Stock to Watch Today - Rupeedesk Reports - 06.05.2024

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

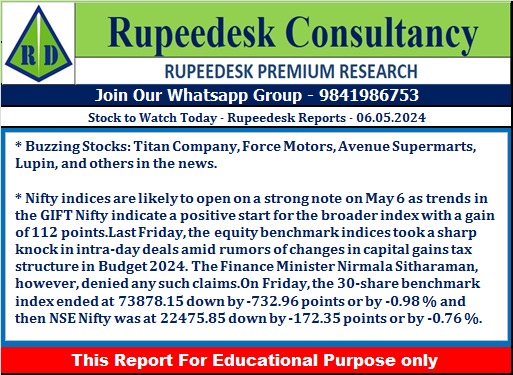

Buzzing Stocks: Titan Company, Force Motors, Avenue Supermarts, Lupin, and others in the news.

Titan Company: The jewellery and watch maker recorded a standalone net profit of Rs 786 crore for the quarter ended March FY24, growing 7.1 percent over the corresponding period of the previous fiscal year, impacted by a weak operating margin. Revenue from operations for the quarter, at Rs 11,257 crore, increased by 16 percent over the same period in the in the previous fiscal. The company announced a dividend of Rs 11 per share for FY24 and re-appointed C. K. Venkataraman as Managing Director with effect from October 1 this year.

Tata Power Company: Subsidiary Tata Power Renewable Energy has signed a power purchase agreement with PSU company SJVN to set up a 460 MW Firm and Dispatchable Renewable Energy (FDRE) project. The plant will generate nearly 3,000 million units (MUs) of power and offset 2,200 million kg of CO2 emissions annually, while FDRE enables round-the-clock power supply, assisting distribution companies in fulfilling renewable purchase obligations, and energy storage obligations.

Dr. Reddy's Laboratories: The pharma company launched Doxycycline capsules, 40 mg, in the US market. The drug is a therapeutic generic equivalent of Oracea capsules approved by the US Food and Drug Administration. Doxycycline capsules are used for the treatment of infections caused by bacteria.

HDFC Bank: The Reserve Bank of India has approved the re-appointment of Atanu Chakraborty as the part-time chairman of HDFC Bank for three years, with effect from May 5 this year.

BSE: Girish Joshi has resigned from the post of Chief Listing and Trading Development of the company, with effect from August 2 this year.

Tata Technologies: The global product engineering and digital services company has reported consolidated net profit of Rs 157.2 crore for the March FY24 quarter, declining 27.4 percent over the same period in the in the previous fiscal year despite a healthy operating margin impacted by weak topline. Revenue from operations fell 7.2 percent on-year to Rs 1,301 crore for the quarter, while EBITDA during the same period declined 1.1 percent to Rs 240 crore and margin expanded 110 bps to 18.4 percent. The company announced a total dividend of Rs 10.05 per share, including a special dividend of Rs 1.65 per share.

IDBI Bank: The lender has recorded net profit at Rs 1,628 crore for the quarter ended March FY24, growing 44 percent over the year-ago period on a 58 percent decline in provisions. Net interest income grew by 12 percent year over year to Rs 3,688 crore for the quarter, with net interest margin declining 10 basis points to 4.91 percent. Asset quality was stable during the quarter, with gross NPA falling 16 bps sequentially to 4.53 percent and net NPA unchanged at 0.34 percent QoQ.

IDBI Bank: The lender has recorded net profit at Rs 1,628 crore for the quarter ended March FY24, growing 44 percent over the year-ago period on a 58 percent decline in provisions. Net interest income grew by 12 percent year over year to Rs 3,688 crore for the quarter, with net interest margin declining 10 basis points to 4.91 percent. Asset quality was stable during the quarter, with gross NPA falling 16 bps sequentially to 4.53 percent and net NPA unchanged at 0.34 percent QoQ.

Inox Wind Energy: The company has reported consolidated net profit of Rs 38.88 crore for the March FY24 quarter, against a loss of Rs 109.5 crore in the corresponding period of the previous fiscal year, with a strong topline. Revenue from operations surged by 184 percent YoY to Rs 528.5 crore for the quarter.

Yes Bank: Foreign investor Goldman Sachs (Singapore) Pte. Ltd. (ODI bought 36,92,43,945 equity shares (equivalent to 1.22 percent of paid-up equity) in the bank at an average price of Rs 24.26 per share, valued at Rs 895.78 crore. However, foreign investor CA Basque Investments sold 59.4 crore equity shares (1.97 percent of paid-up equity) in the bank at an average price of Rs 24.27 per share, which amounted to Rs 1,441.63 crore. As of March 2023, CA Basque Investments had a 9.11 percent stake in Yes Bank.

Results on May 6: Lupin, Marico, Arvind, CarTrade Tech, CG Power and Industrial Solutions, DCM Shriram, Godrej Consumer Products, Gujarat Gas, Happiest Minds Technologies, Indian Bank, Muthoot Microfin, Route Mobile, Suven Life Sciences, and Uttam Sugar Mills will release March FY24 quarter earnings on May 6.

Avenue Supermarts: The D-Mart operator has recorded consolidated net profit of Rs 563.3 crore for the March FY24 quarter, growing 22.4 percent over the same period in the in the previous fiscal year, with healthy topline and operating numbers. Revenue from operations grew by 20.1 percent year over year to Rs 12,726.6 crore for the quarter.

Aurobindo Pharma: The United States Food and Drug Administration (US FDA) inspected Unit-II, a formulation manufacturing facility of the company's subsidiary, Eugia Pharma Specialities, at Bhiwadi, Rajasthan, during April 25 and May 3. The US FDA closed the inspection with seven observations. The observations are procedural in nature and will be responded to within the stipulated time.

One 97 Communications: Bhavesh Gupta has resigned as President and Chief Operating Officer of the company to move to an advisory position with effect from May 31, as a part of the overall organizational restructuring. Bhavesh Gupta will continue to support the company as an advisor in the CEO office after May 31, 2024.

M&M Financial Services: The non-banking finance company has registered a 9.5 percent on-year decline in profit at Rs 619 crore for the quarter ended March FY24, with impairment on financial instruments increasing sharply to Rs 341.47 crore in Q4 FY24 against Rs 0.38 crore in Q4 FY23. Net interest income grew by 15.6 percent year-on-year to Rs 1,919 crore for the quarter.

Kotak Mahindra Bank: The private sector lender has recorded standalone net profit at Rs 4,133 crore for the quarter ended March FY24, growing 18.2 percent over a year-ago period, with strong growth in non-interest income and operating profit. Net interest income rose 13.2 percent year over year to Rs 6,909.4 crore for the quarter. Asset quality improved with the gross NPA falling 34 basis points QoQ to 1.39 percent and the net NPA unchanged at 0.34 percent in Q4 FY24.

Britannia Industries: The biscuit maker has reported consolidated net profit at Rs 536.6 crore for the March FY24 quarter, declining 3.8 percent compared to the corresponding period of the last fiscal, impacted by muted growth in topline and weak operating numbers. Revenue from operations grew by 1.1 percent year over year to Rs 4,069.4 crore for the quarter. The board has recommended a final dividend of Rs. 73.5 per share.

Ujjivan Small Finance Bank: Sanjeev Nautiyal has been appointed as Managing Director and CEO of the small finance bank for three years, with effect from July 1. He will join the bank much prior to his taking charge as the MD and CEO and be designated as the President in the interim.

Jammu and Kashmir Bank: The lender has registered net profit at Rs 638.7 crore for the March FY24 quarter, growing 34 percent over the same period in the in the previous fiscal year, with healthy growth in non-interest income and operating profit. Net interest income grew by 4.5 percent year over year to Rs 1,306 crore for the quarter. Asset quality improved during the quarter, with gross NPA declining 76 bps QoQ to 4.08 percent and net NPA falling 4 bps to 0.79 percent.

REC: The company has received a No Objection Certificate from the Reserve Bank of India (RBI) for setting up a wholly owned subsidiary in the International Financial Services Centre (IFSC), Gujarat International Finance Technology City (GIFT) in Gujarat.

Life Insurance Corporation of India: LIC had sought forbearance in respect of expenses of management for FY23 from the Insurance Regulatory and Development Authority of India (IRDAI). IRDAI has allowed LIC to replenish the excess expenses under respective segments from the shareholders' account in equal annual instalments not exceeding three, starting from Q1 of FY25.

Mangalore Refinery & Petrochemicals (MRPL): The company recorded consolidated net profit at Rs 1,138.5 crore for the quarter ended March FY24, declining sharply by 40.5 percent compared to the year-ago period, impacted by lower topline and weak operating numbers with higher input costs. Revenue from operations (excluding excise duty) fell 0.1 percent year over year to Rs 25,328.7 crore for the quarter. The gross refining margin in Q4FY24 stood at $11.35 a barrel, against $15.12 a barrel in Q4FY23.

Zydus Lifesciences: Sentynl Therapeutics, the US-based biopharmaceutical company wholly owned by Zydus, acquired Zokinvy (Lonafarnib) for the treatment of Hutchinson-Gilford Progeria syndrome from Eiger Biopharmaceuticals. Sentynl acquired its worldwide proprietary rights to Zokinvy, adding to its portfolio of biopharmaceuticals for rare and ultra-rare diseases. Zokinvy is approved in the US (2020), European Union and Great Britain (2022), and Japan (2024) for the treatment of ultra-rare, fatal, and genetic premature aging diseases.

Aarti Drugs: The pharma company has recorded net profit of Rs 47.3 crore for the for the quarter ended March FY24, declining 15.8 percent compared to the year-ago period, with a lower topline. Revenue from operations fell 16.4 percent YoY to Rs 621 crore for the quarter, with API business down 20.6 percent and the specialty chemicals segment down 16.5 percent YoY.

Kansai Nerolac Paints: The paint manufacturing company has registered a 23.7 percent on-year growth in net profit at Rs 116 crore for the quarter ended March FY24, despite muted topline, aided by other income that increased to Rs 32.53 crore from Rs 9.7 crore during the same period and operating margin. Revenue from operations for the quarter at Rs 1,769.4 crore increased by 2 percent YoY. Meanwhile, the board has given its approval for an increase in the capacity of industrial alkyd and polyester resin at the Sayakha plant by 460 MT per month and an increase in the capacity of acrylic resin at the Bawal plant by 390 MT per month.

Filatex Fashions: The company will list its equity shares on the NSE in the normal market segment on May 6. It is already listed on the BSE, and the last closing price on the BSE was Rs 12.99.

Carborundum Universal: The Murugappa Group company has recorded consolidated net profit at Rs 142.6 crore for the January–March FY24 quarter, declining 4.2 percent compared to the year-ago period despite healthy operating numbers. In Q4 FY23, profit was aided by exceptional gains of Rs 24.92 crore. Revenue from operations increased by 0.1 percent year over year to Rs 1,201.2 crore for the quarter.

Rallis India: The Tata Group company has commissioned an 8,000-metric-ton water-soluble fertilizer plant in Akola, Maharashtra.

Gravita India: Promoter Rajat Agrawal sold 7.5 lakh equity shares (equivalent to 1.08 percent of paid-up equity) of the company at an average price of Rs 934.4 per share via an open market transaction. Abu Dhabi Investment Authority Monsoon (IEDPASIVE/EMIINDIA) was the buyer in this transaction.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment