a diversified revenue base with healthy cash flows.

E) It has an experienced management and qualified team and is promoted by Shanghai Fosun Pharma.

Company's Strategies

A) The company intends to expand its product portfolio and delivery systems to drive revenue growth.

B) The company aims to continue investing in manufacturing technologies to build new capabilities to support the production of a future portfolio of complex injectables, primarily for the US market.

C) It intends to maintain a strategic emphasis on the United States, Europe, Canada and Australia, while continuing to pursue growth opportunities in China, India, Brazil and the Rest of the world.

D) It intends to continue strategic alignment with Shanghai Fosun Pharma to increase market share in the global generic injectables industry.

D) To complement organic growth and internal expertise, it may also pursue strategic acquisitions of companies, products and technologies to add to capabilities and technical expertise or enter into partnerships to strengthen product and technology infrastructure in areas including steroidal hormonal products, suspensions, anti-neoplastics and nasal and inhalation products.

E) It aims to continue to maintain cost management focus, including in-house integrated manufacturing capabilities, across the business to deliver growth as well as to achieve economies of scale.

Financials

The company's total revenue from operations has grown at a CAGR of 27.38 percent from FY18 to FY20, EBITDA at a CAGR of 36.90 percent and restated profit has grown at a CAGR of 55.15 percent during the same period.

The United States contributed 66.74 percent to total revenue in FY20 and India 17.74 percent. The following table explains the same:

Its top five customers in FY18, FY19 and FY20 and the three months ended June 2020 accounted for 49.92 percent, 47.86 percent, 48.86 percent, and 44.45 percent respectively, of total revenue from operations for the relevant period.

Promoters and Shareholding

Fosun Singapore and Shanghai Fosun Pharma are the promoters of the company. Fosun Singapore holds 11,46,62,620 equity shares, including 10 equity shares each held by Fosun Industrial Co, Ample Up, Regal Gesture and Lustrous Star for the benefit of Fosun Singapore, which aggregates to 74 percent of the pre-offer, paid-up equity capital of the company.

Shanghai Fosun Pharma holds 100 percent of the share capital of Fosun Industrial Co, which holds 100 percent in Fosun Singapore.

Here is the list of major equity shareholders holding 1 percent or more stake in the company:

Management

Yiu Kwan Stanley Lau is the Chairman and Independent Director of the company. He is a director on the board of directors Solasia Pharma KK and TaiLai Bioscience. He was previously the chief executive officer of Amsino Medical Group, the chief operating officer of Eddingpharm Investment Co, and the president of China Biologic Products Inc. He also worked with Merck Sharp & Dohme (Asia) and Baxter (China) Investment Co.

Srinivas Sadu is the MD and CEO of Gland Pharma, with effect from April 2019. He previously worked at Natco Pharma and is presently a director on the board of Sadu Advisory Services. He has over 21 years of experience in business operations and management. He joined Gland Pharma as the general manager – exports in 2000, and elevated to the position of senior general manager in 2002, vice president in 2003, director in 2005, and chief operating officer in 2011.

Qiyu Chen, Dongming Li, Xiaohui Guan, Yifang Wu and Udo Johannes Vetter are Non-Executive Nominee Directors on the board, while Essaji Goolam Vahanvati and Satyanarayana Murthy Chavali is Independent Directors.

Ravi Shekhar Mitra is the CFO of the company. He has over 20 years of experience in finance. Prior to joining Gland Pharma, he had worked at Indian Oil Corporation, Vedanta-Sterlite Industries (India), Ranbaxy Laboratories and Wockhardt.

No comments:

Post a Comment