Stock to Watch Today - Rupeedesk Reports - 15.02.2024

Stock to Watch Today - Rupeedesk Report

Stock to Watch Today - Rupeedesk Reports

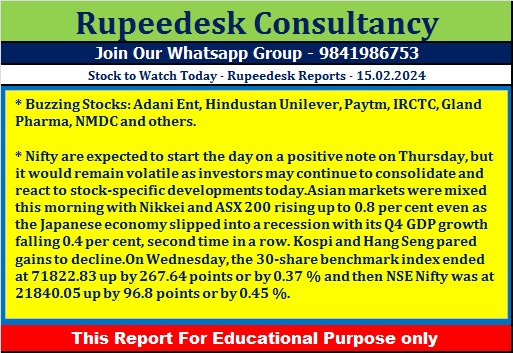

Buzzing Stocks: Adani Ent, Hindustan Unilever, Paytm, IRCTC, Gland Pharma, NMDC and others.

Adani Enterprises: Mumbai Travel Retail, a step-down subsidiary of Adani Enterprises, has completed the incorporation process of a wholly owned subsidiary, namely OSPREE International FZCO, in the UAE.

One 97 Communications: The company, its subsidiaries, and its associate, Paytm Payments Bank, have received notices and requisitions for information, documents, and explanations from the authorities, including the Enforcement Directorate (ED), with respect to the customers that may have done business with the respective entities. The company and its associates have continued to provide such information, documents, and explanations to the authorities as is required by them. Paytm Payments Bank does not undertake outward foreign remittances. Meanwhile, the exchanges revised the circuit limit for the stock to 5 percent, up from 10 percent earlier.

Hindustan Unilever: The FMCG major is in talks with the Andhra Pradesh government to collaborate on palm oil production in the state. HUL sought to partner with more than 15,000 farmers in Andhra Pradesh to create at least 30,000 hectares of oil palm plantations. The proposed plan will lead to investments of over Rs 300 crore during the project development period. The proposed palm oil mill is expected to create over 1,000 direct and indirect jobs in the state.

Aditya Birla Fashion & Retail: The Aditya Birla Group company has posted a consolidated net loss of Rs 77.9 crore for the quarter ended December FY24, against a profit of Rs 15.8 crore in the year-ago period, partly impacted by higher other expenses. Revenue from operations grew by 16.1 percent YoY to Rs 4,166.7 crore for the quarter.

Indian Railway Catering and Tourism Corporation: The Government of India has approved the appointment of Sanjay Kumar Jain for the post of Chairman and Managing Director at IRCTC on an immediate absorption basis. Sanjay Kumar Jain has relinquished the charge of PCCM/Northern Railway on February 13, 2024, and has assumed the charge of Chairman and Managing Director at IRCTC on a regular basis, with effect from February 14.

lndiabulls Housing Finance: The housing finance company has reported standalone profit of Rs 225.74 crore for the quarter ended December FY24, falling 1.6 percent compared to the year-ago period. Net interest income dropped 46.9 percent year-on-year to Rs 196.61 crore for the quarter.

Muthoot Finance: The gold financing company has reported standalone profit of Rs 1,027.3 crore for the October–December period of FY24, growing 14 percent over the corresponding period of the last fiscal. Net interest income during the quarter increased by 11.8 percent year-on-year to Rs 1,905.7 crore. Meanwhile, the company has received board approval for an additional equity infusion of Rs 300 crore in subsidiary Belstar Microfinance and the secondary purchase of equity shares of Belstar from the existing promoters for up to Rs 75 crore.

Container Corporation of India: The state-owned entity has signed an addendum to the existing Memorandum of Understanding (MoU) with Container Company of Bangladesh (CCBL), which extended its validity for a further period until April 7, 2027. The said MoU was earlier executed in 2017 for developing modalities for running container trains between India and Bangladesh to facilitate cross-border trade, besides developing various infrastructure, logistics businesses, and project-related services.

Gland Pharma: The pharmaceutical company recorded net profit of Rs 191.9 crore for the quarter ended December FY24, falling 17.3 percent compared to the year-ago period impacted by weak operating margin. Revenue from operations grew by 65 percent year-on-year to Rs 1,545.2 crore for the quarter.

Gujarat State Petronet: The natural gas distribution company has registered a 9.9 percent on-year growth in consolidated net profit at Rs 394.9 crore for the third quarter of FY24. Revenue from operations grew by 9.8 percent year-on-year to Rs 4,389 crore for the quarter.

NMDC: The state-owned iron ore company has recorded 62.6 percent on-year growth in consolidated net profit at Rs 1,470 crore for the quarter ended December FY24, backed by healthy topline and operating numbers. Consolidated revenue from operations grew by 45.4 percent year-on-year to Rs 5,410 crore for the quarter. The company has announced an interim dividend of Rs. 5.75 per share.

Utkarsh Small Finance Bank: The board of directors of the small finance bank will meet in due course to evaluate the proposal of a reverse merger of holding company Utkarsh CoreInvest with the bank. The board members of Utkarsh CoreInvest (UCL) have already passed the resolution, wherein UCL has proposed to initiate steps of a proposed reverse merger of UCL with the bank, subject to regulatory and statutory approvals. The proposal of evaluating a reverse merger would be in the direction of fulfilling the regulatory stipulation emanating from the Reserve Bank of India, requiring to dilute the promoter shareholding to 26 percent within 15 years from the date of commencement of banking business.

Narayana Hrudayalaya: The healthcare services provider has recorded consolidated net profit at Rs 188.1 crore for the quarter ended December FY24, growing 22.3 percent over a year-ago period. Revenue from operations increased 6.7 percent year-on-year to Rs 1,203.6 crore for the quarter.

Glenmark Pharmaceuticals: The pharma company has posted a consolidated net loss of Rs 449.6 crore for the October–December period of FY24, against a profit of Rs 185.8 crore in the year-ago period, impacted by lower India and US businesses. Revenue from operations fell 19.1 percent year-on-year to Rs 2,506.7 crore for the quarter.

Sun TV Network: The Chennai-based media company clocked 6.8 percent on-year growth in consolidated net profit at Rs 454 crore for the third quarter of FY24 despite weak operating margins. Revenue from operations grew by 4 percent year over year to Rs 923 crore for the quarter. The company said the board has declared an interim dividend of Rs 2.50 per share.

West Coast Paper Mills: West Coast Optilinks, a division of West Coast Paper Mills, has doubled its capacity for optical fiber cable production by setting up a new manufacturing unit at Fab City, Hyderabad.

Crompton Greaves Consumer Electricals: The electrical products company has recorded consolidated profit at Rs 86 crore for the October-December period of FY24, rising 0.9 percent over a year-ago period impacted by weak operating numbers. Revenue from operations grew by 11.6 percent year-on-year to Rs 1,692.7 crore for the quarter.

Sidwal Refrigeration Industries: The wholly owned material subsidiary of the company, has made a primary investment of Rs 100 crore in the equity share capital of Shivaliks Mercantile. The company will infuse the amount in two tranches.

National Fertilizers: The fertilizer company has reported consolidated net profit of Rs 150.9 crore for the third quarter of FY24, declining 73 percent compared to the corresponding period of the last fiscal. Revenue from operations fell 25.2 percent YoY to Rs 7,581 crore for the quarter.

Hinduja Global Solutions: The IT services management company has recorded consolidated net profit at Rs 8.2 crore for the third quarter of FY24, falling 84.1 percent compared to the year-ago period despite healthy operating numbers. In Q3 FY23, the profit was boosted by exceptional gains and tax write-backs. Revenue from operations increased by 7.6 percent year-on-year to Rs 1,203.7 crore for the quarter.

Rudra Gas Enterprise: The company will list its equity shares on the BSE SME on February 15. The issue price is Rs. 63 per share. The stock will be in the trade-for-trade segment for 10 trading days.

Alpex Solar: The solar panel manufacturing company is set to debut on the NSE Emerge on February 15. The final issue price has been fixed at Rs. 115 per share. Its equity shares will be available for trading in the trade-for-trade surveillance segment.

Free Demo Intraday Tips : Whatsapp : 9841986753

Free Demo Commodity Tips : Whatsapp : 9841986753

RUPEEDESK PREMIUM RESEARCH

SEBI REGISTERED RESEARCH ANALYST - INH2000007292

We(rupeedesk.in) are SEBI Registered leading Indian Stock Market Trading Tips Providers for Equity,Commodity and currency market traded in NSE, BSE, MCX, , NCDEX And MCXSX.USDINR,EURINR,GBPINR,JPYINR,Dollar,Euro,Pound,Yen currencies.Indian Currency futures and Options Trading Tips. . Free Currency Tips|Stock and Nifty Options Tips| Commodity Tips |Intraday Tips Register Here : 91-9094047040 |91-9841986753

*Data Source : Govt, Nse ,Bse, Private News Channels and Websites Etc

No comments:

Post a Comment