Stock to watch bharatforg hits 3 months low today - 15.02.2023

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Tuesday, February 14, 2023

Stock to watch bharatforg hits 3 months low today - 15.02.2023

Stock to watch : Grasim - 15.02.2023

Stock to watch : Grasim - 15.02.2023

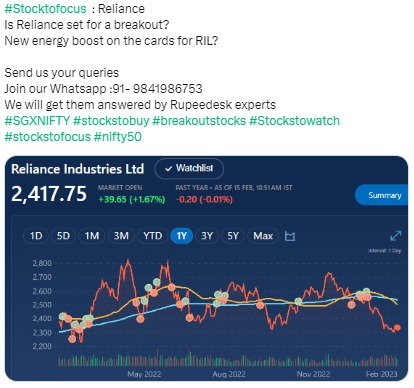

Is Reliance set for a breakout ? - 15.02.2023

Is Reliance set for a breakout ? - 15.02.2023

US and Asian Market - 15.02.2023

US and Asian Market - 15.02.2023

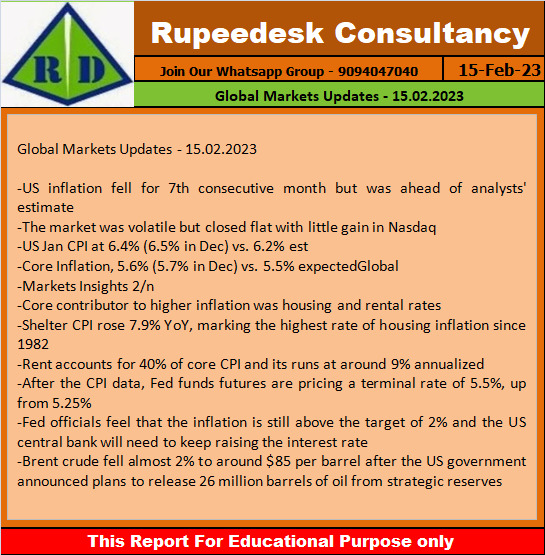

Global Markets Updates - 15.02.2023

Global Markets Updates - 15.02.2023

Stock to Watch Today - Rupeedesk Reports - 15.02.2023

Stock to Watch Today - Rupeedesk Reports - 15.02.2023

Buzzing Stocks: ONGC, Prestige Estates, Bata India, and others in news today.

ONGC: The state-owned oil & exploration company has recorded a 26% year-on-year growth in standalone profit at Rs 11,045 crore for quarter ended December FY23. Revenue for the quarter at Rs 38,583.3 crore increased by 35.5% over a year-ago period, with crude oil price realisation growing 26%. The board members have declared second interim dividend of Rs 4 per share.

LT Foods: The Competition Commission of India has approved acquisition of certain equity shares of consumer food company LT Foods by SALIC International Investment Corporation based in Saudi Arabia. SALIC is an investment company with holdings in various international companies specialised in the fields of agriculture and trading of food commodities both in Saudi Arabia and internationally.

Prestige Estates Projects: The real estate developer has recorded a massive 47.6% year-on-year growth in consolidated profit at Rs 127.8 crore for quarter ended December FY23, supported by healthy topline and operating income. Revenue from operations grew significantly by 74.5% YoY to Rs 2,317 crore for the quarter. On the operating front, EBITDA jumped 57.5% YoY to Rs 574.2 crore in Q3FY23, but margin fell by 268 bps YoY to 24.78%.

Bata India: The footwear company has reported a 15% year-on-year growth in profit at Rs 83.1 crore for quarter ended December FY23, supported by operating performance. Revenue for the quarter at Rs 900.2 crore grew by 7% over a year-ago period. At the operating level, EBITDA jumped 22.2 YoY to Rs 206 crore with margin expansion of 284 bps in Q3FY23. Numbers were lower than analysts' expectations. Strong portfolio evolution, strong footprint expansion across touchpoints coupled with improving cost efficiencies helped drive revenue growth and increase margins despite significant inflationary pressure.

Apollo Hospitals Enterprise: The healthcare services provider has registered a 33.3% year-on-year decline in consolidated profit at Rs 162.3 crore for third quarter of FY23, impacted by weak operating performance. The higher purchase of stock-in-trade and employee expenses impacted operating numbers. Revenue for the quarter at Rs 4,264 crore increased by 17.2% over a year-ago period. On the operating front, EBITDA fell 14% YoY to Rs 505.35 crore with margin down by 428 bps for the quarter. The board declared an interim dividend of Rs 6 per share.

Torrent Power: The power utility company has recorded a whopping 86% year-on-year growth in consolidated profit at Rs 685 crore for three-month period ended December FY23 as revenue grew by 71% YoY to Rs 6,443 crore during the quarter. On the operating front, EBITDA for the quarter at Rs 1,444 crore increased by 54.6% over a year-ago period, but margin declined 239 bps in the same period. The company declared an interim dividend of Rs 22 per share including Rs 13 per share as a special dividend for FY23.

Biocon: The biopharmaceutical company has posted a consolidated loss of Rs 41.8 crore for December FY23 quarter as against a profit of Rs 187.1 crore in corresponding period of last fiscal as there was one-time loss of Rs 271.4 crore during the quarter. Consolidated revenue grew by 35.3% YoY to Rs 2,941 crore driven by growth across key segments (generics, biosimilars and research services). At the operating level, EBITDA surged 32% YoY to Rs 644.3 crore but margin declined 55 bps on higher input cost for the quarter. Biocon has entered into a definitive agreement with Kotak Strategic Situations Fund for a structured funding up to Rs 1,200 crore.

GMR Airports Infrastructure: The company has reported profit at Rs 191.4 crore for quarter ended December FY23, against loss of Rs 626.3 crore in same period last year, supported by exceptional gain of Rs 292.52 crore, higher other income and forex gains. Revenue grew by 29.5% YoY to Rs 1,766.4 crore for the quarter. On the operating front, EBITDA fell by 26% YoY to Rs 530 crore with margin contraction of 2,245 bps compared to year-ago period.

PNC Infratech: The construction engineering company has reported a massive 69% year-on-year growth in consolidated profit at Rs 140 crore for three-month period ended December FY23 as there was sharp fall in depreciation and other expenses. Revenue for the quarter grew by 4.7% YoY to Rs 1,803 crore, while on the operating front, EBITDA increased by 6% YoY to Rs 345 crore with margin expansion of 116 bps.

EID Parry (India): The sugar manufacturer has reported consolidated profit at Rs 250.89 crore for quarter ended December FY23, rising 10.1% YoY impacted by lower operating margin. Consolidated revenue grew by 52% YoY to Rs 9,917 crore for the quarter. At the operating level, EBITDA jumped 49% YoY to Rs 914.4 crore but margin fell by 17 bps YoY to 9.22% for the quarter on higher input cost.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

Mcx Commodity Intraday Trend Rupeedesk Reports - 14.02.2023

Mcx Commodity Intraday Trend Rupeedesk Reports - 14.02.2023

Currency Market Intraday Trend Rupeedesk Reports - 14.02.2023

Currency Market Intraday Trend Rupeedesk Reports - 14.02.2023

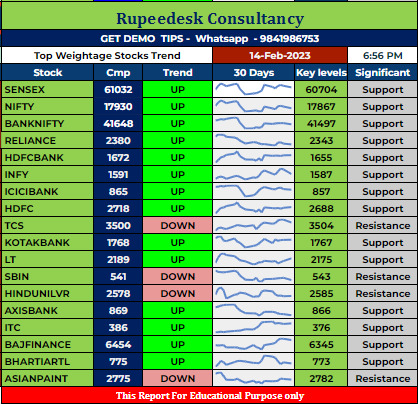

Top Weightage Stocks Trend Rupeedesk Reports - 14.02.2023

Top Weightage Stocks Trend Rupeedesk Reports - 14.02.2023

Market Highlights - 14.02.2023

Market Highlights - 14.02.2023

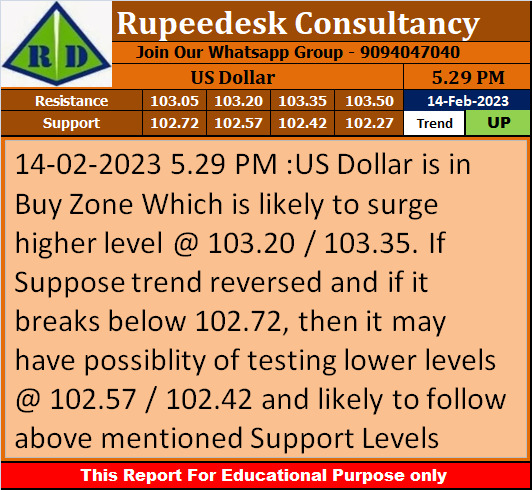

US Dollar Trend Update - Rupeedesk Reports - 14.02.2023

US Dollar Trend Update - Rupeedesk Reports - 14.02.2023

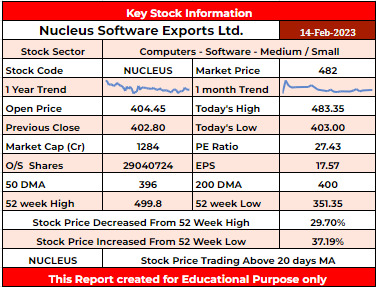

NUCLEUS Stock Analysis - Rupeedesk Reports - 14.02.2023

NUCLEUS Stock Analysis - Rupeedesk Reports - 14.02.2023

Oil refiners may buy more Russian fuel, export local products to Western markets - Rupeedesk Reports - 14.02.2023

Oil refiners may buy more Russian fuel, export local products to Western markets - Rupeedesk Reports - 14.02.2023

European Union suggests reforms to enable currency convertibility from India - Rupeedesk Reports - 14.02.2023

European Union suggests reforms to enable currency convertibility from India - Rupeedesk Reports - 14.02.2023

Central government may allocate more subsidies to promote electric buses - Rupeedesk Reports - 14.02.2023

Central government may allocate more subsidies to promote electric buses - Rupeedesk Reports - 14.02.2023

Infosys, Wipro keep upcoming engineering graduates waiting for campus placements - Rupeedesk Reports - 14.02.2023

Infosys, Wipro keep upcoming engineering graduates waiting for campus placements - Rupeedesk Reports - 14.02.2023

Market regulator to discuss Adani stock rout at board meeting this week - Rupeedesk Reports - 14.02.2023

Market regulator to discuss Adani stock rout at board meeting this week - Rupeedesk Reports - 14.02.2023

Mauritius says no breach of law by entities being linked to Adani Group - Rupeedesk Reports - 14.02.2023

Mauritius says no breach of law by entities being linked to Adani Group - Rupeedesk Reports - 14.02.2023

Vodafone Idea in discussions to refinance loans worth up to Rs 4,000 crore - Rupeedesk Reports - 14.02.2023

Vodafone Idea in discussions to refinance loans worth up to Rs 4,000 crore - Rupeedesk Reports - 14.02.2023

Tata Group poised to post highest growth in history of over 20 per cent - Rupeedesk Reports - 14.02.2023

Tata Group poised to post highest growth in history of over 20 per cent - Rupeedesk Reports - 14.02.2023