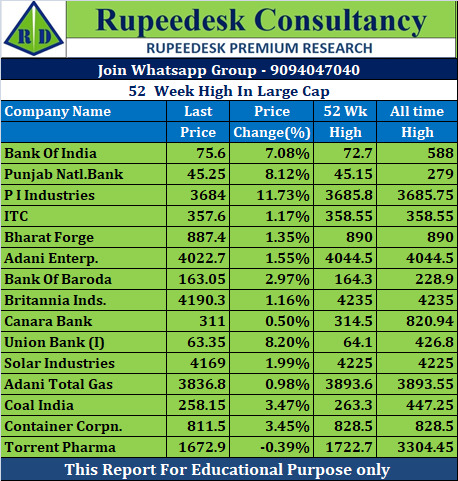

52 Week High In Large Cap - 09.11.2022

Stock Market Training for beginners. Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in.Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.

Tuesday, November 8, 2022

52 Week High In Large Cap - 09.11.2022

Price Increase & Vol Increase In Large Cap - 09.11.2022

Price Increase & Vol Increase In Large Cap - 09.11.2022

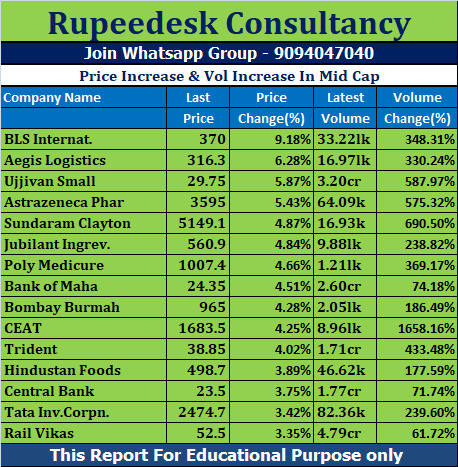

Price Increase & Vol Increase In Mid Cap - 09.11.2022

Price Increase & Vol Increase In Mid Cap - 09.11.2022

Price Increase & Vol Increase In Small Cap - 09.11.2022

Price Increase & Vol Increase In Small Cap - 09.11.2022

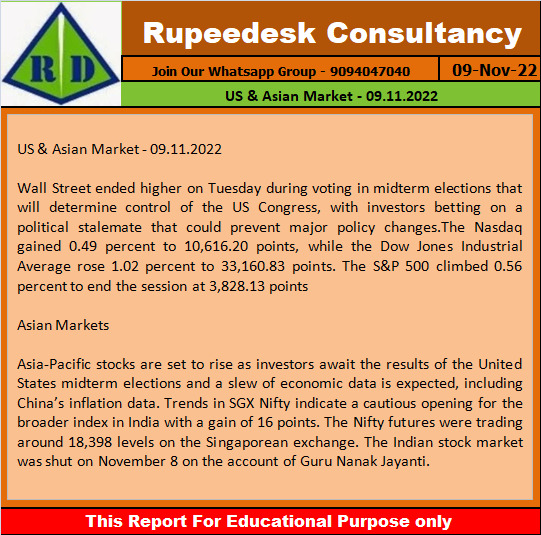

US & Asian Market - 09.11.2022

US & Asian Market - 09.11.2022

TOP 10 Stocks In Focus - 09.11.2022

TOP 10 Stocks In Focus - 09.11.2022

Global Market Updates - 09.11.2022

Global Market Updates - 09.11.2022

Earning Results Corner - 09.11.2022

Earning Results Corner - 09.11.2022

Nifty Outlook - 09.11.2022

Nifty Outlook - 09.11.2022

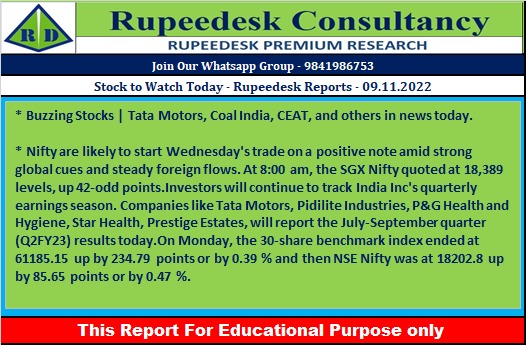

Stock to Watch Today - Rupeedesk Reports - 09.11.2022

Stock to Watch Today - Rupeedesk Reports - 09.11.2022

Buzzing Stocks | Tata Motors, Coal India, CEAT, and others in news today.

Results on November 9: Tata Motors to be in focus ahead of September FY23 quarter earnings on November 9. Others to declare their financial results for the September 2022 quarter today include Lupin, NALCO, Bajaj Consumer Care, Balrampur Chini Mills, Barbeque-Nation Hospitality, Deepak Nitrite, Edelweiss Financial Services, Engineers India, Godrej Properties, Nuvoco Vistas Corporation, Petronet LNG, Pidilite Industries, Prestige Estates Projects, Quess Corp, Star Health, and Tracxn Technologies.

Coal India: Coal India Q2 profit jumps 106% YoY to Rs 6,044 crore supported by healthy top line, higher other income. Revenue jumps 28%. The country's largest coal mining company clocked a massive 106% year-on-year increase in consolidated profit at Rs 6,044 crore for the quarter ended September FY23, supported by healthy top line, higher other income, and strong operating performance. Revenue from operations jumped 28% YoY to Rs 29,838 crore for the quarter with raw coal production rising 10.6% YoY to 139.2 million tonnes, and raw coal off take increasing 4.8% to 154.53 million tonnes.

CEAT: CEAT Q2 profit tanks 85% YoY to Rs 6.44 crore impacted by increase in input cost, expenses towards voluntary retirement scheme. The RPG Group company has reported a 85% year-on-year decline in consolidated profit at Rs 6.44 crore for the quarter ended September FY23, dented by increase in input cost and expenses towards voluntary retirement scheme. Revenue from operations increased by 18% YoY to Rs 2,894 crore, and EBITDA at Rs 203.14 crore fell by 7.8% compared to year-ago period. It received approval from board of directors for additional investment of Rs 396 crore to increase farm radial tyres capacity at Ambarnath plant, by 55 tonnes per day over a period of next two years.

Cera Sanitaryware: Cera Sanitaryware Q2 profit jumps 19% to Rs 51.14 crore on healthy operating performance. Revenue grows 5.5%. The company recorded consolidated profit at Rs 51.14 crore for the quarter ended September FY23, up 19% over year-ago period, on healthy operating performance. Revenue at Rs 416 crore for the quarter increased by 5.5% YoY. EBITDA jumped 13.6% YoY to Rs 67.92 crore and margin expanded 115 bps YoY to 16.32% in Q2FY23.

One 97 Communications: Paytm Q2 loss widens YoY to Rs 571.5 crore. Operating revenue increases 76%. Paytm posted consolidated loss at Rs 571.5 crore for the quarter ended September FY23, widening from loss of Rs 473.5 crore in same period last year, but falling from loss Rs 645.4 crore in previous quarter. Revenue from operations increased by 76% on-year to Rs 1,914 crore for the quarter, driven by increase in merchant subscription revenues, growth in bill payments due to growing MTU (monthly transaction user) and growth in disbursements of loans through the platform. The sequential rise in top line was 14%.

Bharat Petroleum Corporation: Bharat Petroleum Corporation Q2 loss at Rs 304.2 crore despite one-time compensation from government for under recoveries. The oil marketing company reported standalone loss of Rs 304.2 crore for the quarter ended September FY23, against profit of Rs 2,841 crore in same period last year, despite one-time compensation of Rs 5,582 crore from government for under recoveries. Revenue from operations increased 26% YoY to Rs 1.28 lakh crore for the quarter.

Multi Commodity Exchange of India: Sebi appoints Harsh Kumar Bhanwala as Chairman of Multi Commodity Exchange of India. SEBI has given its approval for appointment of Dr Harsh Kumar Bhanwala as Chairman of the governing board of MCX. The said appointment is effective from November 7. He has over 36 years of experience in development finance, organisational transformation and solving rural problems, enhancing farmer’s income and promoting sustainable agriculture.

Endurance Technologies: Endurance Technologies Q2 profit falls 1.4% YoY to Rs 131.5 crore on higher input cost, other expenses. Revenue up 25%. The company recorded consolidated profit at Rs 131.5 crore for the qurater ended September FY23, down 1.4% compared to year-ago period, hit by higher input cost, and other expenses. Consolidated revenue from operations grew by 25% to Rs 2,360.6 crore compared to same period last year.

KEC International: KEC International Q2 profit falls 31% YoY to Rs 55 crore impacted by weak operating performance. Revenue grows 13.3%. The infrastructure EPC major has recorded a 31% year-on-year decline in consolidated profit at Rs 55 crore for the quarter ended September FY23, impacted by weak operating performance. Revenue from operations grew by 13.3% YoY to Rs 4,064 crore, but EBITDA fell 30% YoY to Rs 178 crore and margin contracted by 270 bps YoY to 4.4% for the quarter. The year-to-date order intake was Rs 10,465 crore, a robust growth of 25% YoY.

PB Fintech: PB Fintech Q2 loss narrows to Rs 186.63 crore. Revenue jumps 105% to Rs 574 crore. The policybazaar posted consolidated loss of Rs 186.63 crore for the quarter ended September FY23, narrowing from loss of Rs 204.44 crore in corresponding quarter of last fiscal, but revenue from operations at Rs 573.5 crore for the quarter increased by 105% YoY. The company stayed confident of being adjusted EBITDA positive by Q4 this year.

Grauer & Weil India: Grauer & Weil India Q2 profit jumps 56% on strong by top line, operating income. Revenue increases 21%. The company has reported a 56.5% year-on-year growth in consolidated profit at Rs 28 crore for the quarter ended September FY23, supported by top line and operating income. Revenue for the quarter at Rs 205 crore increased by 21% compared to same period last year.

Bharat Electronics: Bharat Electronics in pact with Delhi Metro Rail Corporation to develop train control system. The Navratna defence PSU has signed a Memorandum of Understanding (MoU) with Delhi Metro Rail Corporation (DMRC) for jointly developing the indigenous communication-based train control system (i-CBTC). This is an important milestone in India's journey towards self-reliance in Rail and Metro operations.

Redington India: Redington Q2 profit rises 21.3% YoY to Rs 391.91 crore. Revenue grows 24.6% with healthy growth in SISA, Rest of World. The company reported a 21.3% year-on-year increase in consolidated profit at Rs 391.91 crore for the quarter ended September FY23. Revenue grew by 24.6% to Rs 19,051 crore compared to same period last year with healthy growth in Singapore, India & South Asia, as well as Rest of World.

Affle India: Affle India Q2 profit jumps 40% YoY to Rs 58.7 crore on healthy growth in topline, operating performance. Revenue rises 29%. The consumer intelligence driven global technology company has clocked a 39.6% year-on-year increase in profit at Rs 58.7 crore for the quarter ended September FY23 on healthy growth in topline and operating performance. Revenue at Rs 354.6 crore for the quarter increased by 29% YoY and EBITDA rose 39% YoY to Rs 72.3 crore in Q2FY23. The CPCU business noted strong momentum delivering 6.5 crore converted users in Q2FY23, an increase of 32.7% YoY.

Insecticides (India): Insecticides (India) Q2 profit rises 7% YoY to Rs 44.83 crore. Revenue grows 31%. The chemical manufacturing company has reported a 7% year-on-year growth in consolidated profit at Rs 44.83 crore for the quarter ended September FY23, led by strong top line and operating performance. Revenue grew by 31% year-on-year to Rs 582 crore for the quarter.

Peninsula Land: Peninsula Land reports Q2 profit at Rs 20.7 crore. Revenue grows 76%. The company recorded consolidated profit at Rs 20.7 crore for the quarter ended September FY23, against loss of Rs 48.16 crore in corresponding period last fiscal. Revenue from operations for the quarter at Rs 296.4 crore grew by 76% compared to year-ago period.

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc