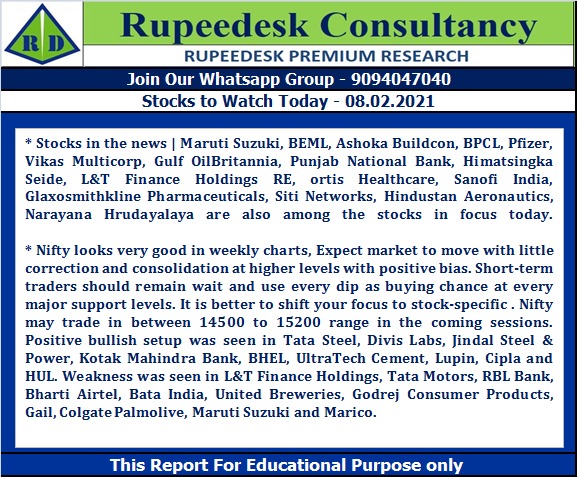

Stocks in the news | Maruti Suzuki, BEML, Ashoka Buildcon, BPCL, Pfizer, Vikas Multicorp, Gulf Oil

Britannia, Punjab National Bank, Himatsingka Seide, L&T Finance Holdings RE, Stove Kraft, Fortis Healthcare, Sanofi India, Glaxosmithkline Pharmaceuticals, Siti Networks, Hindustan Aeronautics, Narayana Hrudayalaya are also among the stocks in focus today.

Results today | BPCL, Aditya Birla Fashion, Astrazeneca Pharma, Balkrishna Industries, Bombay Dyeing, Godrej Consumer Products, NMDC, Redington India, Sun Pharma Advanced Research Company, Sun TV Network, Torrent Pharmaceuticals, Usha Martin and Vakrangee were among 140 companies to announce their quarterly earnings.

Britannia | The company reported a profit of Rs 452.6 crore in Q3 FY21 against Rs 368.9 crore in Q3 FY20. Revenue rose to Rs 3,165.6 crore from Rs 2,982.7 crore YoY.

Punjab National Bank | The bank reported a profit of Rs 506 crore in Q3 FY21 against Rs 621 crore in Q2 FY21. Revenue fell to Rs 8,313 crore from Rs 8,444.9 crore QoQ.

Maruti Suzuki | Total production in January 2021 dropped to 1.60 lakh units from 1.79 lakh units in January 2020.

BEML | The company signed a MoUs with 11 entities to explore & enhance business in defence & aerosapce.

Ashoka Buildcon | The company reported a consolidated profit of Rs 88.4 crore in Q3 FY21 against Rs 32.4 crore in Q 3FY20, while revenue increased to Rs 1,305.5 crore from Rs 1,280.4 crore YoY.

Pfizer | The company reported a profit of Rs 141.2 crore in December quarter 2020 against Rs 139.1 crore in December quarter 2019, revenue increased to Rs 593.5 crore from Rs 538.2 crore YoY.

Himatsingka Seide | The company reported a consolidated profit at Rs 45.1 crore in Q3 FY21 against Rs 2.8 crore in Q3 FY20, revenue rose to Rs 679.4 crore from Rs 665.6 crore YoY.

Ganesha Ecosphere | Tata Trustee Company for Tata MF acquired 4.65 lakh equity shares of the company at Rs 475 per share on the NSE. However, MCAP India Fund sold 2.5 lakh shares at Rs 475.13 per share and another 2.5 lakh shares at Rs 475.02 per share.

L&T Finance Holdings RE | Citigroup Global Markets Mauritius sold 34,54,478 Rights Entitlement shares of the company at Rs 24.84 per share on the NSE.

Stove Kraft | Nippon India Mutual Fund bought 7 lakh shares of the company at Rs 455.87 per share and Unifi Capital bought 6,69,275 shares at Rs 453.07 per share on the NSE. However, Copthall Mauritius Investment sold 2,31,370 shares at Rs 462.48 per share, Integrated Core Strategies Asia Pte sold 1,92,939 shares at Rs 462.59 per share and Societe Generale sold 1.8 lakh shares at Rs 451.24 per share.

Vikas Multicorp | Albula Investment Fund sold 1 crore shares of the company at Rs 3.6 per share on the NSE.

Gulf Oil Lubricants | The company reported a profit at Rs 64 crore in Q3 FY21 against Rs 55.87 crorein Q3 FY20, revenue rose to Rs 481.86 crore from Rs 421.86 crore YoY.

KPI Global Infrastructure | The company signed new long-term power purchase agreements (PPAs) for sale of 13.15 MW solar power for a period of 20 years under Independent Power Producer (IPP) business vertical. The company received the intimation for cancellation of 1.995 MW order of solar power plant under captive power producer (CPP) and Independent Power Producer (IPP) segment of the company.

Fortis Healthcare | TThe company posted a consolidated profit of Rs 53.88 crore in Q3 FY21 against a loss of Rs 69.3 crore in Q3F Y20. Revenue rose to Rs 1,177 crore from Rs 1,169 crore YoY.

Sanofi India | The company reviewed the proposed plan of the Sanofi Group to globally sell some of its old brands along with their trademarks which Sanofi Group owns.

Jindal Saw | The company reported a consolidated profit of Rs 88.09 crore in Q3 FY21 against Rs 65.49 crore in Q3 FY20, while revenue fell to Rs 2,864.7 crore from Rs 2,988 crore YoY.

CG Power and Industrial Solutions | The company posted a loss of Rs 534.6 crore in Q3 FY21 against loss Rs 210 crore in Q3 FY20, revenue fell to Rs 819.5 crore from Rs 1,178.32 crore YoY.

Mrs Bectors Food Specialities | The company reported a profit of Rs 20.67 crore in Q 3FY21 against Rs 11.14 crore in Q3 FY20. Revenue rose to Rs 225.75 crore from Rs 203.8 crore YoY.

Puravankara | Kuldeep Chawla resigned as Chief Financial Officer and key managerial personnel of the company.

Glaxosmithkline Pharmaceuticals | The company reported a consolidated profit of Rs 156.5 crore in Q3 FY21 against a loss of Rs 661.16 crore in Q3 FY20, revenue rose to Rs 857.20 crore from Rs 778.6 crore YoY.

Siti Networks | The company approved the sale of 6,667 equity shares (constituting 40 percent equity stake) held by subsidiary Variety Entertainment in Voice Snap for Rs 10 crore.

Hindustan Aeronautics | The company and Safran signed MoU for Collaboration in the development, manufacture, maintenance, training and upgrade of high-thrust aero-engines.

Narayana Hrudayalaya | The company reported a consolidated profit of Rs 40.8 crore in Q3 FY21 against Rs 31.4 crore in Q3 FY20, revenue fell to Rs 750.3 crore from Rs 785.2 crore YoY.

Shipping Corporation of India | The company reported a consolidated profit of Rs 131.57 crore in Q3 FY21 against Rs 295.2 crore in Q3 FY20, revenue fell to Rs 841.2 crore from Rs 1,218.2 crore YoY.

Equitas Holdings | The company reported a consolidated profit of Rs 251.45 crore in Q3FY21 against Rs 79.3 crore in Q3FY20, revenue rose to Rs 1,133.23 crore from Rs 737.8 crore YoY.

Adani Enterprises | The company arm bought 23.5 percent stake in Mumbai international airport for Rs 1700 crore.