Buzzing Stocks: Asian Paints, PNB Housing, Mindtree and other stocks in news today

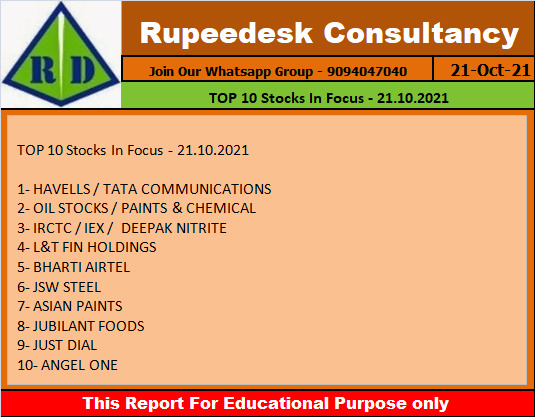

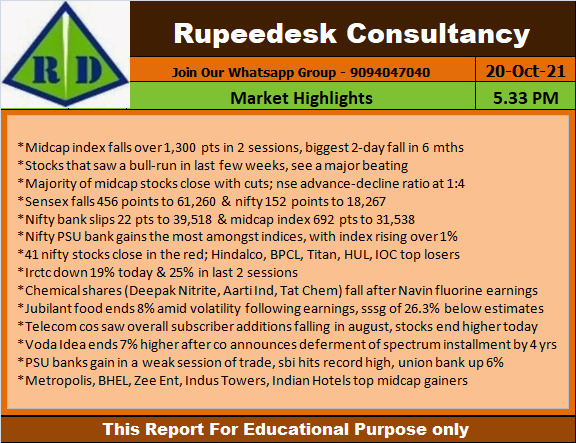

Results on October 21: Asian Paints, JSW Steel, Biocon, 63 Moons Technologies, Agro Tech Foods, Borosil Renewables, Can Fin Homes, CG Power and Industrial Solutions, Container Corporation of India, ICICI Lombard General Insurance Company, IDBI Bank, Indian Energy Exchange, IIFL Securities, Indian Hotels, IndiaMART InterMESH, Duncan Engineering, Gateway Distriparks, Heritage Foods, Jubilant Industries, Lemon Tree Hotels, LIC Housing Finance, Bank of Maharashtra, Mphasis, Music Broadcast, Rane Engine Valve, Sasken Technologies, South Indian Bank, Sterlite Technologies, Tanla Platforms, Trident, TVS Motor Company, and VST Industries will release September quarter earnings on October 21.

L&T Finance Holdings: The company reported lower consolidated profit at Rs 224.03 crore in Q2FY22 against Rs 265.12 crore in Q2FY21, revenue fell to Rs 3,051.82 crore from Rs 3,408.10 crore YoY.

PNB Housing Finance: The company will consider the issuance of non-convertible debentures on private placement basis of Rs 2,000 crore in tranches on November 2.

Mindtree: Dayapatra Nevatia resigned as Executive Director & COO of the company.

Havells India: The company reported lower consolidated profit at Rs 302.39 crore in Q2FY22 against Rs 326.36 crore in Q2FY21, revenue rose to Rs 3,238 crore from Rs 2,459.5 crore YoY.

Tejas Networks: The company reported lower consolidated profit at Rs 3.66 crore in Q2FY22 against Rs 4.53 crore in Q2FY21, revenue jumped to Rs 172.78 crore from Rs 110.06 crore YoY.

Tata Communications: The company reported higher consolidated profit at Rs 425.38 crore in Q2FY22 against Rs 384.48 crore in Q2FY21, revenue fell to Rs 4,174 crore from Rs 4,401 crore YoY.

Prince Pipes and Fittings: South Asia Growth Fund II Holdings LLC sold 22.12 lakh equity shares in the company via open market transactions, reducing shareholding to 3.65% from 5.66% earlier.

Bharat Gears: The company approved rights entitlement ratio at 1:10 (one equity share for every 10 shares held by shareholders) and fixed issue price at Rs 105 per rights equity share.

Hathway Cable & Datacom: The company reported lower consolidated profit at Rs 19.05 crore in Q2FY22 against Rs 52.33 crore in Q2FY21, revenue rose to Rs 447.87 crore from Rs 431.24 crore YoY.

Jindal Stainless (Hisar): The company commissioned the 26,000 tonnes per annum (TPA) capacity precision strip mill as part of the first phase of its latest brownfield expansion plan at specialty products division (SPD).

Angel Broking: The company reported higher consolidated profit at Rs 134.2 crore in Q2FY22 against Rs 74.5 crore in Q2FY21, revenue jumped to Rs 527.34 crore from Rs 309.85 crore YoY.

Varroc Engineering: HDFC Asset Management Company acquired 0.58% stake in the company via open market transactions on October 19, increasing shareholding to 5.11% from 4.53% earlier.

INEOS Styrolution India: Nippon Life India Trustee sold 50,000 equity shares in the company via open market transactions on October 18, reducing shareholding to 2.97% from 3.26% earlier.

TT Limited: The company reported profit at Rs 5.20 crore in Q2FY22 against loss of Rs 2.66 crore in Q2FY21, revenue jumped to Rs 117.64 crore from Rs 98.90 crore YoY.

Dhani Services: The company approved preferential issue of Rs 1,200 crore to five investors, at a price of Rs 196 per share.