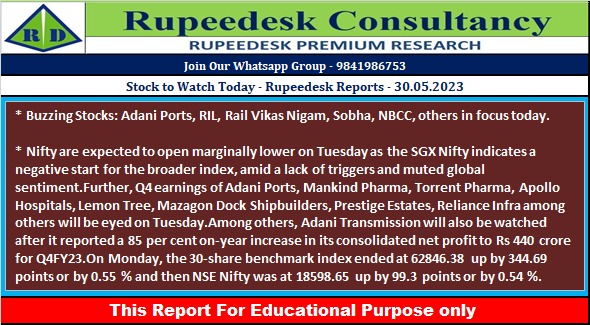

Stock to Watch Today - Rupeedesk Reports - 30.05.2023

Buzzing Stocks: Adani Ports, RIL, Rail Vikas Nigam, Sobha, NBCC, others in focus today.

Results on May 30: Adani Ports and Special Economic Zone, Mankind Pharma, Torrent Pharmaceuticals, Action Construction Equipment, Aegis Logistics, Apollo Hospitals Enterprise, Astrazeneca Pharma India, Bajaj Healthcare, Birla Tyres, Gujarat Mineral Development Corporation, Graphite India, Greenply Industries, Heranba Industries, Indiabulls Real Estate, Insecticides (India), KRBL, Lemon Tree Hotels, Lumax Auto Technologies, Lux Industries, Marksans Pharma, Mazagon Dock Shipbuilders, Panacea Biotec, Patanjali Foods, PC Jeweller, Peninsula Land, Prestige Estates Projects, Rashtriya Chemicals & Fertilizers, Reliance Infrastructure, Suzlon Energy, Uflex, Vakrangee, V-Guard Industries, Vivimed Labs, and Welspun Corp will declare their quarterly earnings today.

Reliance Industries: NBC Universal (NBCU) and JioCinema, Viacom18’s streaming service, have entered into a multi-year partnership to offer films and TV series in India. Under the partnership, the over-the-top (OTT) platform will stream Comcast NBCUniversal’s production entities and brands. The deal will give JioCinema's premium subscribers access to popular hollywood shows. JioCinema is the streaming platform run by India's Reliance Industries.

Rail Vikas Nigam: The state-owned railway company has recorded a 5% year-on-year decline in consolidated profit at Rs 359 crore for quarter ended March FY23, impacted by lower topline. Consolidated revenue from operations dropped 11.1% to Rs 5,720 crore compared to corresponding period last fiscal, but operating profit margin was better due to lower operation expenses.

Torrent Power: The power utility has registered a consolidated profit of Rs 449 crore for the quarter ended March FY23, as against a loss of Rs 488 crore a year ago. Profit in Q4FY23 was boosted by healthy revenue growth, while loss in Q4FY22 was due to one-time loss of Rs 1,300 crore. Revenue from operations grew by 61.3% to Rs 6,038 crore compared to corresponding period last fiscal.

Sobha: The south-based real estate company has reported a massive 242% year-on-year growth in consolidated profit at Rs 48.6 crore for March FY23 quarter despite weak operating margin, driven by healthy topline growth. Revenue from operations surged 70.3% to Rs 1,210 crore compared to corresponding period last year, with consistently higher sales, the highest ever collections and healthy customer deliveries. The board recommended a dividend of Rs 3 per share for FY23.

NBCC (India): The public sector enterprise has registered a whopping 206% year-on-year growth in consolidated profit at Rs 108.4 crore for fourth quarter of FY23, driven by healthy operating performance. Consolidated revenue from operations for the quarter stood at Rs 2,790 crore, increasing 14.3% over a year-ago period.

Indian Railway Catering and Tourism Corporation: The company has recorded a massive 30.4% year-on-year growth in standalone profit at Rs 278.8 crore for March FY23 quarter despite weak operating margin, driven by healthy topline, higher other income and exceptional income. Revenue from operations grew by 40% to Rs 965 crore compared to corresponding period last fiscal.

Jubilant Pharmova: The pharma company has posted consolidated loss of Rs 97.8 crore for quarter ended March FY23, against profit of Rs 59.5 crore in same period last year. The profitability was impacted by dismal operating numbers with significant rise in depreciation, higher inventory, and input cost. Revenue from operations grew by 9.7% to Rs 1,661 crore compared to corresponding period last fiscal.

Campus Activewear: The footwear company's profit for March FY23 quarter came in flat at Rs 22.95 crore compared to corresponding period last fiscal, impacted by lower topline, disappointing operating numbers and higher other expenses. Revenue from operations for the quarter stood at Rs 347.7 crore, falling 1.3% compared to corresponding period last fiscal. The company said the board has appointed Sanjay Chhabra as Chief Financial Officer with effect from June 1 after Raman Chawla resigned as CFO.

ISGEC Heavy Engineering: The engineering company has reported consolidated profit at Rs 86.13 crore for fourth quarter of last financial year 2022-23, growing 129% over corresponding period last fiscal, driven by healthy topline as well as operating numbers. Revenue from operations for the quarter stood at Rs 2,043 crore, increasing 28% over year-ago period. The board recommended a dividend of Rs 3 per share for FY23.

NHPC: The state-owned hydropower development organization has registered profit at Rs 643.4 crore for fourth quarter of FY23, rising 38% over corresponding period last fiscal, driven by robust operating performance. Revenue for March FY23 quarter grew by 21.2% to Rs 2,029 crore compared to year-ago period.

Route Mobile: Guj Info Petro has partnered with Route Mobile to enable SSC (10th grade) examination results over WhatsApp. Now students can simply access their result by sending their exam seat number on the official WhatsApp number. This entire WhatsApp solution has been facilitated by Route Mobile’s CPaaS platform for WhatsApp Business Messaging. Guj Info Petro is the official IT partner of the Gujarat Secondary and Higher Secondary Education Board.

Clean Science & Technology: Think India Opportunities Master Fund LP bought 8.82 lakh equity shares in the company via open market transactions at an average price of Rs 1,406 per share. However, promoters - Nilima Krishnakumar Boob sold 8.78 lakh shares in the company at an average price of Rs 1,406.64 per share, Asha Ashok Boob offloaded 18.65 lakh shares at an average price of Rs 1,407.22 per share, and Asha Ashok Sikchi sold 9.84 lakh shares at an average price of Rs 1,406 per share.

Gravita India: Promoter Rajat Agrawal has offloaded 32 lakh shares or 4.63 percent stake in the company via open market transaction at an average price of Rs 565 per share. However, Employees Provident Fund Board Managed by Nomura Asset Management Malaysia SDN BHD bought 5.5 lakh shares, The Nomura Trust and Banking Co Ltd as The Trustee of Nomura India Stock purchased 7.5 lakh shares, The MTBJ A/C Nomura India Inves FD purchased 15 lakh shares, and Nomura Funds Ireland Public Limited Company- Nomura Funds Ireland - India Equity Fund bought 4 lakh shares, at an average price of Rs 565 per share.

Techno Electric & Engineering Company: The company has reported consolidated profit at Rs 56.8 crore for March FY23 quarter, rising 52.5% over a year-ago period despite weak operating performance and muted topline growth, driven by one-time exceptional gain. Revenue from operations grew by 2.5% to Rs 313 crore compared to same period last year.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc