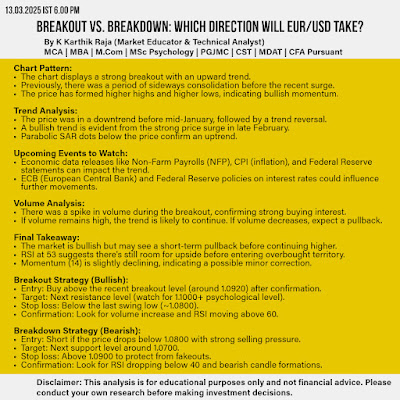

Chart Pattern:

- The chart displays a strong breakout with an upward trend.

- Previously, there was a period of sideways consolidation before the recent surge.

- The price has formed higher highs and higher lows, indicating bullish momentum.

Trend Analysis:

- The price was in a downtrend before mid-January, followed by a trend reversal.

- A bullish trend is evident from the strong price surge in late February.

- Parabolic SAR dots below the price confirm an uptrend.

Upcoming Events to Watch:

- Economic data releases like Non-Farm Payrolls (NFP), CPI (inflation), and Federal Reserve statements can impact the trend.

- ECB (European Central Bank) and Federal Reserve policies on interest rates could influence further movements.

Moving Averages Insights:

- Green line (200 SMA): Price has crossed above the long-term moving average, confirming a bullish breakout.

- Orange & red lines (short-term MAs): These are sloping upwards, indicating a shift in momentum.

- The crossover of shorter MAs above longer MAs supports a bullish outlook.

Volume Analysis:

- There was a spike in volume during the breakout, confirming strong buying interest.

- If volume remains high, the trend is likely to continue. If volume decreases, expect a pullback.

Final Takeaway:

- The market is bullish but may see a short-term pullback before continuing higher.

- RSI at 53 suggests there's still room for upside before entering overbought territory.

- Momentum (14) is slightly declining, indicating a possible minor correction.

Breakout Strategy (Bullish):

1. Entry: Buy above the recent breakout level (around 1.0920) after confirmation.

2. Target: Next resistance level (watch for 1.1000+ psychological level).

3. Stop loss: Below the last swing low (~1.0800).

4. Confirmation: Look for volume increase and RSI moving above 60.

Breakdown Strategy (Bearish):

1. Entry: Short if the price drops below 1.0800 with strong selling pressure.

2. Target: Next support level around 1.0700.

3. Stop loss: Above 1.0900 to protect from fakeouts.

4. Confirmation: Look for RSI dropping below 40 and bearish candle formations.

No comments:

Post a Comment