Stock to Watch Today - Rupeedesk Reports - 30.04.2024

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

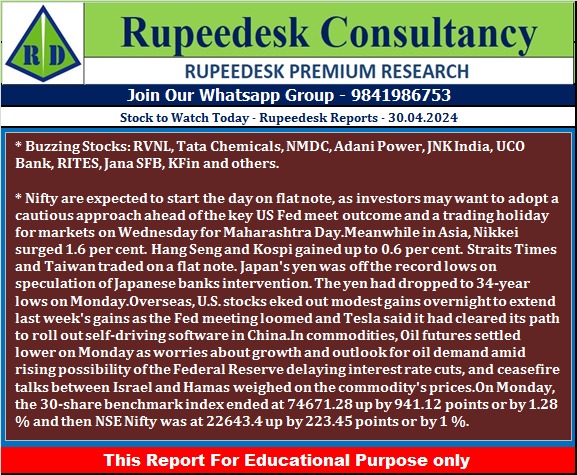

Buzzing Stocks: RVNL, Tata Chemicals, NMDC, Adani Power, JNK India, UCO Bank, RITES, Jana SFB, KFin and others.

Rail Vikas Nigam: The company said the joint venture KRDCL-RVNL has received a Letter of Acceptance (LoA) from Southern Railway for the redevelopment of Thiruvananthapuram central railway station in engineering, procurement, and construction (EPC) mode. The project cost is Rs 438.96 crore, while RVNL's share in the project is 49 percent.

NMDC: The state-owned iron ore company has increased the lump ore price by Rs 400 to Rs 6,200 per tonne. The price of fines rose by Rs 200 per tonne to Rs 5,260 per tonne. The previous price of lump ore was Rs 5,800 per tonne, with fines at Rs 5,060 per tonne.

Tata Chemicals: The Tata Group company has posted a net loss of Rs 850 crore for the January–March FY24 quarter against a profit of Rs 709 crore in the year-ago period. The company has recognized a non-cash write-down of assets worth Rs 963 crore with respect to the UK (Lostock Plant), which has been disclosed as an exceptional loss. Revenue from operations fell by 21.1 percent year over year to Rs 3,475 crore for the quarter.

UCO Bank: The lender has recorded a net profit of Rs 525.8 crore for the quarter ended March FY24, falling 9.5 percent from last year, partly because of elevated provisions for bad loans and lower pre-provision operating profit. Net interest income increased by 10.9 percent year over year to Rs 2,187.4 crore for the quarter. Asset quality improved for the quarter, with gross NPA declining 39 bps QoQ to 3.46 percent and net NPA falling 9 bps QoQ to 0.89 percent.

Results on April 30: Indus Towers, Indian Oil Corporation, Adani Energy Solutions, Adani Total Gas, Castrol India, Central Bank of India, Cholamandalam Investment and Finance Company, Exide Industries, Fino Payments Bank, Five-Star Business Finance, Havells India, Nuvoco Vistas Corporation, REC, Sona BLW Precision Forgings, Star Health and Allied Insurance Company, and Symphony will release quarterly earnings on April 30.

Poonawalla Fincorp: The non-banking finance company has reported standalone net profit of Rs 331.7 crore for the March FY24 quarter, growing sharply by 83.6 percent over the corresponding period of the previous fiscal. Net interest income grew by 57 percent year over year to Rs 641 crore for the quarter. Asset quality improved during the quarter as the gross NPA decreased by 17 bps QoQ to 1.16 percent and the net NPA declined by 11 bps sequentially to 0.59 percent.

Jana Small Finance Bank: The small finance bank has recorded net profit at Rs 321.7 crore for the quarter ended March FY24, growing nearly 4-fold from Rs 81 crore in the same period last year, driven by tax write-back and lower provisions. Net interest income grew by 26.5 percent year over year to Rs 591 crore for the quarter. Asset quality has seen improvement, with the gross NPA declining 8 bps sequentially to 2.11 percent and the net NPA down 15 bps to 0.56 percent for the quarter.

RITES: The company has received a letter of acceptance from Bangladesh Railway for the supply of 200 Broad Gauge (BG) passenger carriages to Bangladesh Railway. The contract worth $111.26 million will be executed within 36 months.

Spandana Sphoorty Financial: The microfinance institution has registered net profit at Rs 122.2 crore for the January–March FY24 quarter, growing 5.2 percent over the year-ago period. Net interest income rose by 21.2 percent year over year to Rs 399 crore for the quarter.

KFin Technologies: The tech-driven financial services firm has reported consolidated net profit of Rs 74.5 crore for the March FY24 quarter, rising 30.6 percent over the same period in the in the previous fiscal. Revenue from operations for the quarter, at Rs 228.3 crore, grew by 24.7 percent YoY. The board has recommended a final dividend of Rs 5.75 per share for FY24.

Birlasoft: The software company has registered consolidated net profit of Rs 180 crore for the quarter ended March FY24, increasing 60.5 percent over the corresponding period of the previous fiscal year, driven by healthy operating numbers. Revenue from operations grew by 11.1 percent year over year to Rs 1,362.6 crore for the quarter. The board has recommended a final dividend of Rs 4 per share for FY24.

Shoppers Stop: The department store chain has recorded a 62.55 percent on-year growth in consolidated net profit at Rs 23.2 crore for the March FY24 quarter, partly driven by a healthy topline and other income. Revenue from operations increased by 13.3 percent year over year to Rs 1,046.3 crore for the quarter. Meanwhile, the board has elevated and appointed Kavindra Mishra as MD and CEO of the company.

Gillette India: The personal care product company has reported net profit at Rs 99.1 crore for the quarter ended March FY24, falling 3.5 percent compared to the same period previous fiscal despite healthy operating numbers, partly impacted by lower other income. Revenue from operations increased nearly 10 percent year over year to Rs 680.7 crore for the quarter.

Coromandel International: The agri-solutions provider has commenced the project activity to set up its phosphoric acid-sulphuric acid complex facility at Kakinada, Andhra Pradesh. With an estimated outlay of Rs 1,000 crore, the project is expected to be commissioned in two years’ time.

PC Jeweller: The State Bank of India has submitted an application before the National Company Law Tribunal, New Delhi, seeking withdrawal of its petition filed against PC Jeweller as the bank and the company agreed on settlement terms.

Ircon International: Ashish Bansal has received an additional charge as Chairman and Managing Director of the company, with effect from April 29. However, Brijesh Kumar Gupta has relinquished the additional charge of Chairman and Managing Director of the company.

KEC International: The global infrastructure EPC major has won new orders of Rs 1,036 crore across its various businesses, including transmission and distribution projects in the Middle East and the Americas.

Results on May 1: Adani Power, Ambuja Cements, Adani Wilmar, Dhampur Sugar Mills, Greenpanel Industries, Netweb Technologies India, Orient Cement, PNB Gilts, SIS, and Zenotech Laboratories will announce January-March quarter earnings on May 1.

JNK India: The heating equipment manufacturer is set to debut on the bourses on April 30. The final issue price has been fixed at Rs. 415 per share.

Shivam Chemicals: The company will debut on the BSE SME on April 30. The issue price is Rs. 44 per share. The stock will be available in the trade-for-trade segment for 10 trading days.

Emmforce Autotech: The trading in equity shares of the auto ancillary company will commence on the BSE SME with effect from April 30. The issue price has been fixed at Rs. 98 per share. The stock will be available in the trade-for-trade segment for 10 trading days.

Varyaa Creations: The trading in equity shares of the company will commence on the BSE SME with effect from April 30. The issue price is Rs. 150 per share. The stock will be in the trade-for-trade segment for 10 trading days.

Subex: The company has received an order from the Deputy Commissioner of Income Tax, Bengaluru, for the Assessment Year 2013–14. As per the order, the company is entitled to a refund of Rs 7.11 crore. As per the order, the additional income determined on account of the transfer pricing adjustment of Rs 24.50 crore now stands reduced to Rs 3.87 crore, as a result of which a refund of Rs 7.11 crore has been determined.

eMudhra: The company has recorded consolidated net profit at Rs 21.2 crore for the March FY24 quarter, growing 34.2 percent over a year-ago period driven by healthy operating and topline numbers. Revenue from operations increased by 30 percent on-year to Rs 99.7 crore for the quarter, while EBITDA jumped 40 percent YoY to Rs 36.3 crore with a margin expansion of 240 bps at 35.2 percent in Q4 FY24.

Protean eGov Technologies: IIFL Special Opportunities Fund Series 7 sold 10 lakh equity shares in the company at an average price of Rs 1,221.92 crore, valued at Rs 122.19 crore via open market transactions. However, Plutus Wealth Management LLP bought 5 lakh shares in Protean at an average price of Rs 1,220 per share.

Vesuvius India: The company has recorded net profit at Rs 68.8 crore for the first quarter of the calendar year 2024, growing 58.66 percent compared to the same period last fiscal year, driven by robust operating numbers. Revenue from operations grew by 23.2 percent year over year to Rs 453.4 crore for the quarter.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment