Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

Aussie Dollar Outlook: Bullish Rally or Bearish Trap?

K Karthik Raja (Market Educator & Technical Analyst)

MCA | MBA | M.Com | MSc Psychology | PGJMC | CST | MDAT | CFA Pursuant

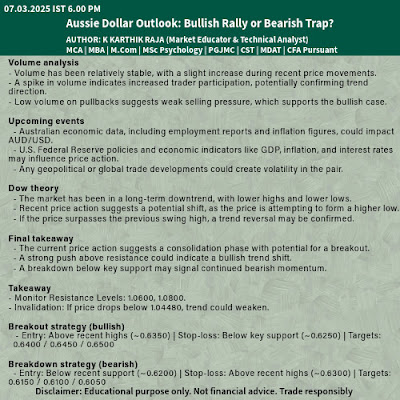

- Volume analysis

- Volume has been relatively stable, with a slight increase during recent price movements.

- A spike in volume indicates increased trader participation, potentially confirming trend direction.

- Low volume on pullbacks suggests weak selling pressure, which supports the bullish case.

- Upcoming events

- Australian economic data, including employment reports and inflation figures, could impact AUD/USD.

- U.S. Federal Reserve policies and economic indicators like GDP, inflation, and interest rates may influence price action.

- Any geopolitical or global trade developments could create volatility in the pair.

- Dow theory

- The market has been in a long-term downtrend, with lower highs and lower lows.

- Recent price action suggests a potential shift, as the price is attempting to form a higher low.

- If the price surpasses the previous swing high, a trend reversal may be confirmed.

- Final takeaway

- The current price action suggests a consolidation phase with potential for a breakout.

- A strong push above resistance could indicate a bullish trend shift.

- A breakdown below key support may signal continued bearish momentum.

- Breakout strategy (bullish)

- Entry: Above recent highs (~0.6350) | Stop-loss: Below key support (~0.6250) | Targets: 0.6400 / 0.6450 / 0.6500

- Confirmation: Breakout with strong volume

- Breakdown strategy (bearish)

- Entry: Below recent support (~0.6200) | Stop-loss: Above recent highs (~0.6300) | Targets: 0.6150 / 0.6100 / 0.6050

- Confirmation: Strong selling pressure and close below moving averages

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Please consult with a professional before making investment decisions.

Online Stock Market Traning : Whatsapp : 9841986753

One to One Share Market Training : Whatsapp : 9841986753

RUPEEDESK SHARES

Rupeedesk Shares| Share Market Training | Intraday Training | Wealth creation

Stock Market Training for beginners,Technical Analysis on Equity,Commodity,Forex Market,Learn Indian Equity Share Market Share Market Trading Basics: Fundamentals Of Share Market Trading training, Stock Market Basics - Share Market Trading Basics,Share Market Trading Questions/Answers/Faq about Share Market derivatives,rupeedesk,learn and earn share Equity,Commodity and currency market traded in NSE,MCX,NCDEX And MCXSX- Rupeedesk.Contact: 9094047040/9841986753/ 044-24333577, www.rupeedesk.in)

No comments:

Post a Comment