NIFTY Index Outlook - 21.07.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Thursday, July 20, 2023

NIFTY Index Outlook - 21.07.2023

Stock to Watch Today - Rupeedesk Reports - 21.07.2023

Stock to Watch Today - Rupeedesk Reports - 21.07.2023

Buzzing Stocks: RIL, HUL, Infosys, L&T, LTIMindtree, HAL, Utkarsh Small Finance Bank & others in the news today.

Results on July 21: Reliance Industries, HDFC Life Insurance Company, JSW Steel, UltraTech Cement, Vedanta, One 97 Communications, Aarti Drugs, Ashok Leyland, CMS Info Systems, CreditAccess Grameen, Cyient DLM, DLF, Dodla Dairy, Glenmark Life Sciences, Hindustan Zinc, Ramkrishna Forgings, and Tejas Networks will be in focus ahead of June FY24 quarter earnings on July 21.

Results on July 22: ICICI Bank, Kotak Mahindra Bank, RBL Bank, AU Small Finance Bank, Yes Bank, Seshasayee Paper & Boards, Sportking India, Thirumalai Chemicals, and Titagarh Rail Systems will be in focus ahead of their quarterly earnings on July 22.

Infosys: The country's second-largest IT services provider recorded a profit of Rs 5,945 crore for the quarter ended June FY24, down 3 percent compared to the previous quarter, and slashed full-year revenue growth guidance to 1-3.5 percent from 4-7 percent earlier while maintaining EBIT margin guidance at 20-22 percent. Revenue grew by 1.3 percent sequentially to Rs 37,933 crore, while dollar revenue rose by 1.4 percent QoQ to $4,617 million and revenue growth in constant currency terms stood at 1 percent against CNBC-TV18 poll estimates of 0.7 percent rise.

Hindustan Unilever: The FMCG major has registered a 6.1 percent year-on-year growth in revenue at Rs 15,148 crore and 8 percent on-year growth in profit at Rs 2,472 crore for the quarter ended June FY24, with growth in all key segments - home care, beauty & personal care, and foods & refreshment. On the operating front, EBITDA grew by 8.4 percent to Rs 3,521 crore with a margin expansion of 50 bps at 23.2 percent compared to the year-ago period. The underlying volume growth stood at 3 percent for the quarter, which was lower than CNBC-TV18 poll estimates of 5-6 percent.

Jindal Stainless: The country's largest stainless steel manufacturing company has completed the acquisition of Jindal United Steel. Earlier, the company held a 26 percent stake in Jindal United Steel, and now it has acquired the remaining 74 percent equity stake in Jindal United Steel for a cash consideration of Rs 958 crore. With this, Jindal United Steel becomes a 100 percent subsidiary of Jindal Stainless. Jindal United Steel has been operating a hot strip mill of 1.6 million tons per annum (MTPA) capacity and a cold rolling mill of 0.2 MTPA capacity. It is also undergoing capacity expansion up to 3.2 MTPA at Jajpur, Odisha.

Larsen & Toubro: The engineering and infrastructure major said the board of directors will meet on July 25 to consider the buyback of equity shares of the company, and special dividend for the financial year 2023-24. If approved, the record date for determining the entitlement of the equity shareholders for the said dividend will be August 2. The board will also approve the unaudited consolidated and standalone financial results for the quarter ended June 2023.

Utkarsh Small Finance Bank: The small finance bank shares will list on the bourses on July 21. The issue price has been fixed at Rs 25 per share.

LTIMindtree: The technology consulting and digital solutions company has announced a strategic partnership with CYFIRMA, an external threat landscape management platform company, to enhance the threat intelligence capabilities of its XDR platform and help global enterprises identify, evaluate, and manage potential risks and threats.

Hindustan Aeronautics: The state-owned defence major and Argentina have signed a Letter of Intent (Lol) on productive cooperation and acquisition of light and medium utility helicopters for the armed forces of the Argentine Republic.

Persistent Systems: Pune-based IT company has reported a net profit of Rs 228.8 crore for the quarter ended June FY24, falling 9 percent compared to the previous quarter, dented by weak operating performance. Revenue in rupee terms grew by 3 percent QoQ to Rs 2,321.2 crore and topline in dollar terms also increased by 3 percent to $282.90 million for the quarter. The order booking for the quarter ended June 2023 was at $380.3 million in total contract value and at $271.9 million in annual contract value terms.

Mahindra and Mahindra: The Federal District Court at Michigan has issued order on Fiat Chrysler Automobile's (FCA) renewed motion to enjoin the Post-2020 ROXOR and has based on its analysis, declined to apply the safe distance-rule to this case as sought by FCA. Accordingly, FCA’s motion to enjoin the Post-2020 ROXOR was denied. With this ruling, Mahindra Automotive North America, a subsidiary of the company, continues to have no restraints on its ability to produce, sell and distribute the Post-2020 ROXOR in the United States.

IndusInd Bank: The private sector lender has received board approval for raising of funds up to Rs 20,000 crore via debt securities, on a private placement basis.

Union Bank of India: The public sector lender has recorded profit at Rs 3,236 crore for quarter ended June FY24, rising 107.67% over Rs 1,558 crore in year-ago period. Net interest income during the quarter grew by 16.6% year-on-year to Rs 8,840 crore with net interest margin expansion of 13 bps at 3.13% in Q1FY24. Global advances for the quarter increased by 12.33% to Rs 8.18 lakh crore and deposits grew by 13.63% to Rs 11.28 lakh crore compared to corresponding period last fiscal. Asset quality improved with the gross non-performing assets (NPA) falling 19 bps sequentially to 7.34% and net NPA declining 12 bps QoQ to 1.58% in Q1FY24.

Tata Motors: Luxury car maker Jaguar Land Rover (JLR) appointed Adrian Mardell as Chief Executive Officer for a three-year term, and Richard Molyneux as Chief Financial Officer. Richard Molyneux was appointed as acting Chief Financial Officer in December 2022, following six years as Finance Director, Operations at JLR.

Coforge: The global IT solutions organisation has recorded profit at Rs 165.3 crore for quarter ended June FY24, rising 44% over previous quarter. Revenue grew by 2.4% sequentially to Rs 2,221 crore, while dollar revenue increased by 2.8% QoQ to $271.8 million and revenue growth in constant currency was 2.7% QoQ. The company announced highest ever order intake of $531 million during the quarter and has reiterated FY24 annual revenue growth guidance of 13-16% in constant currency terms.

United Spirits: The beverage alcohol company has reported standalone profit at Rs 238.2 crore for the quarter ended June FY24, against profit of Rs 194.9 crore in year-ago period. Revenue from operations (net of excise duty) dropped 1 percent to Rs 2,171.9 crore during the quarter, down from Rs 2,194.6 crore in corresponding period last fiscal. Volumes stood at 13.24 million cases in Q1FY24, against 12.5 million cases in Q1FY23.

Dalmia Bharat: The cement manufacturing company has recorded profit at Rs 144 crore for June FY24 quarter, declining 29.6% compared to year-ago period impacted by lower operating margin performance. Revenue from operations grew by 9.8% year-on-year to Rs 3,624 crore for the quarter, with volumes rising 12.4% YoY to 7 million tonnes.

IndiaMART InterMESH: The company has registered a 78% year-on-year growth in profit at Rs 83 crore for June FY24 quarter led by other income of Rs 57 crore (on fair value gain on treasury investments) against Rs 1 crore in the same period. Revenue from operations grew by 26% to Rs 282 crore compared to year-ago period, primarily driven by 16% increase in number of paying subscription suppliers. On the operating front, EBITDA for the quarter grew by 20% to Rs 77 crore YoY, but margin dropped 200 bps YoY to 27% as the company continued making growth investments in manpower, product and technology, sales and servicing. The company has received board approval for share buyback of up to Rs 500 crore at a price of Rs 4,000 per share.

Tanla Platforms: The CPaaS provider has registered a 35% year-on-year growth in profit at Rs 135.4 crore for quarter ended June FY24. Revenue during the quarter increased by 14% on-year to Rs 911.1 crore, with growth across both digital platforms and enterprise communications business.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Currency Pivot Levels - 20.07.2023

Currency Pivot Levels - 20.07.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 20.07.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 20.07.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

PREMIUM Package - Short Term Delivery - SHRIRAMFIN gives 30% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - SHRIRAMFIN gives 30% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - MFSL gives 26% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - MFSL gives 26% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - BAJAJFINSV gives 20% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - BAJAJFINSV gives 20% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - AXISBANK gives 12% Returns - 20.07.2023

PREMIUM Package - Short Term Delivery - AXISBANK gives 12% Returns - 20.07.2023

This Week Delivery Achieved Our Calls - Rupeedesk Reports - 20.07.2023

This Week Delivery Achieved Our Calls - Rupeedesk Reports - 20.07.2023

Currency Market Intraday Trend Rupeedesk Reports - 20.07.2023

Currency Market Intraday Trend Rupeedesk Reports - 20.07.2023

Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

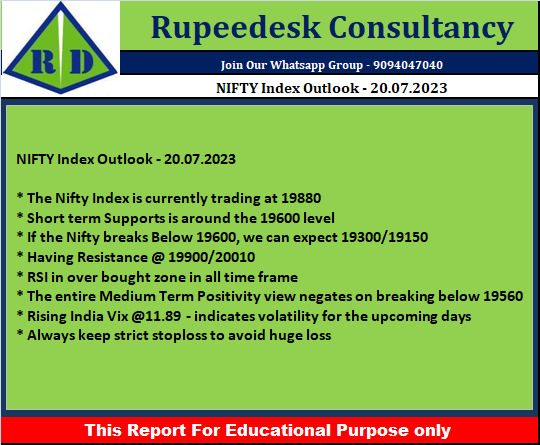

NIFTY Index Outlook - 20.07.2023

NIFTY Index Outlook - 20.07.2023