52 Week High In Large Cap - 08.08.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Sunday, August 7, 2022

52 Week High In Large Cap - 08.08.2022

Price Increase & Vol Increase In Large Cap - 08.08.2022

Price Increase & Vol Increase In Large Cap - 08.08.2022

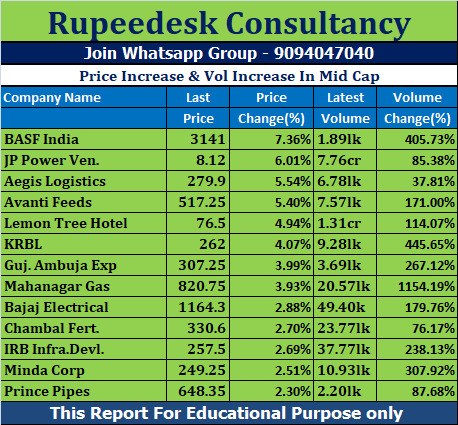

Price Increase & Vol Increase In Mid Cap - 08.08.2022

Price Increase & Vol Increase In Mid Cap - 08.08.2022

Price Increase & Vol Increase In Small Cap - 08.08.2022

Price Increase & Vol Increase In Small Cap - 08.08.2022

Short Term - MGL - MahanagarGasLtd - Rupeedeskreports - 08.08.2022

Short Term - MGL - MahanagarGasLtd - Rupeedeskreports - 08.08.2022

US and Asian Market - 08.08.2022

US and Asian Market - 08.08.2022

Earning Results Corner - 08.08.2022

Earning Results Corner - 08.08.2022

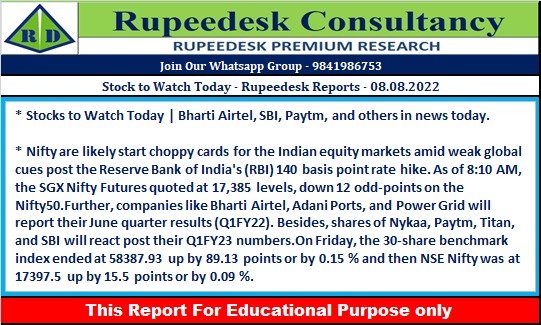

Stock to Watch Today - Rupeedesk Reports - 08.08.2022

Stock to Watch Today - Rupeedesk Reports - 08.08.2022

Stocks to Watch Today | Bharti Airtel, SBI, Paytm, and others in news today

Results on August 8: Bharti Airtel to be in focus ahead of its June quarter earnings to be declared today. Besides Bharti Airtel, Adani Ports and Special Economic Zone, Power Grid Corporation of India, NALCO, Astrazeneca Pharma India, Chemcon Speciality Chemicals, City Union Bank, Delhivery, Dhanlaxmi Bank, Gujarat Narmada Valley Fertilizers & Chemicals, Housing & Urban Development Corporation, JK Tyre & Industries, Jaypee Infratech, Vedant Fashions, Samvardhana Motherson International, Sequent Scientific, Sun Pharma Advanced Research Company, Subex, Torrent Power, and Whirlpool of India will share their June quarter earnings on August 8.

State Bank of India: The country's largest lender reported a 6.7 percent year-on-year decline in profit at Rs 6,068 crore for the quarter ended June FY23 impacted by lower operating profit and other income, though supported by lower provisions. Net interest income during the quarter grew by 12.87 percent YoY to Rs 31,196 crore, but operating profit declined 32.8 percent YoY to Rs 12,753 crore and other income plunged 80 percent YoY to Rs 2,312 crore for the quarter ended June FY23. Loan loss provisions fell by 15.14 percent to Rs 4,268 crore during the same period.

Hindustan Petroleum Corporation: Oil retailer HPCL posted a big loss of Rs 10,197 crore for the quarter ended June FY23 against profit of Rs 1,795 crore for the same period last year, impacted by erosion in the marketing margin on motor fuels and LPG. Revenue grew by 56 percent YoY to Rs 1.22 lakh crore during the same period.

Marico: The FMCG company reported a 3.3 percent YoY increase in consolidated profit at Rs 377 crore for the June FY23 quarter supported by higher operating performance. Revenue grew by 1.3 percent YoY to Rs 2,558 crore and EBITDA increased by 9.77% to Rs 528 crore compared to year-ago period.

One 97 Communications: Digital payments platform operator Paytm has posted consolidated loss of Rs 645.4 crore for the quarter ended June FY23, widening from loss of Rs 381.9 crore in same period last fiscal. Revenue from operations grew by 88.5 percent to Rs 1,679.60 crore during the same period.

FSN E-Commerce Ventures: The Nykaa brand operator clocked a 42.24 percent year-on-year increase in consolidated profit at Rs 5.01 crore for the quarter ended June FY23, aided by better topline and operating performance of the cosmetics-to-fashion retailer. Revenue from operations for the June FY23 quarter came in at Rs 1,148.4 crore, registering a 40.56% growth compared to same period last year. The consolidated gross merchandise value (GMV) has been quite strong, and has grown 47 percent year-on-year to Rs 2,155.8 crore for the quarter ended June FY23.

IRB Infrastructure Developers: The road developer has reported a 405 percent year-on-year increase in consolidated profit at Rs 363.2 crore for June FY23 quarter driven by higher operating income. Revenue grew by 18.4 percent to Rs 1,924.6 crore compared to corresponding period last fiscal.

NHPC: The company said the board of directors on August 10 may consider monetization of future cash flow (consisting return on equity, capacity based incentive) of one or more power station (s) for suitable tenure, as part of the funding plan of CAPEX for the current financial year 2022-23.

Birla Corporation: The company recorded a 56 percent year-on-year decline in profit at Rs 61.92 crore for the quarter ended June FY23 dented by escalating power, fuel and freight costs. EBITDA fell by 22.5 percent YoY to Rs 274 crore during the quarter, while revenue for the June FY23 quarter increased by 26 percent to Rs 2,218 crore YoY.

Indian Overseas Bank: The public sector lender reported 20 percent year-on-year growth in standalone profit at Rs 392.2 crore for the quarter ended June FY23 quarter supported by lower provisions. Net interest income grew by 17.2 percent on-year to Rs 1,753.8 crore for the June FY23 quarter.

Mahanagar Gas: The company reported a 9.3 percent on-year decline in profit at Rs 185.20 crore for the quarter ended June FY23 impacted by higher cost of natural gas. Revenue grew significantly by 139 percent YoY to Rs 1,593.2 crore during the June FY23 quarter.

Amara Raja Batteries: The automobile battery manufacturer recorded a 6.4 percent YoY growth in consolidated profit at Rs 132 crore for the quarter ended June FY23 supported by revenue but impacted by higher input cost. Revenue grew by 39 percent to Rs 2,620.53 crore during the same period.

Rossari Biotech: The company recorded a 17 percent YoY growth in consolidated profit at Rs 28.68 crore during the quarter ended June FY23 on strong revenue growth & operating performance, but impacted by higher input cost and employee cost. Revenue grew by 88 percent YoY to Rs 434.71 crore in Q1FY23.

Lumax Auto Technologies: The company said the board of directors has given approval for raising of funds upto Rs 400 crore by issuance of securities. The company reported a 431% year-on-year increase in consolidated profit at Rs 26 crore for the quarter ended June FY23 on a low base but there was significant increase in input cost. Revenue grew by 62% YoY to Rs 421.93 crore during the same quarter.

Affle India: The company recorded a 93.5% YoY growth in profit after tax at Rs 55.2 crore for the quarter ended June FY23 on broadbased growth in both CPCU business and non-CPCU business, across India & International markets. Revenue at Rs 347.5 crore grew by 128% YoY and EBITDA rose by 96% to Rs 68.7 crore compared to year-ago period.

Birla Soft: Axis Mutual Fund bought 5.08 lakh shares in the company via open market transactions on August 4. With this, its shareholding in the company increased to 5.12%, up from 4.94% earlier.

Fortis Healthcare: The company recorded a 69% year-on-year decline in consolidated profit at Rs 134.31 crore for the quarter ended June FY23 on a high base as there was an exceptional gain of Rs 306.14 crore in Q1FY22. Revenue grew by 5.5% to Rs 1,487.85 crore compared to corresponding period last fiscal.

Shipping Corporation of India: The company has reported a 28% year-on-year decline in consolidated profit at Rs 114.2 crore for the quarter ended June FY23, impacted by lower operating performance. Revenue grew by 42.5% YoY to Rs 1,465 crore in Q1FY23.

Siemens: The company has made an investment of Rs 1.14 crore in Sunsole Renewables Private Limited, India, towards second tranche equity allotment. The company’s shareholding in Sunsole, post the additional investment, continues to remain at 26% of the paid-up equity share capital of Sunsole.

Engineers India: The company reported a consolidated profit at Rs 64.81 crore for the quarter ended June FY23, rising 2,318% compared to Rs 2.68 crore profit in year-ago period, aided by low base. The Q1FY22 profit was impacted by loss in joint venture entities or associates. Revenue grew by 9.2% YoY to Rs 814.8 crore in June FY23 quarter.

Raymond: The company recorded consolidated profit at Rs 81 crore for the quarter ended June FY23 against loss of Rs 157 crore in corresponding period last fiscal. The year-ago numbers were affected by second Covid wave. Revenue grew by 104% YoY to Rs 1,754 crore for the June FY23 quarter.

Maruti Suzuki India: Life Insurance Corporation of India has sold 2.015% stake or 60.88 lakh equity shares in the country's largest car maker via open market transactions. With this, LIC's stake in the company reduced to 4.2%, down from 6.22% earlier.

Bharat Dynamics: Life Insurance Corporation of India has offloaded 2% equity stake in the company via open market transactions. With this, LIC's shareholding in the company declined to 4.4%, down from 6.4% earlier.

Petronet LNG: The company reported a 8.2% year-on-year increase in consolidated profit at Rs 724.84 crore for the quarter ended June FY23, impacted by higher input cost. Revenue surged 66% to Rs 14,263.8 crore compared to year-ago period.

SJVN: The company has bagged the full quoted capacity of 200 MW solar project at Rs 2.90 per unit on build own and operate (BOO) basis through e-RA conducted on August 4. The power purchase agreement shall be executed after issuance of letter of intent from Maharashtra State Electricity Distribution Company Limited (MSEDCL). The ground mounted solar project shall be developed by SJVN anywhere in Maharashtra through EPC contract.

Ahluwalia Contracts (India): The company has secured new order from IISc Medical School Foundation, Bangalore for construction of IISc Medical School worth of Rs 220 crore. The order inflow during the FY23 stands at Rs 2,352.13 crore, till date.

NMDC: The company clocked a 54% year-on-year decline in consolidated profit at Rs 1,467.65 crore for the quarter ended June FY23, impacted by lower topline. Revenue from operations fell 27% to Rs 4,767 crore compared to year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Global Market Updates - 08.08.2022

Global Market Updates - 08.08.2022